China Caixin PMI Services for August fell to 51.8, down from 54.1 in July and below market expectations of 53.6. This marks the lowest reading in eight months. According to Caixin, the softer performance was due to a slower increase in business activity and new orders. While employment continued to rise, input cost inflation reached a six-month low.

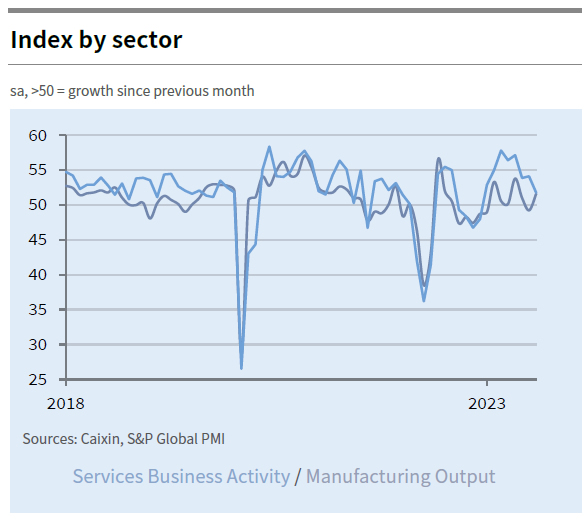

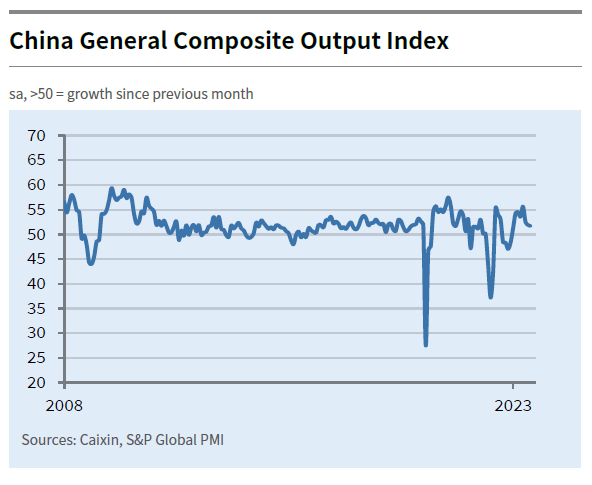

Composite Output Index, which includes both manufacturing and services sectors, slightly decreased from 51.9 to 51.7. Though it still indicates expansion, the rate of growth was the slowest since January this year. A milder expansion in services sector was partially offset by a modest uptick in factory production.

Wang Zhe, Senior Economist at Caixin Insight Group, attributed the lackluster performance to seasonal fluctuations, extreme weather conditions like high temperatures and flooding, and a complicated global economic environment. These factors are further exacerbated by weak domestic demand.

Wang also warned of the long-term challenges facing the Chinese economy, stating, “Looking ahead, seasonal impacts will gradually subside, but the problems of insufficient domestic demand and weak expectations may form a vicious cycle for a protracted period of time.” He added that given the uncertainty in external demand, downward pressure on the economy may continue to intensify.