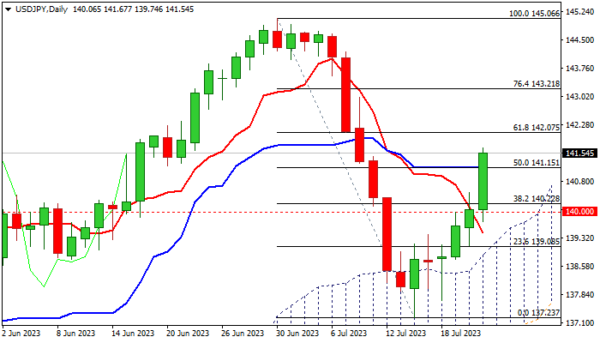

USDJPY rose to 1 ½ week high in early Friday, following break of pivotal barriers at 140.00/22 (psychological / Fibo 38.2% of 145.06/137.23 bear-leg).

Bulls remain firmly in play for the third straight day and verifying reversal signals on daily chart, as fresh advance retraced over 50% of 145.06/137.23 pullback and confirming a higher low at 137.23 (July 14).

Rising daily Ichimoku cloud contained correction from 145.06 (2023 high, posted on June 30) as penetration into cloud was short-lived and price action returned above the cloud, which is currently underpinning recovery.

Daily technical studies are improving, but more work at the upside is still needed to shift into bullish configuration, with close above cracked barrier at 141.15 (50% of 145.06/137.23 / daily Kijun-sen) to generate fresh bullish signal.

Markets shift focus to key events, Fed and BOJ policy meetings, due next week.

The US central bank is widely expected to deliver another 25 basis points hike this month and likely to keep interest rates high for extended period, as the latest economic data show that US economy is resilient and sideline recession threats.

On the other hand, the Bank of Japan is unlikely to change its monetary policy this year, despite the fact that inflation remains above central bank’s target, which may keep yen under pressure.

Res: 141.83; 142.07; 143.00; 143.21.

Sup: 141.15; 140.50; 140.22; 140.00.