Key Highlights

- USD/JPY is consolidating above the 145.50 support.

- A key bullish trend line is forming with support near 145.50 on the 4-hour chart.

- EUR/USD struggled to clear the 1.0940 and trimmed gains.

- The US nonfarm payrolls could increase by 170K in August 2023.

USD/JPY Technical Analysis

The US Dollar started a short-term downside correction from the 147.40 zone against the Japanese Yen. USD/JPY declined below the 147.00 and 146.50 levels.

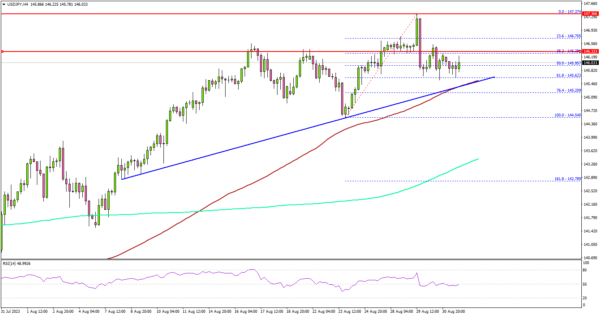

Looking at the 4-hour chart, the pair is still trading well above the 145.00 support, the 100 simple moving average (red, 4 hours), and the 200 simple moving average (green, 4 hours).

It is now consolidating and might attempt a fresh increase. On the upside, an initial resistance is near the 146.35 level. The first major resistance is near the 146.50 level.

A close above 146.50 could start a decent increase. In the stated case, the pair could rise toward the 147.40 level. Any more gains could send the pair toward the 148.00 level.

If not, the pair might start a fresh decline below the 145.65 support. The next key support is seen near the 145.50 level. There is also a key bullish trend line forming with support near 145.50 on the same chart.

If there is a move below 145.50, the pair could dive toward 145.20. Any more losses might send the pair toward the 144.50 level.

Looking at EUR/USD, the pair struggled to recover above the 1.0940 zone, faced rejection, and started a fresh decline.

Economic Releases

- Germany’s Manufacturing PMI for August 2023 – Forecast 39.1, versus 39.1 previous.

- Euro Zone Manufacturing PMI for August 2023 – Forecast 43.7, versus 43.7 previous.

- UK Manufacturing PMI for August 2023 – Forecast 42.5, versus 42.5 previous.

- US ISM Manufacturing PMI for August 2023 – Forecast 47.0, versus 46.4 previous.

- US nonfarm payrolls for August 2023 – Forecast 170K, versus 187K previous.

- US Unemployment Rate for August 2023 – Forecast 3.5%, versus 3.5% previous.