Australian Dollar finds itself on shaky ground today, trading lower due to lackluster investor sentiment, and stays soft after RBA’s decision to keep interest rates unchanged, a move that was widely anticipated. New Zealand Dollar is tracking its Australian counterpart, emerging as the day’s second-worst performer. Canadian Dollar is not far behind, showing weakness ahead of tomorrow’s BoC rate decision. In contrast, Dollar is holding the fort as today’s strongest currency so far, followed by European majors led by Euro. Japanese Yen is showing a mixed performance, continuing its near-term range trading against its major rivals.

Equities in China and Hong Kong took a hit, erasing all of yesterday’s gains, following disappointing PMI Services data from China. Some economists are skeptical about the effectiveness of recent policy moves by Chinese authorities, labeling them as mere relaxation of over-regulation rather than genuine stimulus measures. While Country Garden, the troubled property developer, managed to avoid its first default by paying coupons on two dollar bonds within grace periods, this news failed to uplift the general market mood.

Technically, USD/CNH’s rally today further affirms the case that correction from 7.3491 has completed at 7.2387. Focus for the next few days will be on 7.3103 resistance. Decisive break there would push USD/CNH through 7.3491 to retest 7.3745 (2022 high). Renewed selloff in Yuan might prompt the Chinese authority to announce more supporting measures.

In Asia, at the time of writing, Nikkei is down -0.10%. Hong Kong HSI is down -1.51%. China Shanghai SSE is down -0.63%. Singapore Strait Times is down -0.26%. Japan 10-year JGB yield is up 0.0092 at 0.656.

RBA holds rates steady at 4.10%, maintains hawkish bias

RBA held its cash rate target unchanged at 4.10% in a widely expected move, offering additional time to evaluate impact of previous interest rate hikes and evolving economic outlook. Although the central bank maintained hawkish bias, it emphasized that future decisions would be highly data-dependent, particularly scrutinizing global economic trends, household spending, and conditions in labor and inflation.

In its accompanying statement, the RBA noted, “Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe.”

RBA stated that the Australian economy is undergoing a period of “below-trend growth,” a situation expected to persist. Unemployment rate is anticipated to rise gradually to around 4.5% by the end of next year. Recent data suggests that inflation will likely re-enter the 2-3% target range over the forecast horizon.

However, it cautioned that uncertainties abound, including the persistent nature of services price inflation observed overseas, which could manifest similarly in Australia. Other uncertainties revolve around the lag effects of monetary policy, labor market’s response to slower economic growth, and behavior of firms in their pricing and wage-setting decisions.

It also expressed concerns about the household sector. Global uncertainties, particularly those related to the Chinese economy, were noted as an additional risk, given the ongoing stresses in China’s property market.

China’s Caixin PMI services fell to 51.8, waning economic momentum

China Caixin PMI Services for August fell to 51.8, down from 54.1 in July and below market expectations of 53.6. This marks the lowest reading in eight months. According to Caixin, the softer performance was due to a slower increase in business activity and new orders. While employment continued to rise, input cost inflation reached a six-month low.

Composite Output Index, which includes both manufacturing and services sectors, slightly decreased from 51.9 to 51.7. Though it still indicates expansion, the rate of growth was the slowest since January this year. A milder expansion in services sector was partially offset by a modest uptick in factory production.

Wang Zhe, Senior Economist at Caixin Insight Group, attributed the lackluster performance to seasonal fluctuations, extreme weather conditions like high temperatures and flooding, and a complicated global economic environment. These factors are further exacerbated by weak domestic demand.

Wang also warned of the long-term challenges facing the Chinese economy, stating, “Looking ahead, seasonal impacts will gradually subside, but the problems of insufficient domestic demand and weak expectations may form a vicious cycle for a protracted period of time.” He added that given the uncertainty in external demand, downward pressure on the economy may continue to intensify.

