Investors react favorably to the much-anticipated US Non-Farm Payroll data, sending stock futures soaring while Treasury yields and Dollar weaken. The latest numbers point to a more relaxed labor market, yet with decent job growth, which is what Fed would love to see. Additionally, the slowdown in wage growth suggests some relief for domestic inflation pressures.

In the currency markets, Japanese Yen emerged as the primary winner, appreciating broadly in the wake of the NFP release. New Zealand and Australian Dollars followed suit, buoyed by risk-on sentiment. On the other end of the spectrum, is flaring even worse against the greenback after GDP data. Meanwhile, European majors showed limited enthusiasm, gaining only modestly following NFP.

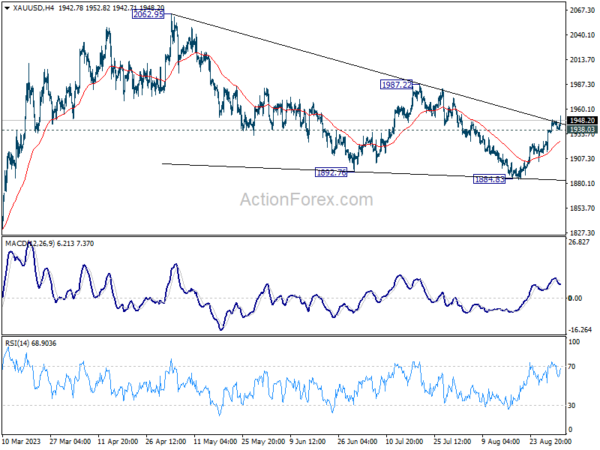

Technically, Gold is making bullish progress by resuming the rally from 1884.84. Break of the trend line resistance affirms the case that corrective pattern from 2062.95 has completed at 1884.83. Further rally would be seen to 1987.22 resistance for confirmation. Nevertheless, break of 1938.03 minor support will mix up the near term outlook.

In Europe, at the time of writing, FTSE is up 0.43%. DAX is down -0.14%. CAC is up 0.20%. Germany 10-year yield is up 0.0142 at 2.479. Earlier in Asia, Nikkei rose 0.28%. China Shanghai SSE rose 0.43%. Japan 10-year JGB yield dropped -0.0157 to 0.632.

US NFP grows 187k, unemployment rate jumps to 3.8%

US non-farm payroll employment grew 187k in August, above expectation of 170k. That’s notably lower than the average monthly gain of 271k over the prior 12 months.

Unemployment rate jumped from 3.5% to 3.8%, above expectation of 3.5%, marking the highest level in a year and a half. Number of unemployment persons increased by 514k to 6.4m. Labor force participation rate rose 0.2% to 62.8%, first increase since March.

Average hourly earning rose 0.2% mom, below expectation of 0.3% mom. Over the past 12 months, average hourly earnings have increased by 4.3% yoy.

Canada GDP contracts -0.2% mom in Jun, flat in Jul

Canada’s GDP contracted -0.2% mom in June, matched expectations. Services-producing industries was down -0.2% mom. Goods-producing industries were down -0.4% mom. 12 of 20 industrial sectors posted decreases.

Advance information indicates that real GDP was essentially unchanged in July.

UK PMI manufacturing finalized at 43, deepening downturn

UK PMI Manufacturing was finalized at 43.0 in August, down from 45.3 in July. This marks the lowest level since May 2020, underscoring the frailty in the sector. S&P Global highlighted that the demand slackened due to weaker domestic and export conditions. Interestingly, purchase prices have also declined at their fastest rate since January 2016.

Rob Dobson, Director at S&P Global Market Intelligence, described the situation as a “deepening of the UK manufacturing downturn,” with the latest PMI reaching a 39-month low. He drew attention to the severity of the contraction rates in output and new orders, which he said are “rarely seen outside of major periods of economic stress, such as the global financial crisis of 2008/09 and the pandemic lockdowns.”

Dobson elaborated on multiple economic headwinds affecting demand, including rising interest rates, the ongoing cost-of-living crisis, export losses, and overall market outlook concerns. These conditions have forced manufacturing firms into a “more defensive posture,” with cutbacks in purchasing activity, inventory holdings, and staffing levels as they focus on controlling costs and maintaining margins.

