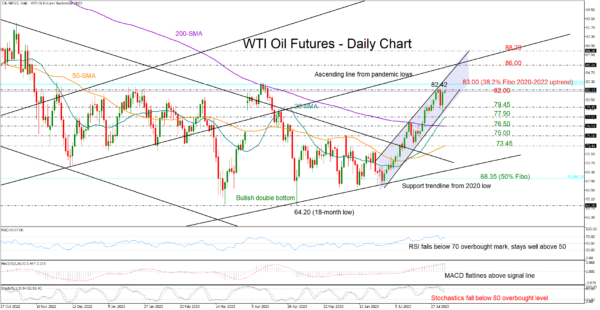

WTl oil futures (September delivery) won back Wednesday’s loss to retest the 82.00 resistance area after pivoting at the bottom of a tight bullish channel.

Oil prices are on the rise for the sixth consecutive week and a downside correction cannot be excluded, as the RSI and the Stochastic oscillator are showing signs of weakness following their peaks in their overbought zones.

Still, with the RSI standing comfortably above its 50 neutral mark and the MACD holding above its red signal line, the market might become bullish again in the short-term picture. Besides, Wednesday’s red candlestick seems to be part of a bullish three strike candlestick pattern, which is considered a positive signal of continuation.

In trend signals, the 20-day simple moving average (SMA) has strengthened above the 200-day SMA for the first time since October 2020, leading to optimism that the bullish wave could stretch beyond the 83.00 level and April’s ceiling of 83.40. If efforts prove successful and the price exits the tight upward-sloping channel above 83.60, the door could open for the 86.00 barrier. The long-term ascending line from April 2020 is passing through this area. Therefore, a move higher could add more fuel to the rally, shifting the spotlight to 88.00.

In the bearish scenario, where the price slides below the channel and the 79.45 level, the 20- and 200-day SMAs could immediately come to the rescue near 77.90 and 76.50, respectively. A move below the latter could ignite fresh selling towards the 75.00 mark and then down to the 50-day SMA at 73.45.

All in all, although WTI oil futures have stabilized after the peak at 82.42 earlier this week, only a drop below the short-term channel and the 79.45 area could reduce hopes for a bullish continuation.