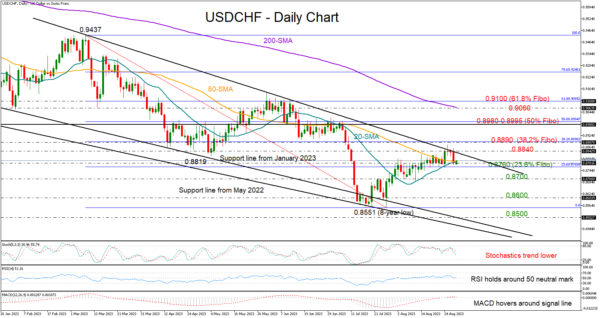

USDCHF reversed on Tuesday after six weeks of gains, as the bulls became tired near the resistance trendline at 0.8840 from March.

The 20- and 50-day simple moving averages (SMAs) came immediately to defend the upleg that started from the eight-year low of 0.8515 in mid-July. Traders might also keep a close eye on the 23.6% Fibonacci mark of the March-July downfall, slightly lower at 0.8760. If that base cracks, they may press the price towards the 0.8700 constraining area. Then, another deep negative correction could follow to 0.8600 if sellers stay in the driver’s seat.

Technically, a rebound in the price cannot be excluded as the RSI has not crossed below its 50 neutral mark yet, while the MACD is still hovering around its red signal line.

Still, it’s uncertain whether the pair will find sufficient buying interest to advance sustainably above the descending trendline and the 0.8840 area. The 38.2% Fibonacci mark of 0.8890 could be another headache for the bulls. If the latter gives way, the price could rise exponentially towards the 0.8980 crucial barrier and the 50% Fibonacci, while an extension above 0.9000 could clear the way towards the 200-day SMA.

In brief, USDCHF is testing a potential support zone with scope to force its way back to the important 0.8840 resistance bar. Hopes for a bullish revival could stay intact unless the price dives below 0.8760.