Dollar is surging broadly in early US session as risk aversion appears to be intensifying slightly. The appears to be a reaction to Moody’s cut the credit ratings of a host of small and mid-sized U.S. banks late Monday, and changed its outlook to negative for 11 banks. 10-year yield sinks below 4% handle on safe haven too. Yen reversed earlier losses on risk aversion, and follows the greenback as the second strongest, and then Swiss Franc.

Commodity currencies are the worst performances. Aussie’s selloff started earlier today on poor China trade data, and the decline is accelerating on risk-off sentiment in early US session. Kiwi and Loonie are following closely. Euro and Sterling are mixed for now but start to look vulnerable against the greenback.

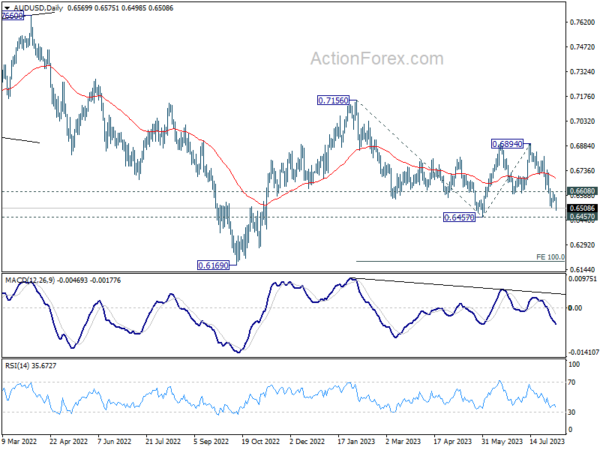

Technically, AUD/USD’s decline form 0.6894 resumes today by breaking through last week’s low at 0.6513. Retest of 0.6457 support could be seen soon. Firm break there will resume whole fall from 0.7156 towards 0.6169 low. In any case, outlook will now stay cautiously bearish as long as 0.6608 resistance holds. Let’s seen if Thursday’s US CPI would trigger the downside breakout.

In Europe, at the time of writing, FTSE is down -0.60%. DAX is down -1.24%. CAC is down -0.96%. Germany 10-year yield is down -0.146 at 2.453. Earlier in Asia, Nikkei rose 0.38%. Hong Kong HSI dropped -1.81%. China Shanghai SSE dropped -0.25%. Singapore Strait Times rose 0.12%. Japan 10-year JGB yield dropped -0.0167 to 0.611.

Fed’s Harker foresees stable rates and soft landing

Philadelphia Fed President Patrick Harker suggested a pause on rate changes in the coming months, emphasizing the importance of allowing current monetary policy measures to take effect.

He said today, “Absent any alarming new data between now and mid-September, I believe we may be at the point where we can be patient and hold rates steady and let the monetary policy actions we have taken do their work.”

He also cautioned against expecting immediate rate reductions, noting, “The pandemic taught us to never say never, but I do not foresee any likely circumstance for an immediate easing of the policy rate.”

Harker indicated that there might be a slight rise in the unemployment rate, which was most recently recorded at 3.5% in July, along with a deceleration in the GDP’s growth rate.

Nonetheless, he remains optimistic, stating, “In sum, I expect only a modest slowdown in economic activity to go along with a slow but sure disinflation.”

“I do see us on the flight path to the soft landing we all hope for and that has proved quite elusive in the past, he added.

ECB consumer survey: Easing inflation expectations, but waning spending optimism

In June ECB Consumer Expectations Survey, consumer concerns over inflation appear to be receding, with expectations for both short-term and three-year horizons declining. Despite steady views on income growth over the next year, there’s a palpable decrease in optimism around consumer spending. Meanwhile, the outlook for economic growth sees a marginal uptick, albeit remaining muted.

Notably, consumers seem to be less concerned about rampant inflation. Expectations for inflation over the next 12 months have retreated, with mean prediction decreasing from 5.1% to 4.7%. Median inflation outlook for the same period experienced a steeper decline, shifting from 3.9% down to 3.4%. This downward trend also extends to longer-term predictions. Mean inflation expectations for a three-year horizon have decreased from 4.0% to 3.8%, while median expectations for the same period have edged down from 2.5% to 2.3%.

Consumer views on household income for the next 12 months remained steady, with both mean and median expectations unmoved at 1.2% and 0.1% respectively. However, there’s growing pessimism concerning consumer spending. Expectations for mean household spending over the next year have slightly decreased from 3.5% to 3.4%, while median forecast has descended more markedly from 2.4% to 2.1%.

In terms of economic performance, consumers are marginally less bearish about near-term growth outlook. Mean expectation for economic growth over the next year has improved slightly from -0.7% to -0.6%, even though median remains unchanged at flat 0.0%. Interestingly, there were no alterations in consumer outlook for unemployment over the next year, with predictions holding steady.

