Investor attention is set to pivot towards Japan’s Q2 GDP data in the upcoming Asian session. Preliminary forecasts project a qoq growth of 0.8%, translating to an annualized expansion of 3.1%. In today’s trading, Nikkei took a significant hit, sliding by -1.27% or -413.7 points, largely influenced by bearish sentiments rooted in China’s property sector. Meanwhile, Yen showed signs of wavering post an initial surge, setting the stage for a keen watch on its reaction, as well as Nikkei’s, to the impending GDP figures.

After some initial volatility following BoJ’s adjustment on YCC on July 28, Nikkei has weakened notably. Technically, it’s now pressing 55 D MEA and looks vulnerable to deeper decline. Nevertheless, Overall price actions from 33772.89 are just viewed as a corrective move to the long term up trend only, as also supported by the structure. Hence, even in case of a deeper pull back, strong support should be seen from 38.2% retracement of 25661.89 to 33772.89 to contain downside. Meanwhile, strong rebound from current level, would bring retest of 33772.89 high.

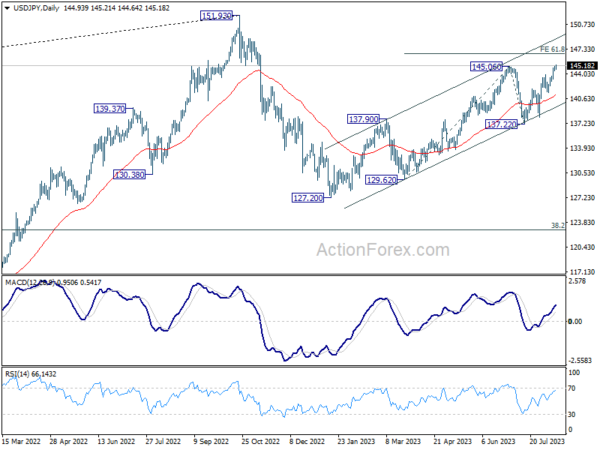

Meanwhile, Yen continued to weaken after brief post-BoJ spike, with USD/JPY breaking through 145 handle today. Market chatter suggests a potential pushback by Ministry of Finance in the 145-148 range, though tangible signs of intervention remain absent. Yet it’s a wait-and-watch game to discern if Japan would act beyond the 145 mark. Nevertheless, technically, 61.8% projection of 129.62 to 145.06 from 137.22 at 146.76 doe present a resistance to overcome.