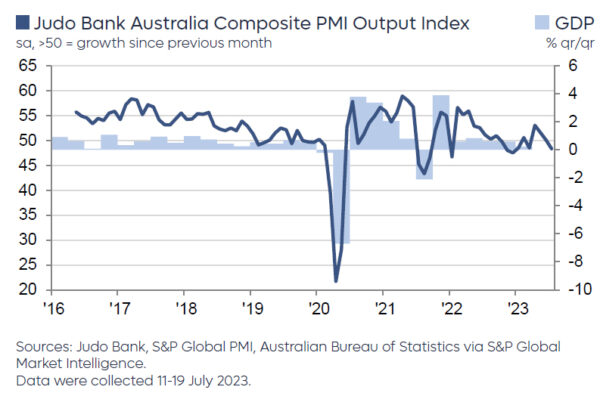

Australia’s PMI Manufacturing recorded a mild uptick in July, rising from 48.2 to 49.6, marking a 5-month high, but still falling short of the expansionary threshold of 50. Concurrently, PMI Services took a downward turn from 50.3 to 48.0, hitting a 7-month low. Consequently, Composite PMI, a measure of combined sectors, dipped from 50.1 to 48.3, which is also a 7-month low.

Warren Hogan, Chief Economic Advisor at Judo Bank, attributed the soft July figures predominantly to a dip in business activity in the services sector, which had previously been on a recovery path in 2023. But the “Australian economy remains on the ‘narrow path’ for a soft landing.”

The July Flash report raised some concerns regarding inflation. Despite the slowdown in activity, price indicators trended higher, particularly within the services sector. These inflationary signals remain elevated, pointing to a potential inflation rate of around 4-5%, substantially exceeding RBA’s target of 2% to 3%.

Hogan noted that the disinflationary trend evident throughout 2022 “appears to have ceased”. As such, July figures will provide critical insights into whether Australia’s inflation aligns with the declining trends seen in other countries recently, or if the nation is “set to experience a more sticky inflation trend in 2023/24.”