- Today, ECB decided to hike its three policy rates by 25bp. The deposit rate is now 3.75% which was widely anticipated. ECB left no clear guidance on a potential rate hike in September, as they will assess the strength of the incoming data.

- The balanced communication, weighting the lagged effect of monetary policy measures already taken and the strength of the incoming data, left no clear clues for a potential hike in September as Lagarde was very explicit about the not making any commitments, but truly staying data dependent on a meeting by meeting basis. Therefore a rate hike in September will depend on the incoming data and the staff projections in September. The weak PMI and gloomy bank lending survey released earlier this week is somewhat challenging our September rate hike call, in absence of an August rebound. However, the inflation releases (Monday next week) and end of August is essential for a firm conclusion of a September hike.

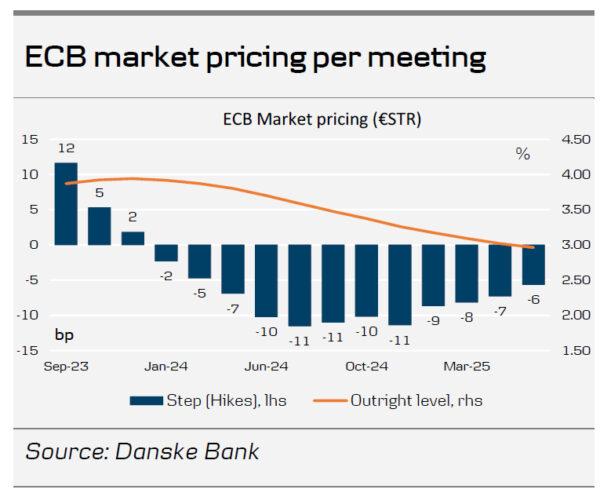

- Markets didn’t react much to today’s meeting and continues to have another 19bp to a 3.94% peak in the deposit rate. We find that pricing fair.

Inflation still too high

Overall, ECB acknowledge that inflation has continued to decline yet it is still ‘expected to remain too high for too long’. In particular, President Lagarde highlighted that the drivers of inflation are changing as while the external price drivers are easing, it is now the domestic price drivers that are increasingly important with notably rising wages and profit margins becoming an increasingly important source of underlying inflation. In sum, the underlying inflation remains high overall. ECB highlighted that the near term economic activity have deteriorated mainly due to domestic demand as well as due to high inflation and tightening financing conditions. The economy is expected to remain weak in the near term.

Softer language on additional tightening. Door wide open for hike or pause

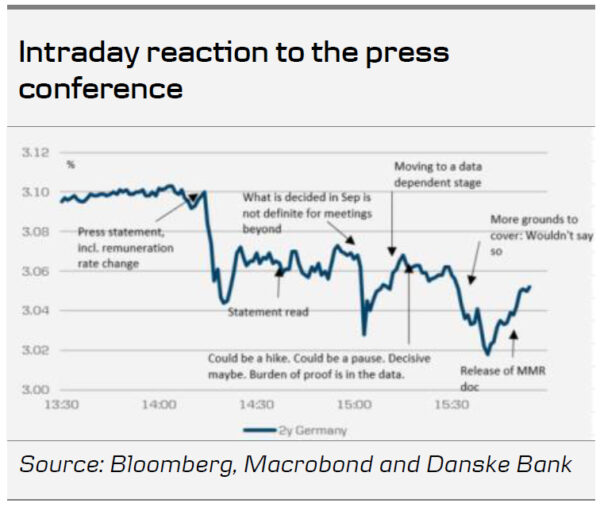

While the economic outlook and inflation assessment was overall in line with expectations, we take note a minor but important change to the guidance which allows that ECB have come with their final rate hike today. ECB changed the words ‘brought to’ to ‘set’ for their rate guidance to be ‘sufficiently restrictive levels’ to bring inflation in line with the target. That subtle change was clearly emphasised by Lagarde during the press conference where she made clear that no decision or guidance are given for the September meeting and even if they decide not to hike, this may not constitute the end of the hiking cycle, but may be a pause. She emphasised that a September decision will not say anything about the October decision. Lagarde said on a potential September hike that it is a ‘definite maybe’.

Changes to reserve remuneration

ECB also announced a technical change to their operation framework. From 20 September the minimum reserve requirements (totalling around EUR160bn) will be remunerated at 0%. ECB has made this change to ensure the monetary policy transmission and the ‘overall amount of interest that needs to be paid on reserves in order to implement the appropriate stance.’ This change will save ECB around EUR6bn/year assuming current depo rate level.

Sharp decline in EUR/USD and broad EUR depreciation

EUR/USD moved sharply lower towards 1.10 on the dovish market interpretation of the ECB meeting and a batch of robust US data releases (strong US Advance Q2 GDP figures and lower-than-expected US jobless claims). The EUR broadly weakened in the G10 space, especially against the Dollar bloc. As we recently have highlighted, we think the general USD weakness this month has been more driven by positioning and sentiment rather than fundamentals. July has generally been characterised by disinflation signs and increasing soft landing optimism benefitting cyclical currencies and sending EUR/USD to new highs for the year. Increased risk appetite, moves in relative rates and particularly the soft June US CPI print have broadly led to a USD sell-off in July, although momentum has been reversing during the past week.

We still think the lagging effect of the restrictive monetary policy is yet to filter through to the euro area economy. In contrast to the relatively robust US economy, we think the euro area economy looks fragile and it has already been showing weakening signs, especially in the manufacturing sector. We expect that to be a headwind for the EUR in the coming months. It is also worth noting that trade weighted EUR is around all-time highs in nominal terms, which we find difficult to explain from a fundamental perspective.

Overall, we maintain our strategic case for a lower EUR/USD based on relative terms of trade, real rates and relative unit labour costs. We expect the relative strength of the US economy to weigh on the EUR/USD in the coming months, and we continue to forecast the cross at 1.06/1.03 in 6/12M. In the near-term, continued data dependence from both the Fed and the ECB will likely keep EUR/USD jumpy around US and euro area data releases in the next couple of months.