Looking ahead

Eurozone PMI services final and PPI will be released in European session. UK will also publish PMI services final. Later in the day, US will release factory orders.

AUD/USD Daily Report

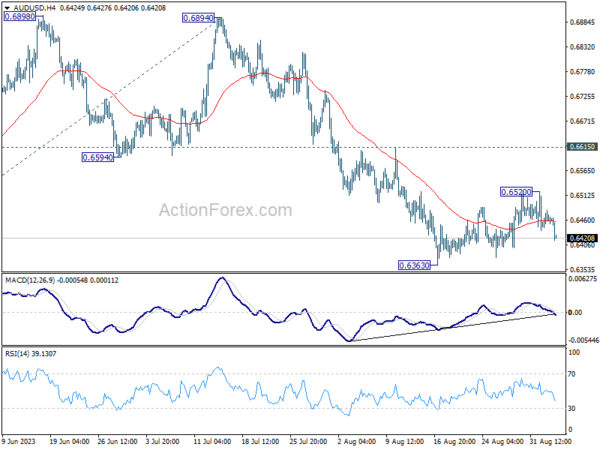

Daily Pivots: (S1) 0.6444; (P) 0.6463; (R1) 0.6480; More…

AUD/USD falls notably today but stays above 0.6363 short term bottom. Intraday bias remains neutral for now, and another recovery cannot be ruled out. But in that case, upside should be limited by 0.6615 resistance. On the downside, firm break of 0.6363 will resume larger fall from 0.7156 to 100% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195.

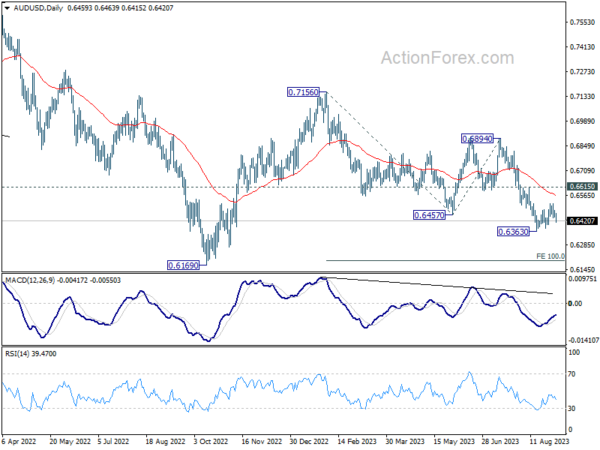

In the bigger picture, current development argues that the down trend from 0.8006 (2021 high) is still in progress. Decisive break of 0.6169 will target 61.8% projection of 0.8006 to 0.6169 to 0.7156 at 0.6021. This will now remain the favored case as long as 0.6894, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Aug | 4.30% | 2.20% | 1.80% | |

| 01:30 | AUD | Current Account Balance (AUD) Q2 | 7.7B | 8.1B | 12.3B | 12.5B |

| 01:45 | CNY | Caixin Services PMI Aug | 51.8 | 53.6 | 54.1 | |

| 04:30 | AUD | RBA Interest Rate Decision | 4.10% | 4.10% | 4.10% | |

| 07:45 | EUR | Italy Services PMI Aug | 50.2 | 51.5 | ||

| 07:50 | EUR | France Services PMI Aug F | 46.7 | 46.7 | ||

| 07:55 | EUR | Germany Services PMI Aug F | 47.3 | 47.3 | ||

| 08:00 | EUR | Eurozone Services PMI Aug F | 48.3 | 48.3 | ||

| 08:30 | GBP | Services PMI Aug F | 48.7 | 48.7 | ||

| 09:00 | EUR | Eurozone PPI M/M Jul | -0.60% | -0.40% | ||

| 09:00 | EUR | Eurozone PPI Y/Y Jul | -7.60% | -3.40% | ||

| 14:00 | USD | Factory Orders M/M Jul | -2.50% | 2.30% |