Eurozone PMI manufacturing finalized at 43.5, glimmers of hope despite persistent weakness

Eurozone PMI Manufacturing was finalized at 43.5, marking a slight uptick from July’s 38-month low of 42.7. Country-level readings reveal that Germany, the largest economy in the Eurozone, remains a cause for concern. Although it reported a two-month high, its PMI of 39.1 underscores its struggles. Spain (46.5), France (46.0), the Netherlands (45.9), Italy (45.4), and Austria (40.6) remained in contraction. Greece and Ireland were above 50-mark at 52.9 and 50.8 respectively.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, commented on the situation, stating, “These numbers aren’t as terrible as they might look at first glance.”

Despite the obvious weakness signaled by a PMI below 50, de la Rubia pointed out that all twelve subindices either improved or remained stable. “This indicates that the downward trend from the past few months is starting to lose steam across the board,” he added.

However, the cloud over Germany continues to darken. “Germany remains a negative outlier among the big euro countries,” de la Rubia noted. This latest data will likely rekindle debates about Germany being the “sick man of Europe”, even though it remains one of the most diversified economies in the region.

Swiss CPI up 0.2% mom in Aug, unchanged at 1.6% yoy

Swiss CPI rose 0.2% mom in August, matched expectations. Core CPI (excluding fresh and seasonal products, energy and fuel) rose 0.1% mom. Domestic products prices was flat 0.0% mom. Import products prices rose 0.8% mom.

Compared with the same month a year ago, CPI was unchanged at 1.6% yoy, above expectation of 1.5% yoy. Core CPI slowed from 1.7% yoy to 1.5% yoy. Domestic products prices slowed from 2.3% yoy to 2.2% yoy. Imported products prices rose from -0.6% yoy to -0.3% yoy.

Japan PMI manufacturing finalized at 49.6, input costs inflation at three-month high

Japan’s PMI Manufacturing remained stagnant at 49.6 in August, indicating a third consecutive month of sectoral contraction. According to Usamah Bhatti at S&P Global Market Intelligence, the rate of deterioration was “unchanged from July and only fractional,” primarily due to a “slower reduction in new orders.”

The report highlighted concerning trends in cost pressures. “Input prices rose at a quicker pace for the first time since September 2022, pushing the rate of input cost inflation to a three-month high,” Bhatti stated. The escalation in input costs was specifically attributed to high raw material prices, labor costs, and a weakened yen.

Despite these pressures, the report found that manufacturers increased their selling prices at the “weakest rate in two years,” indicating that companies may be absorbing the additional costs instead of transferring them to consumers.

The employment situation also emerged as a point of concern. Bhatti noted, “The rate of job creation broadly stalled, with the latest increase the slowest recorded in the 29-month sequence.”

China’s Caixin PMI manufacturing rose to 51, output and employment see uptick

China’s Caixin PMI for manufacturing defied expectations in August, rising from 49.2 to 51.0 and beating market forecasts of 49.4. This indicates a return to expansionary territory. The report noted several key improvements, including increases in output, new business, and a rebound in employment levels. Significantly, input costs rose for the first time since February, suggesting an easing in deflationary pressures.

Wang Zhe, Senior Economist at Caixin Insight Group, elaborated on the data, stating, “In August, the manufacturing sector showed overall improvement. Apart from sluggish exports, the gauges for supply, total demand, and employment were all in expansionary territory.” Wang also noted that the “slight rise in prices buffered the pressure of deflation” and that logistics remained smooth.

However, caution still underlines the market’s medium-term outlook. According to Wang, “Looking ahead, seasonal impacts will gradually subside, but the problem of insufficient internal demand and weak expectations may form a vicious cycle for a longer period of time.” Wang also warned that “combined with the uncertainty in external demand, the downward pressure on the economy may continue to increase.”

PBOC slashes FX RRR

Chinese Yuan saw a sharp uptick after PBoC announced a substantial 200 bps cut in foreign exchange reserve requirement ratio to 4% from 6%, effective September 15. According to PBoC, the move aims to “improve financial institutions’ ability to use foreign exchange funds.”

