Euro is trading broadly lower today as markets are awaiting the highly anticipated ECB meeting later in the week. The common currency is even weaker than the Japanese Yen, which gapped down after Japanese election. Prime Minister Shinzo Abe’s coalition retained absolute majority in the parliament, paving him the way to push for strong fiscal and monetary stimulus. Meanwhile, Dollar is generally firmer today with support from hope on tax cut/reform in the US. New Zealand Dollar and Sterling are also among the strongest ones.

Trump wants to pass the tax plan by Thanksgiving

US President Donald Trump warned House Republicans yesterday that 2018 mid term elections would be "really bad" if they failed to pass the tax plan. Meanwhile, Trump intentionally called the plan "tax cuts" and said "it will be the biggest cuts ever in the history of this country. I think that there’s tremendous appetite. There’s tremendous spirit for it." Trump also noted that he hoped the plan will be done "before the end of the year, but maybe much sooner than that". There are talks that Trump is driving to have the plan passing through the Congress and be on his desk by Thanksgiving.

CBI report showed drastic deterioration in optimism

In UK, a report from the Confederation of British Industry shows that 12% of businesses said they were more optimistic on the general business situation than three months ago. But 24% were less optimistic. That made the Business Optimism index at -11, sharp deterioration from 5 recorded in the three months to July. CBI trends total orders also dropped to -2 in October.

CBI Chief Economist Rain Newton-Smith noted that there is a "general softening in manufacturing activity over the past three months, with the outlook for investment becoming more subdued." And he urged the government to use the Budget to provide a fillip for factories through business rate reforms, including exempting new plant and machinery from rates altogether, and switching to the more recognized CPI inflation measure rather RPI when calculating upratings."

Bundesbank said industry drives German economy

In Germany, Bundesbank said in its monthly reported that "industry, supported by buoyant export demand, is likely to retain its role as a main pillar of a strong economy." And, "the order situation of industrial firms is excellent." Meanwhile, "against the backdrop of very good consumer sentiment and favorable labor market and income prospects, no lasting deterioration in consumption is to be expected."

There the political turmoil in Catalonia continues, Euro traders’ minds are clearly on ECB meeting later this week. The market has already fully priced in an announcement of tapering of the asset purchase program from the current pace of EUR 60B per month until December 2017 "or beyond, if necessary". To what extend the ECB would taper is the question. Some suggest a reduction of monthly purchases to EUR 40B beginning in January 2018 for 6 months, while others expect a cut to EUR 30B for 9 months.

Abe to continue with Abenomics after winning election

After having a landslide victory in Sunday’s snap election, Japanese Prime Minister Shinzo Abe said "the key to Japan’s sustainable growth is how we respond to ageing of the population, which is the biggest challenge for Abenomics." And, he and his cabinet aimed to "exit deflation by accelerating wage growth through innovation on productivity.". Abe also said he will "promote human resources, proceed with free pre-school education in one spell and we are going to offer free higher education for the children who truly need it."

The ruling Liberal Democratic Party and coalition partner Komeito party won 313 of the 465 seats in the lower house. That gives the coalition over 1/3 absolute majority. With renewing strong mandate, Abe continue to push his three arrows in the Abenomics. One of which is aggressive monetary easing. There are talks that BoJ governor Haruhiko Kuroda will have a high chance to have his term renewed if Abe has a landslide victory. But after all, whether Kuroda would stay should not alter the ultra-accommodative policy stance.

EUR/USD Mid-Day Outlook

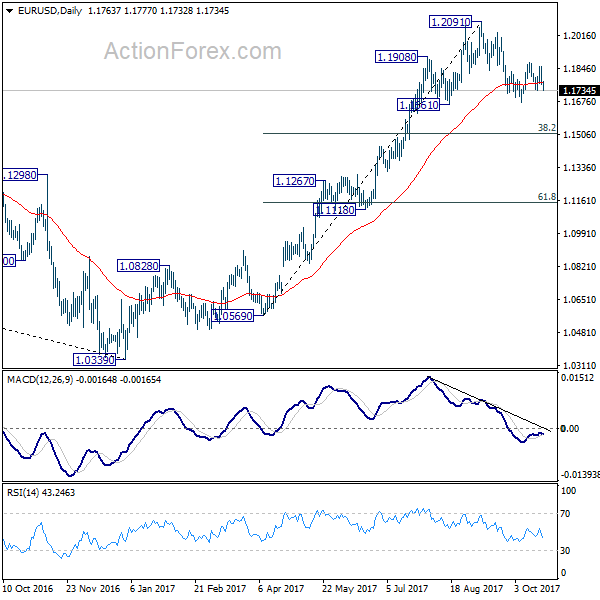

Daily Pivots: (S1) 1.1740; (P) 1.1799 (R1) 1.1835; More…

Euro drops to as low as 1.1732 so far today but stays above 1.1729 support. Intraday bias remains neutral first. On the downside, break of 1.1669 will resume the corrective fall from 1.2091 to 38.2% retracement of 1.0569 to 1.2091 at 1.1510. We’d expect strong support from there to complete the correction. On the upside, break of 1.1879 will revive the case that pull back from 1.2091 has already completed at 1.1669. In such case, intraday bias will be turned back to the upside for retesting 1.2091 high.

In the bigger picture, rise from medium term bottom at 1.0339 is not finished yet. It’s expected to continue after pull back from 1.2091 completes. And, next target will be 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. However, it should be noted that there is no confirmation of trend reversal yet. That is, such rebound from 1.0399 could be a correction. And the long term fall from 1.6039 (2008 high) could resume. Hence, we’d be cautious on strong resistance from 1.2516 to limit upside.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 10:00 | EUR | Bundesbank Releases Monthly Report | ||||

| 10:00 | GBP | CBI Trends Total Orders Oct | -2 | 9 | 7 | 1.70% |

| 12:30 | CAD | Wholesale Sales M/M Aug | 0.50% | 1.10% | 1.50% | |

| 14:00 | EUR | Eurozone Consumer Confidence Oct A | -1.1 | -1.2 |