Recovery leg from $1884 (Aug 17/21 double-bottom) extends into fourth straight day and hit two-week high in early Thursday’s trading.

Gold’s near-term action remains underpinned by weaker dollar and increased demand as traders await fresh signals about interest rates from the gathering of central bankers in Jackson Hole, with focus on Friday’s speech of Fed Chair Jerome Powell.

Series of weaker than expected PMI data from Japan, EU, UK and US, released on Wednesday, point to stagnation and slowdown in the economic activity in these economies, which is strong warning to the central bankers that further increasing of interest rates may additionally hurt economic growth in already fragile conditions.

Although the US policymakers were referring to recent solid economic data which signal that the US economy remains resilient despite high borrowing cost, the latest data showed the weakest growth in months and warn that business activity stagnated in August, contributing to scenario of pausing in hike cycle.

Similar situation is in Europe, with more negative signals about contraction in business activity, which suggests that the ECB may stay on hold in September, with the worst situation seen in the UK, as weak data boost fears that the economy may slide into recession

Such scenario is likely to be supportive for gold, as weakening economic conditions would point to deepening crisis and prompt traders into safety, with pause in raising interest rates to increase pressure on US dollar.

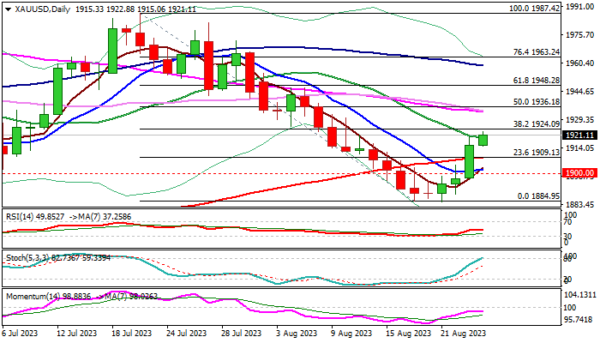

Technical picture on daily chart is improving, following Wednesday’s break and close above 200DMA ($1908) and formation of 5/10DMA bull cross, though the risk of recovery stall exists as 14-d momentum indicator is still in negative territory and stochastic is overbought.

The price is holding just under pivotal Fibo barrier at $1924 (38.2% retracement of $1987/$1884), clear break of which is needed to generate fresh bullish signal and further reduce downside risk.

Fresh recovery could be also attracted by thinning daily cloud which twists next week and possibly help bulls to accelerate towards key obstacles at $1936/42 (50% retracement/cloud base).

Caution on return and close below 200DMA which will generate initial signal that recovery phase might be over, with dip through $1902/00 (10DMA / psychological) to confirm scenario.

Res: 1924; 1936; 1942; 1948.

Sup: 1915; 1908; 1902; 1900.