Japan’s wages growth and household spending miss expectations, supports ultra-loose BoJ

Today’s wage growth data out of Japan came in softer than anticipated, reinforcing BoJ’s position towards maintaining its ultra-loose monetary strategy. Furthermore, the consistent decline in real wages continues to weigh down consumer spending.

Nominal cash earnings for workers in June grew by only 2.3% yoy, missing the projected 3.0% yoy rise. This marks a deceleration from previous month’s impressive 2.9% yoy – the most robust growth observed in nearly 30 years. Delving deeper, June’s base salary advance was logged at 1.4% yoy, , also under May’s 1.7% yoy .

Economists have previously estimated that wage increases of 3% or more are crucial to sustain consumer inflation above BoJ’s 2% target.

Compounding concerns, real cash earnings continued their downward trajectory, recording a decline of -1.6% yoy, faring worse than the anticipated stasis at -0.9% yoy. This represents the 15th consecutive month of negative readings in this domain.

Furthermore, overall household spending for June saw a contraction of -4.2% yoy, veering further off the expected -3.5% yoy decline. This marks the fourth consecutive month of shrinking household spending.

These lackluster wage figures pose a challenge for the BoJ. As Governor Kazuo Ueda remarked, the trajectory of income trends is pivotal in determining the realistic prospects of accomplishing lasting inflation. Today’s data lends credence to the BoJ’s recent evaluation that consistently achieving price increments beyond 2% remains a distant goal. Consequently, the need to uphold its ultra-accommodative monetary parameters becomes ever more evident.

Australia’s Consumer Sentiment down -0.4%, no lift from RBA pause

Australia’s Westpac Consumer Sentiment Index for August indicated a slight decline, registering at 81, a drop of -0.4% mom from July’s reading of 81.3. Westpac’s analysis suggests that this decrease cements the prevailing pessimistic mood among consumers. Interestingly, RBA’s decision to pause rate hikes did not notably influence this sentiment. The prevailing concerns about inflation continue to overshadow, although confidence in the job market did see a marginal improvement.

Regarding RBA’s upcoming meeting on September 5, Westpac anticipates the central bank will maintain its current stance, leaving rates untouched at 4.1%. This cash rate is expected to be the zenith of this financial cycle. It is now up to incoming data and unfolding economic scenarios to present a compelling argument for further monetary tightening.

Westpac emphasized that for RBA to be prompted into action, any economic developments would need to be not just surprising, but also substantial, essentially posing a challenge to the bank’s medium-term outlook.

Australia NAB business confidence rose to 2, inflationary pressures on the rise

Australia’s NAB Business Confidence Index for July revealed an upward tick, moving from -1 in June to 2. However, Business Conditions saw a slight dip from 11 to 10. Delving into specific metrics, readings for trading conditions, profitability, and employment remained unchanged with the previous month, all settling at 16, 10, and 6 respectively.

Notably, the month saw a pronounced rise in price and cost growth. Labour cost growth surged to 3.7% in quarterly equivalent terms, up from June’s 2.3%, and purchase cost growth escalated to 2.6%, a jump from the previous month’s 2.2%. Furthermore, final price growth climbed to 2%, doubling June’s 1%.

Commenting on the findings, NAB Chief Economist, Alan Oster, remarked, “Business conditions in July remained resilient and have largely held steady at above-average levels over the past few months.”

He added, “While business confidence rebounded to positive territory, overall confidence remains muted.”

Oster further noted the inflationary pressures highlighted by the survey, noting, “Despite the Q2 CPI release indicating an improvement, the survey underscores that the upward pressure on inflation remains significant.”

China’s exports down -14.5% yoy in Jul, shipments to ASEAN down -21.4% yoy

July saw a sharper-than-expected contraction in China’s exports, with decline of -14.5% yoy to USD 281.76B. This marked the steepest drop since February 2020 and exceeded market expectations, which had forecasted a decline of -12.5% yoy. Concurrently, imports also took a hit, plunging by -12.4% yoy to USD 201.16B, much steeper than anticipated -5% yoy drop.

With these declines, China’s trade surplus unexpectedly widened. July’s figures show surplus expanding from USD 70.6B to USD 80.6B, surpassing the market forecast of USD 67.8B.

A key observation was the sharp decline in shipments to ASEAN – one of China’s primary trade partners. Exports to ASEAN dropped by a significant -21.43% yoy in July, marking its second straight monthly decline. This is noteworthy as ASEAN had played a pivotal role in bolstering China’s export sector earlier in the year.

