Key Highlights

- AUD/USD could recover above 0.6480 and 0.6500.

- A key bearish trend line is forming with resistance near 0.6445 on the 4-hour chart.

- EUR/USD might recover above the 1.0880 resistance zone.

- The US GDP could grow 2.4% in Q2 2023 (Preliminary).

AUD/USD Technical Analysis

The Aussie Dollar extended its decline below the 0.6550 level against the US Dollar. AUD/USD even broke the 0.6500 level to move further into a bearish zone.

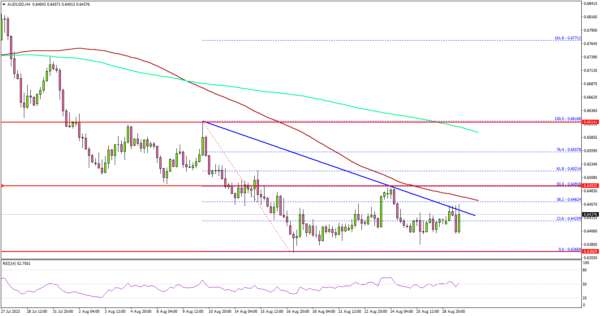

Looking at the 4-hour chart, the pair settled below the 0.6500 level, the 100 simple moving average (red, 4 hours) and the 200 simple moving average (green, 4 hours).

The pair tested the 0.6365 zone. A low was formed near 0.6366 and the pair is now attempting a recovery wave. It broke the 23.6% Fib retracement level of the downward move from the 0.6616 swing high to the 0.6366 low.

On the upside, an initial resistance is near the 0.6450 level. There is also a key bearish trend line forming with resistance near 0.6445 on the same chart.

The first major resistance is near the 0.6465 level or the 100 simple moving average (red, 4 hours). The main resistance is forming near the 0.6500 zone. It is close to the 50% Fib retracement level of the downward move from the 0.6616 swing high to the 0.6366 low.

A close above 0.6500 could start a decent increase. In the stated case, the pair could rise toward the 0.6580 level. Any more gains could send the pair toward the 0.6620 level.

If not, the pair might continue to move down below the 0.6350 support. The next key support is seen near the 0.6520 level. If there is a move below 0.6520, the pair could dive toward 0.6450.

Looking at EUR/USD, the pair is showing some signs of a recovery wave and it might climb above the 1.0880 resistance.

Economic Releases

- US ADP Employment Change for August 2023 – Forecast 195K, versus 324K previous.

- US Gross Domestic Product for Q2 2023 (Preliminary) – Forecast 2.4% versus previous 2.4%.