We expect the Bank of Canada to move back to the sidelines Wednesday, foregoing another interest rate hike. But it’ll keep its options open in case more increases are necessary down the road.

Broader price growth is still running above the BoC’s 2% inflation target despite slower headline CPI growth. But the BoC is more interested in where prices are going than where they’ve been. And softer economic growth numbers suggest headwinds from earlier interest rate hikes are gaining strength.

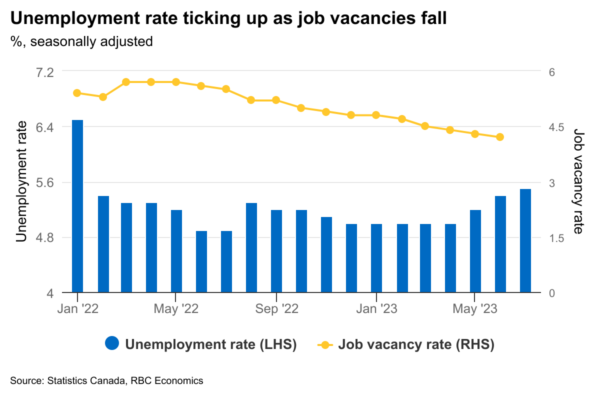

GDP growth has softened with a 0.2% decline (at an annualized rate) in Q2 that was substantially softer than the 1.5% increase the BoC previously assumed. Most of the Q2 weakness came from a decline in June GDP with a flat preliminary estimate for July leaving growth tracking potentially another negative GDP print in Q3 – well below the BoC’s 1.5% (annualized) forecast. And the 0.5 percentage point increase in the unemployment rate over the last three months is the largest rise (outside of the pandemic) since the 2008/09 recession. Canadian labour market data is notoriously volatile, but we think there is more than enough evidence of cooling for the BoC to hold rates steady for now.

The August job numbers—released next Friday—will arrive too late to influence the BoC’s interest rate decision. But they’ll help determine how long this next expected pause in rate hikes will last. For our part, we expect a small increase in August employment (12,000.) That wouldn’t be large enough to prevent a fourth consecutive tick higher in the unemployment rate given surging population growth, and would be further evidence that labour market headwinds are building. The job switching rate has been trending lower, something that typically happens when labour markets weaken. The share of involuntary part-time workers has inched up since early 2023. And labour demand is continuing to slow, with June job vacancies dropping to their lowest level in 2 years.

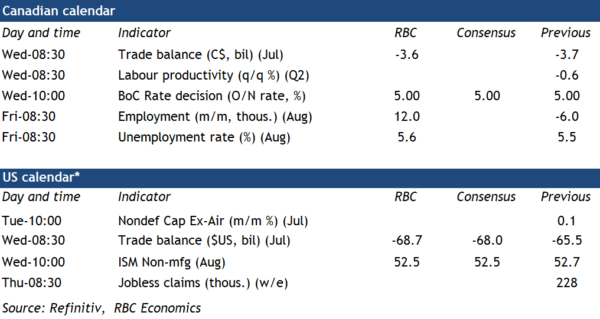

Week ahead data watch

According to the advance economic indicators report, the U.S. goods deficit likely widened to $68.7 billion in July. Much of that was driven by rising consumer goods imports and a 10.3% jump in motor vehicle exports.

July Canadian trade data likely showed declines for both exports and imports with a strike at B.C. ports disrupting ocean trade flows in the month. Higher oil prices likely boosted the energy trade balance, but we look for the trade deficit to be $3.6 billion in July, close to June’s $3.7 billion level.