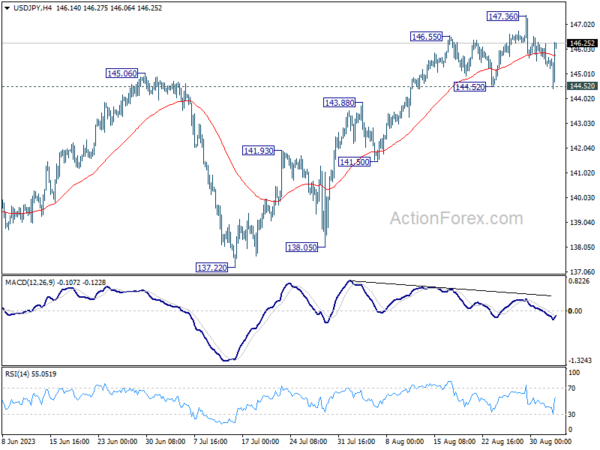

USD/JPY’s retreat was slightly deeper than expected last week, but it recovered quickly after drawing support from 144.52. Initial bias remains neutral this week first. On the upside, firm break of 137.36 will resume larger rally to retest 151.93 high. However, on the downside, firm break of 144.52 should confirm short term topping, and turn bias back to the downside for 55 D EMA (now at 143.06) and possibly below.

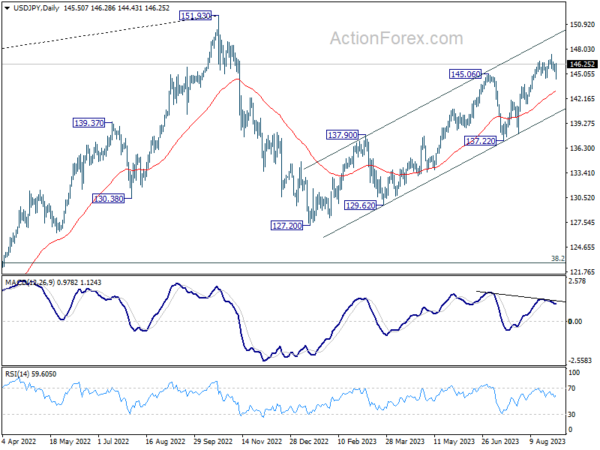

In the bigger picture, overall price actions from 151.93 (2022 high) are views as a corrective pattern. Rise from 127.20 is seen as the second leg of the pattern and could still be in progress. But even in case of extended rise, strong resistance should be seen from 151.93 to limit upside. Meanwhile, break of 137.22 support should confirm the start of the third leg to 127.20 (2023 low) and below.

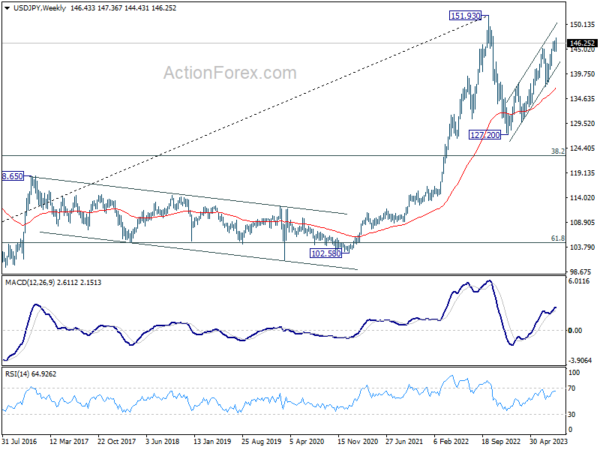

In the long term picture, price action from 151.93 is seen as developing into a corrective pattern to up trend from 75.56 (2011 low). While deeper decline cannot be ruled out, downside should be contained by 38.2% retracement of 75.56 to 151.93 at 122.75.