Key Highlights

- USD/JPY is rising above the 142.00 resistance.

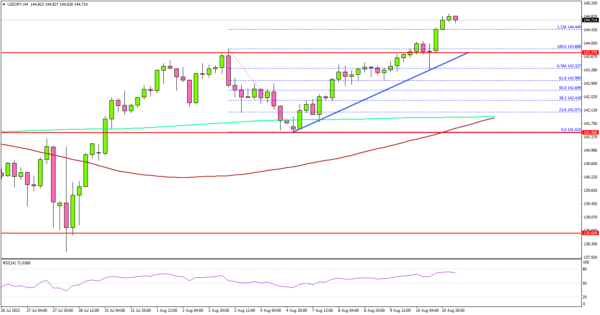

- A connecting bullish trend line is forming with support near 143.80 on the 4-hour chart.

- EUR/USD is recovering losses and trading well above 1.0950.

- Crude oil prices are struggling to surpass $85.

USD/JPY Technical Analysis

The US Dollar started a fresh increase above the 140.00 pivot level against the Japanese Yen. USD/JPY broke the 142.50 resistance to enter further into a positive zone.

Looking at the 4-hour chart, the pair settled above the 142.50 level, the 100 simple moving average (red, 4 hours), and the 200 simple moving average (green, 4 hours).

There was also a spike above the 144.00 level. The pair traded to a new multi-week high and might extend gains above the 145.00 level. The next major resistance is near the 146.20 level. A close above the 146.20 resistance could push the pair toward 148.00. Any more gains could start a fresh increase toward the 150.00 level.

Initial support is near the 143.80 level. There is also a connecting bullish trend line forming with support near 143.80 on the same chart.

The next major support is near 143.00, below which USD/JPY could gain bearish momentum. In the stated case, the pair could test the 142.00 support.

Looking at EUR/USD, the pair started an upside correction and was able to clear the 1.1000 resistance zone.

Economic Releases

- UK GDP for Q2 2023 (Preliminary) (QoQ) – Forecast 0%, versus +0.1% previous.

- UK Industrial Production for June 2023 (MoM) – Forecast +0.1%, versus -0.6% previous.

- UK Manufacturing Production for June 2023 (MoM) – Forecast +0.2%, versus -0.2% previous.