Trading in the forex market today saw a tempered tone, with most major currencies trading in a tight range due to a sparse economic calendar. An early uplift in market sentiment was observed, largely attributed to China’s strategic moves aimed at boosting investor confidence. This positive wave continued into the early US trading hours, though its broader effects remained contained. Australian and New Zealand Dollars are emerging as today’s outperformers, closely shadowed by Euro and Sterling. In contrast, Japanese Yen recorded the most significant dip, with Swiss Franc and Dollar also trailing behind.

Technically, while offshore Chinese Yuan’s recovery in the past week appears to be losing momentum. 38.2% retracement of 7.1154 to 7.3491 at 7.2598 could provide a floor to USD/CNH’s pull back. Break of 7.3165 would bring stronger rebound to retest 7.3491 high at least. Decisive break will resume larger rally to 7.3745 key resistance. Risk aversion in China and Asia could come back if the stronger bounce in USD/CNH is accompanied by poor PMI data from China later in the week.

In Europe, at the time of writing, FTSE is up 0.07%. DAX is up 0.76%. CAC is up 1.00%. Germany 10-year yield is down -0.010 at 2.551. Earlier in Asia, Nikkei rose 1.73%. Hong Kong HSI rose 0.97%. China Shanghai SSE rose 1.13%. Singapore Strait times rose 0.75%. Japan 10-year JGB yield rose 0.0076 to 0.668.

ECB’s Holzmann advocates further rate hike, views economy as stagnating

ECB Governing Council member Robert Holzmann expressed concerns over the inflationary environment, stating, “We’re not yet in the clear when it comes to inflation.” He accentuated the need for continued rate increases, suggesting that barring unforeseen circumstances, there could be a compelling case to “push on with rate increases without taking a pause” come September.

Holzmann emphasized the advantages of achieving the peak rate swiftly, noting, “It’s better to achieve a peak rate faster, which also means we can eventually start going lower earlier.” He highlighted the challenges for markets in navigating a sporadic “stop-and-go rate path.”

Furthermore, Holzmann acknowledged that the ECB has been “somewhat behind the curve” in its endeavors to combat inflation. When quizzed on the possibility of continued rate hikes beyond September, he remarked that once rates reach the 4% threshold, the matter would be up for discussion again.

On the topic of Eurozone’s economic health, Holzmann offered a measured perspective. While conceding that the economy isn’t performing at the anticipated level, he was quick to dismiss fears of an impending recession. He characterized the current economic landscape as one of stagnation, stating, “We’re looking at a stagnating economy.”

Japan’s Cabinet Office upgrades export assessment amid stable economic outlook

In its latest monthly economic report, Japan Cabinet Office has lifted its assessment on exports for the first time since May. Exports, which previously displayed a “steady undertone,” are now characterized as showing “movements of picking up recently.”

Other key areas of the economy showed stable and positive trend. Private consumption and business investment are both on an “picking up”. Corporate profits have seen moderate improvement. Employment situation shows movements of improvement. Consumer prices are rising.

Looking ahead, the report expects the Japanese economy to sustain its moderate recovery, driven by enhancements in employment and income situations. However, it does underscore potential threats. The slowing pace of foreign economies, especially due to global monetary tightening and uncertainties about China’s economic direction, are identified as primary external risks to Japan’s growth trajectory.

Australia retail sales rose 0.5% mom in Jul, but underlying growth subdued

Australia’s retail sales turnover for July showed a 0.5% mom increase, reaching AUD 35.38B, surpassing anticipated 0.3% mom rise. When compared to figures from July 2022, turnover has risen by 2.1% yoy.

Commenting on the rebound, Ben Dorber, ABS head of retail statistics, noted, “The rise in July is a partial reversal of last month’s sharp decline in turnover.” He attributed the June dip to “weaker-than-usual end of financial year sales.”

However, Dorber cautioned against interpreting July numbers as a sign of robust retail health. Elaborating on the sector’s underlying momentum, he stated, “While there was a rise in July, underlying growth in retail turnover remained

Supporting this perspective, Dorber pointed out the lack of substantial movement in the trend terms: “In trend terms, retail turnover was unchanged in July and up only 1.9 per cent compared to July 2022, despite considerable price growth over the year.”

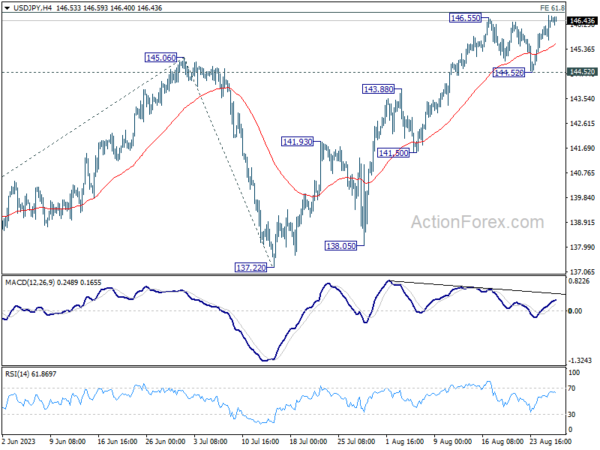

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 145.89; (P) 146.26; (R1) 146.79; More…

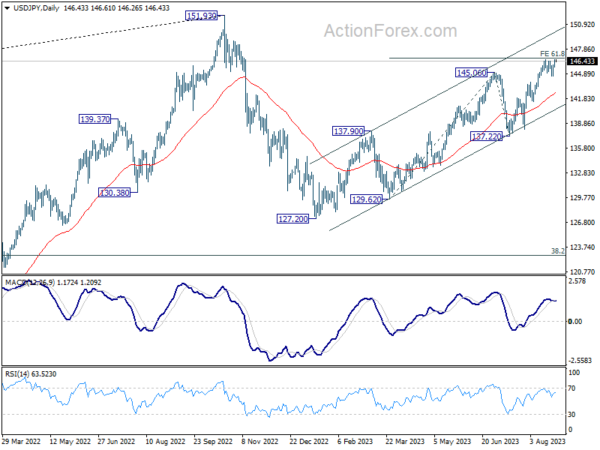

Outlook in USD/JPY remains unchanged and intraday bias stays on the upside. Sustained break of 61.8% projection of 129.62 to 145.06 from 137.22 at 146.76 will pave the way to retest 151.93 high. For now, outlook will stays cautiously bullish as long as 144.52 support holds, in case of retreat.

In the bigger picture, overall price actions from 151.93 (2022 high) are views as a corrective pattern. Rise from 127.20 is seen as the second leg of the pattern and could still be in progress. But even in case of extended rise, strong resistance should be seen from 151.93 to limit upside. Meanwhile, break of 137.22 support should confirm the start of the third leg to 127.20 (2023 low) and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Retail Sales M/M Jul | 0.50% | 0.30% | -0.80% | |

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Jul | 0.40% | 0.00% | 0.60% |