Dollar surged broadly last week as Republican’s tax plan overcame another hurdle. The news also sent DOW and S&P 500 to new records, with upside acceleration. Accompanying that, treasury yields closed sharply higher, reversing prior week’s loss. Technical development in Dollar was not totally convincing yet. NZD/USD led the way lower as markets were unhappy with the new labour-led coalition in New Zealand. USD/CAD followed after disappointing economic data. Solid risk appetite also pushed USD/JPY and USD/CHF near term resistance to resume recent rally. But EUR/USD was kept in range only, showing much resilience in spite of political turmoil in Catalonia. GBP/USD was also held in range with support from some positive news regarding Brexit. AUD/USD also stays in recently established range.

A number of key events will be closely watched this week. The list include election in Japan on Sunday, Catalonia standoff and BoC rate decision. Nonetheless, the more market moving event should be ECB rate decisions where the central bank could announce to extending the asset purchase program but half the purchase size. Q3 GDP from UK and US will also trigger some volatility in the markets. In addition, there could be unscheduled news regarding US President Donald Trump’s choice of next Fed chair, as well as news on the tax plan.

Dollar index gyrated around 55 day EMA – a bullish sign

Dollar index’s gyration around a flat 55 day EMA is taken as a bullish sign. That is, rebound from 91.01 maybe not completed yet. Of course, in the background, there is bullish divergence condition seen in daily MACD. And, DXY breached 91.91/93 key long term support briefly (38.2% retracement of 72.69, 2011 low, to 103.82, 2016 high). Focus could now be back on 94.14/26 resistance zone this week. Decisive break there will confirm medium term reversal and target 38.2% retracement of 103.82 to 91.01 at 95.90.

10 year yield to take on 2.396/402 resistance again

This is also supported by the development in 10 year yield. TNX’s pull back from 2.402 is possibly completed at 2.273, comfortably above 55 day EMA. Focus is now back on 2.396/402 resistance zone. Decisive break there will confirm that whole medium term correction from 2.621 has completed at 2.034, ahead of 50% retracement of 1.336 (2016 low) to 2.621 (2017 high) at 1.978. In that case, TNX would target a test on 2.621 key resistance next. And such development would be Dollar positive and Yen negative.

DOW up trend accelerated further

The above development was accompanied by recent acceleration in US stocks. DOW made another record close at 23328.62. Based on current momentum, DOW should now target 100% projection of 20379.55 to 22179.11 from 21731.12 at 23530.68. There is prospect of hitting 161.8% projection at 24642.80 in medium term. Such development will be Dollar and yield positive, and Yen negative.

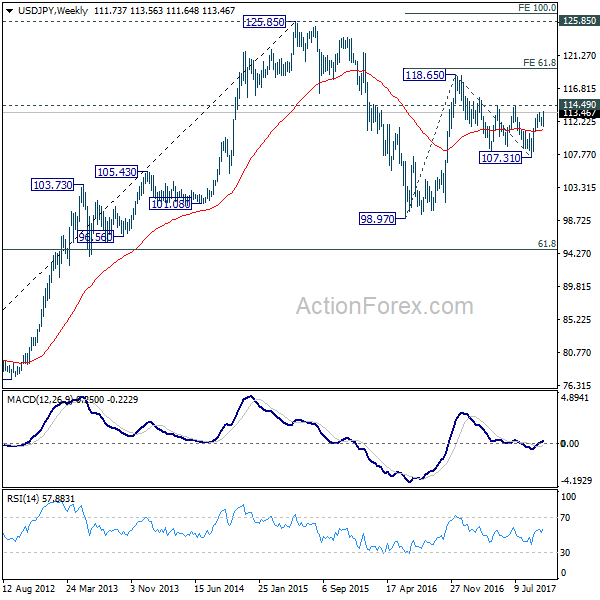

USD/JPY in bullish development

Taking a look at USD/JPY, last week’s breach of 113.43 resistance suggests that rebound from 107.31 is resuming. More importantly, the development revives that case that correction from 118.65 has completed at 107.31 already. Immediate focus will be on 114.49 resistance this week. Sustained break there should at least send USD/JPY through 118.65 to 61.8% projection of 98.97 to 118.65 from 107.31 at 119.47. If the strength in yields and stocks carries on as noted above, USD/JPY should indeed break 125.85 to 100% projection at 126.99.

Trading strategies

Based on the above analysis on stocks, yield, Dollar index and USD/JPY, we’d buy USD/JPY at market this week with a stop at 112.50, slightly below 4 hour 55 EMA. Decisive break of 114.49 resistance will be the first affirmation of our bullish call. And, we’d initially look at 118.65 as first target, but keep an eye on the chance to hit 125.85 and above.

