WTI crude oil continued its impressive rally, marking its highest price point for the year. This surge comes in the wake of Saudi Arabia’s firm stance, as the nation’s cabinet confirmed yesterday its unwavering support for the precautionary strategies adopted by OPEC+.

Adding weight to this commitment, just last week, Saudi Arabia prolonged its voluntary slash in production by a significant 1 million barrels daily until the end of September. Besides, Russia further bolstered the market sentiment by announcing a reduction in oil exports by 300,000 bpd for September.

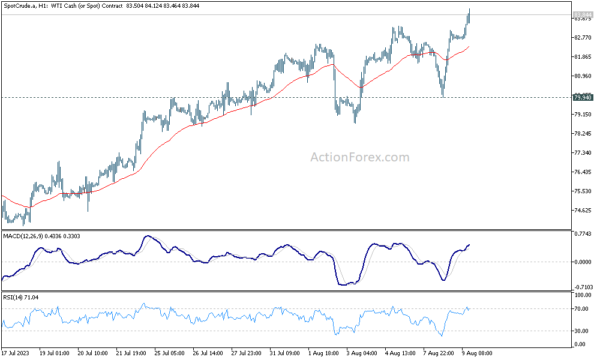

Technically, near term outlook in WTI will now stay bullish as long as 79.94 support holds. Next target is 161.8% projection of 63.67 to 74.74 from 66.94 at 84.85, and possibly above.

However, barring any dramatic development, strong resistance should be seen from 38.2% retracement of 131.82 (2022 high) to 63.67 (2023 low) at 89.70 to limit upside, at least on first attempt.