Key Highlights

- USD/JPY climbed above the 146.00 level before it corrected lower.

- A key bearish trend line is forming with resistance near 146.15 on the 4-hour chart.

- EUR/USD could extend losses below the 1.0800 level.

- GBP/USD could dive and trade toward 1.2550.

USD/JPY Technical Analysis

The US Dollar started a strong increase above the 143.20 level against the Japanese Yen. USD/JPY even before the 144.50 resistance and climbed above 145.50.

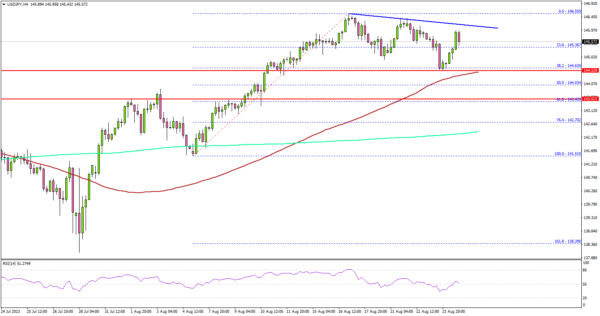

Looking at the 4-hour chart, the pair traded toward the 146.50 level and settled above the 100 simple moving average (red, 4 hours) and the 200 simple moving average (green, 4 hours).

A high was formed near 146.55 before there was a minor downside correction. The pair traded below the 145.50 level and tested the 38.2% Fib retracement level of the upward move from the 141.51 swing low to the 146.55 high.

The pair stayed above 144.60 and the 100 simple moving average (red, 4 hours). It is now attempting a fresh increase above 145.20. On the upside, an initial resistance is near the 146.20 level. There is also a key bearish trend line forming with resistance near 146.15 on the same chart.

A close above 146.20 could start a decent increase. In the stated case, the pair could rise toward the 146.55 level. Any more gains could start a fresh increase toward the 148.00 level.

If not, the pair might react to the downside toward the 144.60 support. The next key support is seen near the 144.00 level or the 50% Fib retracement level of the upward move from the 141.51 swing low to the 146.55 high.

If there is a move below 144.00, the pair could dive toward 142.50. Any more gains might open the doors for a test of 141.50.

Looking at EUR/USD, the pair is still trading in a bearish zone and there is a risk of more downsides below the 1.0800 level.

Economic Releases

- German IFO Business Climate Index for August 2023 – Forecast 86.7, versus 87.3 previous.

- Jackson Hole Symposium.

- Federal Reserve Chair Jerome Powell’s Speech.