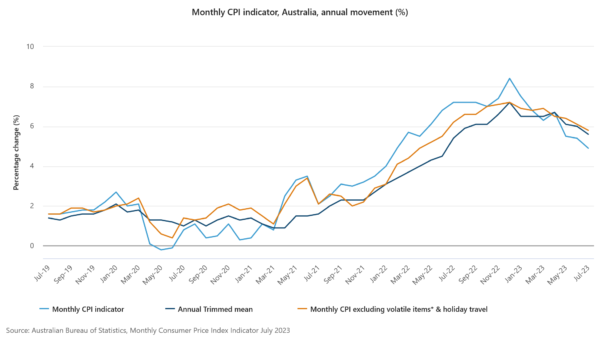

Australia’s monthly CPI for July registered a deeper than expected slowdown, easing from 5.4% yoy to 4.9% yoy. Analysts had forecasted a milder decline to 5.2% yoy. The underlying inflation measures also indicated a deceleration. CPI excluding volatile items such as holiday travel came in at 5.8% yoy, down from 6.1% yoy. The trimmed mean CPI, which is often regarded as a more accurate reflection of inflationary pressures, slowed from 6.0% yoy to 5.6% yoy.

A closer look at the inflation contributors reveals a mixed picture. Housing costs remained a significant upward pressure, climbing 7.3% on an annual basis. Food and non-alcoholic beverages followed closely, rising by 5.6% yoy. However, this was offset by substantial price falls in other areas. Automotive fuel costs dropped by -7.6%, while fruit and vegetable prices declined by -5.4%, thus tempering the overall July increase.

The latest CPI data comes on the heels of yesterday’s hawkish comments from incoming RBA Governor Michele Bullock, who emphasized that her first priority is still to maintain a focus on bringing inflation back down to target. Today’s lower-than-expected inflation figures might lend some flexibility to RBA’s policy approach, but with sectors like housing and food still exhibiting strong price pressures, the central bank’s task appears far from straightforward.