Japanese Yen falls sharply following a Reuters report, which cited five anonymous sources, suggesting BoJ is predisposed towards maintaining its yield curve control at the upcoming meeting next week. Particularly significant is the current trading of 10-year JGB yield comfortably below 0.5%, negating any necessity to adjust even the yield cap.

Furthermore, BoJ appears to be in a position to bide its time until there is greater clarity surrounding the global economy’s ability to circumvent a hard landing. This clarity is particularly relevant in determining if Japanese corporations can generate sufficient profits to continue raising wages in the following year. Meanwhile, doubts persist over the sustainability of inflation, a factor largely contingent on corporate profits and the wage outlook for next year.

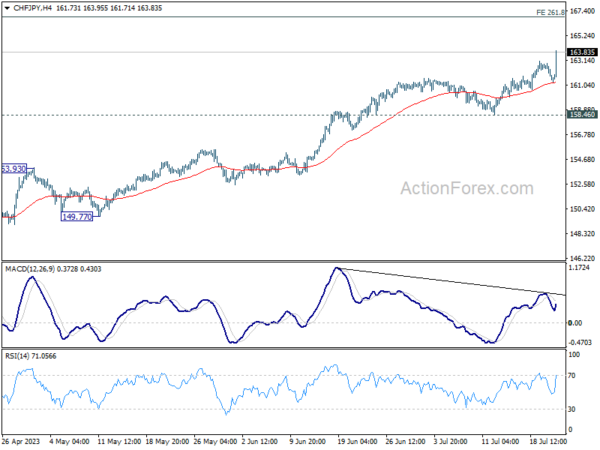

CHF/JPY is currently among the top movers for the day. Current up trend is set to target 261.8% projection of 137.40 to 147.58 from 140.21 at 166.86 next. In any case, outlook will stay bullish as long as 158.46 support holds.