Asian markets exhibited mild risk-off sentiment today, but with limited selloffs observed. China’s data revealed a foray into deflation, though expectation remains that this may not be a prolonged phase, especially given the milder-than-expected dip in CPI. While this doesn’t offer a significant boost in market sentiment, it’s somewhat less gloomy than anticipated.

In the currency arena, the dynamism seemed to ebb once again. Dollar’s rally overnight rally appeared to run out of steam swiftly, suggesting that traders might be reserving their significant moves for the impending US CPI data release tomorrow. Concurrently, both Australian and New Zealand Dollars witnessed marginal recoveries.

For the week at hand, British Pound is leading the charge, followed closely by Dollar and Swiss Franc. On the flip side, Japanese Yen finds itself at the bottom of the performance chart, with Euro and Canadian Dollar trailing not far behind. Post its recovery today, Australian Dollar is mixed for now, together with its Canadian counterpart.

Technically, Bitcoin is attempting a rebound this week, but upside is so far capped by 30337 resistance. Break of this resistance level will suggest that the corrective pullback from 31815 has completed at 28555. That would reaffirm near term bullish for another rise through 31815 to resume larger rally from 15452. If that’s realized, let’s see if NASDAQ would accompany the move higher. Overnight, DOW dropped -0.45%. S&P dropped -0.42%. NASDAQ dropped -0.79%. 10-year yield dropped -0.052 to 4.026.

China CPI down -0.3% yoy, first negative since 2021

China’s CPI for July registered a drop of -0.3% yoy, marking its first decline since February 2021. Although this result is slightly better than the market’s expectation of a -0.4% drop, it underscores the economic headwinds faced.

Core inflation measure, which excludes the often erratic food and energy costs, showed a rise to 0.8% yoy from a mere 0.4% yoy. This points to some underlying demand within the economy, albeit muted.

A deeper dive into CPI reveals that food prices have seen a -1% fall yoy, a sharp contrast to the 2.3% yoy rise observed in the previous month. On the other hand, non-food prices climbed 0.5% yoy last month, bouncing back from a -0.6% yoy.

Dong Lijuan, chief statistician at the NBS, commented, “With the impact of a high base from last year gradually fading, the CPI is likely to rebound gradually.”

On the PPI front, situation remains challenging. PPI improved from -5.4% yoy to -4.4% yoy in July. This figure not only missed market expectations, which stood at -3.8% yoy, but also marked the tenth straight month of negative readings.

RBNZ business survey points to lower inflation expectations, steady interest rates

As seen from the latest Quarterly RBNZ Survey of Expectations, businesses have slightly tapered their inflation expectations in the near term but wage inflation expectations were on the rise. RBNZ OCR is expected to be unchanged at the current 5.50% through the quarter.

Expectations for annual inflation one year ahead have moderated, moving from 4.28% to 4.17%. However, a two-year horizon sees a marginal uptick in these expectations, which have climbed from 2.79% to 2.83%.

More long-term views, reflected in the five and ten-year ahead inflation expectations, both indicate a pullback, dropping to 2.25% (from 2.35%) and 2.22% (from 2.28%), respectively.

A notable area of concern stems from the annual wage inflation expectations. Over the course of both one and two years, these expectations are on the rise. For the year ahead, expectations climbed from 4.80% to 5.04%, and for the two-year mark, they increased from 3.53% to 3.66%.

Regarding monetary policy, the survey results indicate a stable outlook on the OCR. By the close of the September 2023 quarter, businesses anticipate OCR to average around 5.53%, a minimal climb from the prior quarter’s estimate of 5.47%. A one-year ahead mean estimate rose 32 basis points to 5.16% from the previous 4.84%.

Average one-year ahead GDP growth forecast surged to 1.02%, up from previous 0.48%. Moreover, businesses seem to be projecting continued momentum, with two-year ahead GDP growth expectations reaching 1.95% from preceding 1.66%.

GBP/USD Daily Outlook

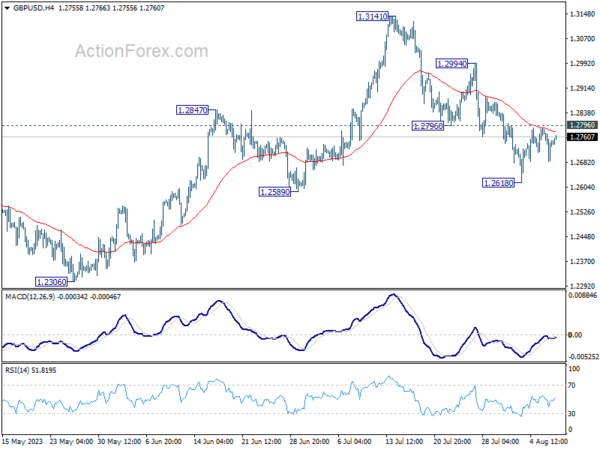

Daily Pivots: (S1) 1.2692; (P) 1.2740; (R1) 1.2795; More…

GBP/USD is still bounded in range above 1.2618 and intraday bias stays neutral at this point. On the downside, below 1.2618, and sustained trading below 1.2678 resistance turned support will argue that it’s already in a larger correction. Deeper decline would then be seen to 1.2306 support next. Nevertheless, firm break of 1.2796 will indicate that the pull back has completed, and turn bias back to the upside for stronger rebound.

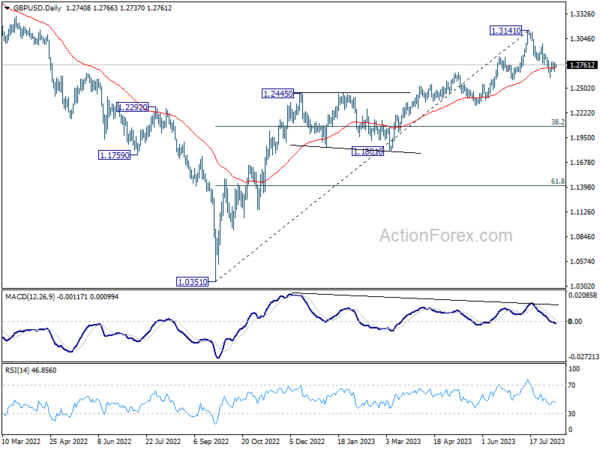

In the bigger picture, a medium term top could be in place at 1.3141 already, on bearish divergence condition in D MACD. Sustained trading below 55 D EMA (now at 1.2726) should confirm this case, and bring deeper fall to 38.2% retracement of 1.0351 to 1.3141 at 1.2075, as a correction to up trend from 1.0351 (2022 low). For now, rise will stay mildly on the downside as long as 1.3141 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | CNY | CPI Y/Y Jul | -0.30% | -0.40% | 0.00% | |

| 01:30 | CNY | PPI Y/Y Jul | -4.40% | -3.80% | -5.40% | |

| 03:00 | NZD | RBNZ Inflation Expectations Q/Q Q3 | 2.83% | 2.79% | ||

| 06:00 | JPY | Machine Tool Orders Y/Y Jul P | -19.80% | -21.70% | -21.10% | |

| 12:30 | CAD | Building Permits M/M Jun | 2.30% | 10.50% | ||

| 14:30 | USD | Crude Oil Inventories | 2.1M | -17.0M |