This RRR cut is set to release approximately USD 16.4B in foreign exchange, based on China’s FX deposits standing at USD 821.8B as of end-July. Market analysts also note that the FX RRR reduction could have the added effect of lowering dollar funding costs in the interbank market, thereby alleviating some of downward pressure on Yuan.

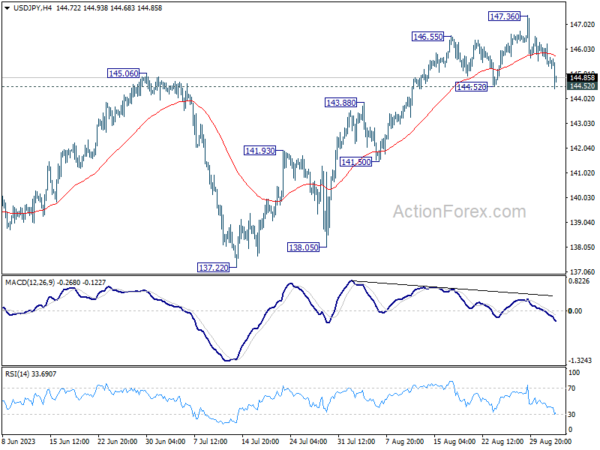

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 145.17; (P) 145.72; (R1) 146.10; More…

USD/JPY falls notably in early US session but it’s still trying to defend 144.52 support. Intraday bias stays neutral first. Strong rebound from current level, follow by break of 147.36, will resume the rise from 127.20 to retest 151.93 high. On the downside, however, firm break of 144.52 should confirm short term topping, and turn bias back to the downside for 55 D EMA (now at 143.04) and possibly below.

In the bigger picture, overall price actions from 151.93 (2022 high) are views as a corrective pattern. Rise from 127.20 is seen as the second leg of the pattern and could still be in progress. But even in case of extended rise, strong resistance should be seen from 151.93 to limit upside. Meanwhile, break of 137.22 support should confirm the start of the third leg to 127.20 (2023 low) and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Capital Spending Q2 | 4.50% | 7.90% | 11.00% | |

| 00:30 | JPY | Manufacturing PMI Aug F | 49.6 | 49.7 | 49.7 | |

| 01:45 | CNY | Caixin Manufacturing PMI Aug | 51 | 49.4 | 49.2 | |

| 06:30 | CHF | CPI M/M Aug | 0.20% | 0.20% | -0.10% | |

| 06:30 | CHF | CPI Y/Y Aug | 1.60% | 1.50% | 1.60% | |

| 07:30 | CHF | PMI Manufacturing Aug | 39.9 | 41.5 | 38.5 | |

| 07:45 | EUR | Italy Manufacturing PMI Aug | 45.4 | 45.9 | 44.5 | |

| 07:50 | EUR | France Manufacturing PMI Aug F | 46 | 46.4 | 46.4 | |

| 07:55 | EUR | Germany Manufacturing PMI Aug F | 39.1 | 39.1 | 39.1 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Aug F | 43.5 | 43.7 | 43.7 | |

| 08:30 | GBP | Manufacturing PMI Aug F | 43 | 42.5 | 42.5 | |

| 12:30 | CAD | GDP M/M Jun | -0.20% | -0.20% | 0.30% | 0.20% |

| 12:30 | USD | Nonfarm Payrolls Aug | 187K | 170K | 187K | 157K |

| 12:30 | USD | Unemployment Rate Aug | 3.80% | 3.50% | 3.50% | |

| 12:30 | USD | Average Hourly Earnings M/M Aug | 0.20% | 0.30% | 0.40% | |

| 13:30 | CAD | Manufacturing PMI Aug | 49.6 | |||

| 13:45 | USD | Manufacturing PMI Aug F | 47 | 47 | ||

| 14:00 | USD | ISM Manufacturing PMI Aug | 46.6 | 46.4 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Aug | 42.9 | 42.6 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Aug | 44.4 | |||

| 14:00 | USD | Construction Spending M/M Jul | 0.50% | 0.50% |