We’re holding on to CAD/JPY long position (bought at 89.90). The cross hit as high as 90.76 but was weighed down by disappointing Canadian data. Still as price actions from 91.62 are corrective looking. And the cross did draw support from rising 55 day EMA. We’re holding on to our bullish view and will keep the position, with stop at 88.50. Break of 91.62 will extend to the rise to our first target of 61.8% retracement of 106.48 to 74.80 at 94.37 and above.

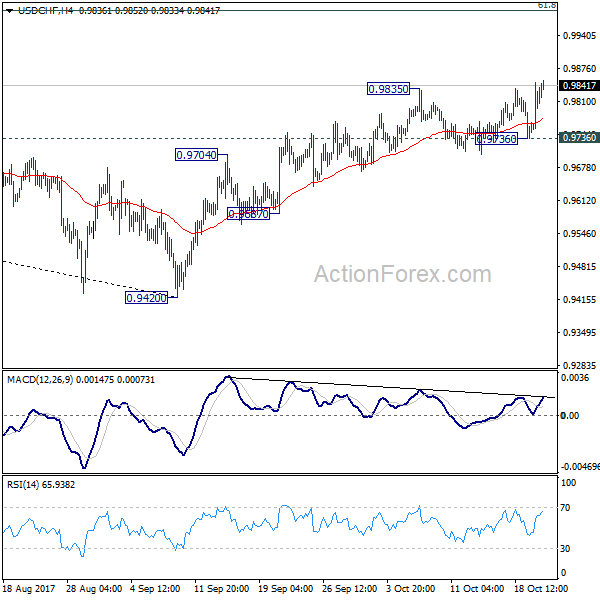

USD/CHF Weekly Outlook

USD/CHF’s break of 0.9835 resistance last week indicates that rebound from 0.9420 is resuming. More importantly, this affirmed the case that medium term fall from 1.0342 has finished at 0.9420. Initial bias stays on the upside this week for 61.8% retracement of 1.0342 to 0.9420 at 0.9990. Sustained break there will pave the way to retest 1.0342 high. However, break of 0.9736 support will mixed up the near term outlook and turn bias back to the downside for 0.9587 support instead.

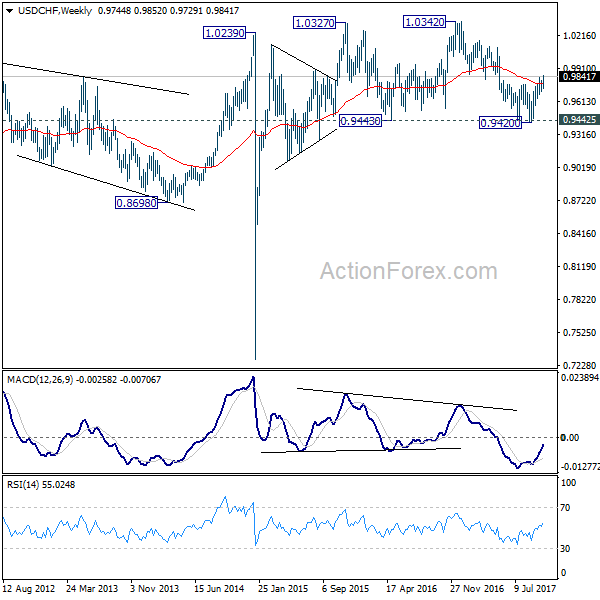

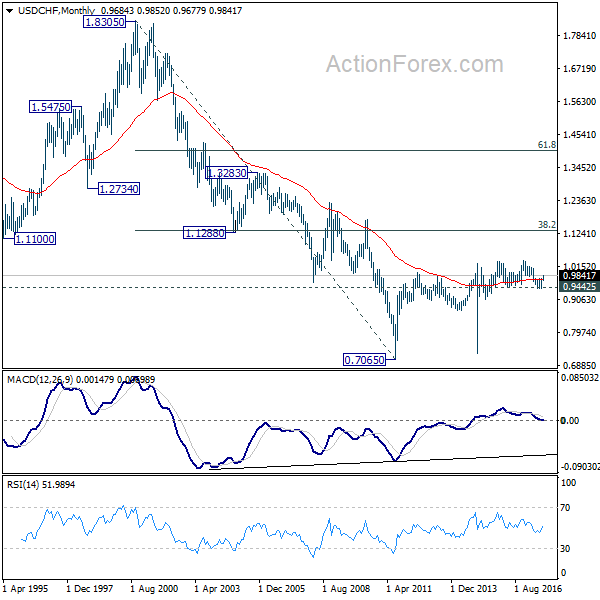

In the bigger picture, current development suggests that USD/CHF has defended 0.9443 (2016 low) key support level again. Rise from 0.9420 could develop into a medium term move and target a test on 1.0342 high. This represents the upper end of a long term range that started back in 2015. On the downside, break of 0.9587 support is now needed to indicate completion of the rise from 0.9420. Otherwise, further rally will remain in favor in medium term.