In addition, exports to EU and US followed suit with declines of -20.62% yoy and -23.12% yoy, respectively. The dip in shipments to US represents a continued trend, with July marking the twelfth consecutive month of decline.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0973; (P) 1.0995; (R1) 1.1026; More…

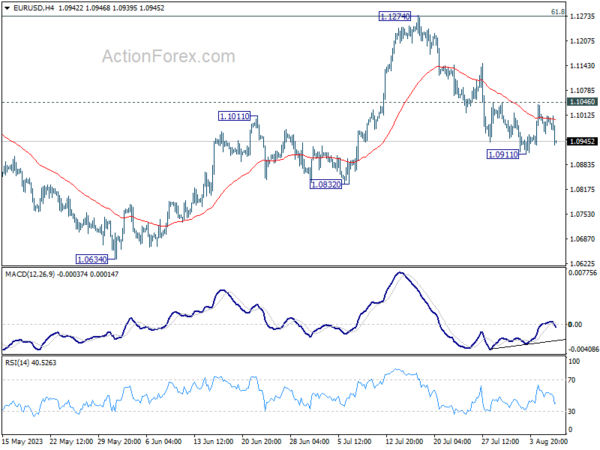

Intraday bias in EUR/USD stays neutral first and further decline is in favor. On the downside, break of 1.0911 will resume the fall from 1.1274 to 1.0832 support. Sustained trading below there will target 1.0609/34 cluster support. However, firm break of 1.1046 minor resistance will argue that pull back from 1.1274 has completed, and bring stronger rebound.

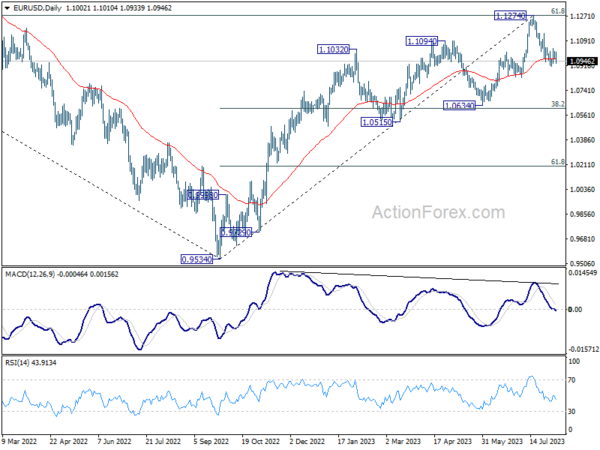

In the bigger picture, a medium term top could be formed at 1.1274, after failing to break through 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 decisively, on bearish divergence condition in D MACD. Sustained trading below 55 D EMA (now at 1.0966) will bring deeper correction to 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609). Strong support could be seen there, at least on first attempt, to set the range for consolidation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Jul | 1.80% | 3.00% | 4.20% | |

| 23:30 | JPY | Labor Cash Earnings Y/Y Jun | 2.30% | 3.00% | 2.50% | 2.90% |

| 23:30 | JPY | Overall Household Spending Y/Y Jun | -4.20% | -3.50% | -4.00% | |

| 23:50 | JPY | Bank Lending Y/Y Jul | 2.90% | 3.10% | 3.20% | |

| 23:50 | JPY | Current Account (JPY) Jun | 2.35T | 2.24T | 1.70T | |

| 00:30 | AUD | Westpac Consumer Confidence Aug | -0.40% | 2.70% | ||

| 01:30 | AUD | NAB Business Conditions Jul | 10 | 9 | 11 | |

| 01:30 | AUD | NAB Business Confidence Jul | 2 | 0 | -1 | |

| 03:00 | CNY | Trade Balance (USD) Jul | 80.6B | 67.8B | 70.6B | |

| 03:00 | CNY | Trade Balance (CNY) Jul | 576B | 470B | 491B | |

| 05:00 | JPY | Eco Watchers Survey: Outlook Jul | 54.4 | 54.5 | 53.6 | |

| 06:00 | EUR | Germany CPI M/M Jul F | 0.30% | 0.30% | 0.30% | |

| 06:00 | EUR | Germany CPI Y/Y Jul F | 6.20% | 6.20% | 6.20% | |

| 06:45 | EUR | France Trade Balance (EUR) Jun | -6.7B | -8.0B | -8.4B | |

| 10:00 | USD | NFIB Business Optimism Index Jul | 91.9 | 90.6 | 91 | |

| 12:30 | USD | Trade Balance (USD) Jun | -65.5B | -65.2B | -69.0B | -68.3B |

| 12:30 | CAD | Trade Balance (CAD) Jun | -3.7B | -1.7B | -3.4B | -2.7B |

| 14:00 | USD | Wholesale Inventories Jun F | -0.30% | -0.30% |