The July 28 Bank of Japan meeting proved less exciting than some market participants anticipated despite the tweak in the yield curve control mechanism introduced. The majority of BoJ members remain dovish despite some relatively optimistic data prints during 2023. Could this week’s data releases have a positive impact on the yen against the euro?

BoJ still not ready for a significant monetary policy change

At its late-July meeting, the BoJ tried to keep the market happy by essentially tweaking the famous YCC framework without portraying it as a monetary policy restrictive action. This announcement might have maintained the status quo at the BoJ policy board but the market was not satisfied. As a result, the yen recorded sizeable losses against both the euro and the US dollar and remains under pressure.

Governor Ueda tried to present a more optimistic case at the press conference by referring to elevated wage growth, but it looks like that the BoJ has probably lost its turn at the current global hiking cycle. This is mostly reflected in the Summary of Opinions released earlier today where there is a plethora of dovish comments that, at the moment, hold the door firmly shut to any meaningful expectations for a rate hike soon.

This situation is also partly confirmed by BoJ policy board members’ forecasts that show the core inflation rate at the range of 1.8-2.2% for the fiscal year of 2025, well below the current 3% levels. A higher set of forecasts would have potentially allowed the BoJ to strike a different tone at its latest gathering. Like both the ECB and the Fed, data dependency remains the name of game for the BoJ as we are going through a data-packed week.

Could earnings save the day?

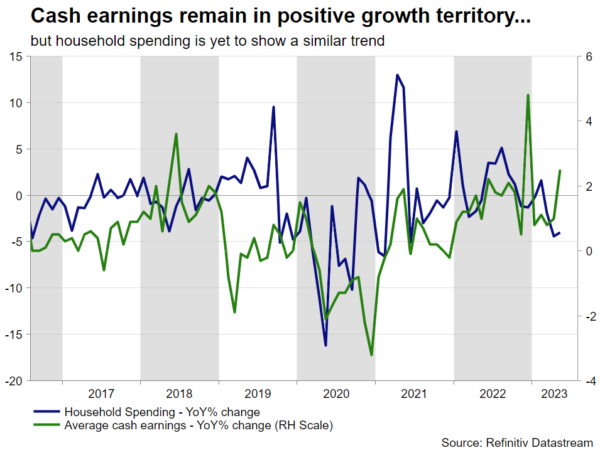

We have already seen the leading indicators index surprising on the downside on Monday but remaining comfortably above its 2023 trend. However, the key piece of data comes on Tuesday in the form of average cash earnings and household spending for the month of June. These datasets have been getting attention lately as wages dominate discussions among central bankers globally. Average cash earnings are expected to show a 1.6% year-on-year increase, recording the longest growth phase since the 2017-2019 period, and giving the minority BoJ hawks something to smile about. Less impressively, the overall household spending continues to contract on an annual basis. However, following the higher wage agreements made in April 2023 there is a strong chance for an upside surprise and hence the indicator finally picking up some momentum.

Among the remaining data releases, there could be some market attention at the July producer price index (PPI) figure coming out on Thursday. Compared to the prints seen in both Europe and the US, Japanese PPI continues to record positive year-on-year increases and hence allowing for a certain degree of optimism regarding future headline CPI levels. However, it is fair to highlight that this indicator has been dropping aggressively from the 10.5% peak, registered in December 2022. Another drop could clearly sound the alarm at the BoJ corridor.

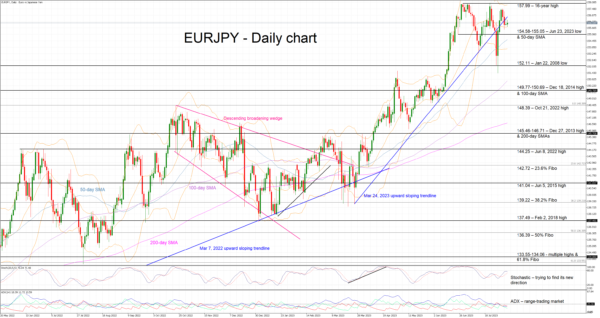

Euro/yen above the 155 level again

Disappointment from the lack of a significant announcement by Ueda et al fueled another rally in the euro/yen pair. However, the euro bulls’ failure to record a higher high, above the 16-year high of 157.99, gave the yen followers the chance to push this pair towards the 156 area. A strange-looking series of lower lows and lower highs will probably maintain some bearish pressure, but data releases remain the key. A positive set of data could push the euro/yen pair towards the 152 area, while a barrage of weak data prints would allow the euro bulls to revisit the recent highs.