- We expect the Fed to hike interest rates for the final time by 25bp in the next week’s meeting, and then go on hold.

- While economic activity has still held up well, easing underlying inflation and declining inflation expectations limit the need for further rate hikes.

- We expect the immediate market reaction to be muted, with risks skewed towards a hawkish reaction, if Powell still maintains the door open for another hike. We see 10y UST yield at 3.50% and EUR/USD at 1.06 by the end of the year.

A 25bp hike in the next week’s meeting is largely ‘a done deal’, as market pricing for the meeting has remained remarkably stable through the recent data releases. The focus will be on forward guidance for the remainder of the year, and whether the FOMC is still convinced it will hike the Fed Funds target rate all the way to 5.50-5.75%, as outlined in the June SEP.

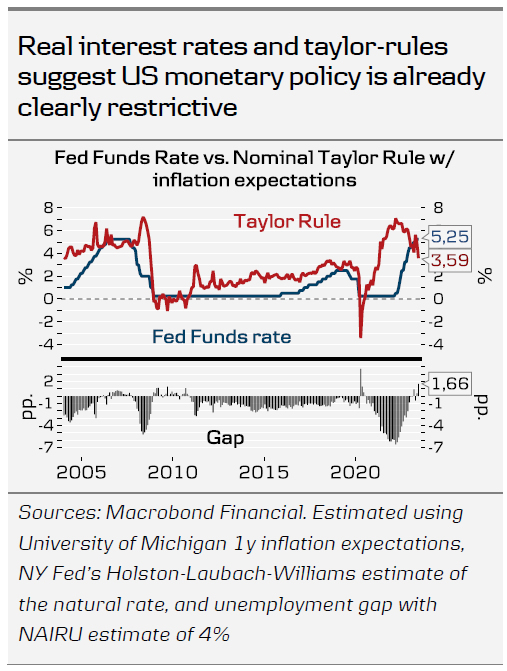

As we discussed two weeks ago in Research US – Rising real rates cast a shadow over upbeat macro data, 7 July, the combination of rising nominal policy rate and declining inflation expectations increases the risk of a harder landing down the line. Short real interest rates are at the highest levels since the GFC, and a simple taylor-rule with inflation expectations gives a similar sense of tight monetary policy stance.

That said, the latest leading economic data as well as this week’s June retail sales suggest that activity is holding up relatively well. Excess savings from the pandemic have likely been soon depleted, which is evident in consumers having already started to increase their savings rates, but strong labour markets continue to support consumption nevertheless.

The situation can be seen in two ways. Either 1) the economy is headed for a true soft landing, where the disinflation seen today continues without a substantial drop in economic activity or that 2) subtly weakening demand, higher interest rates and real wage growth are squeezing companies’ profit margins, paving way for layoffs going forward. In either scenario, we do not foresee a need for further policy rate hikes.

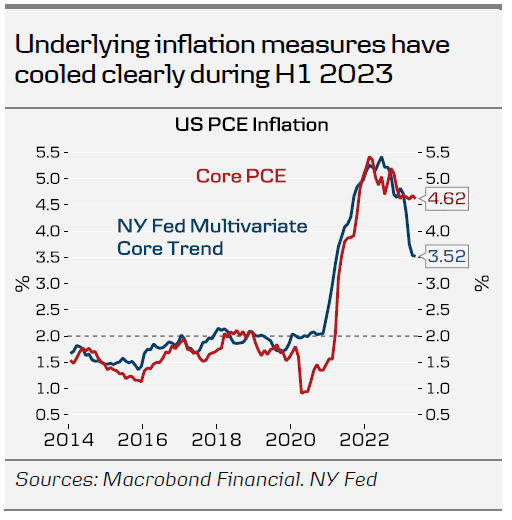

In this week’s Global Inflation Watch, 18 July, we flagged that seasonally adjusted m/m changes in the underlying components of inflation suggests that price pressures have cooled substantially over the past few months. Similarly, measures such as NY Fed’s Multivariate Core Trend PCE, which overweight the more stable components of the PCE price index, have recently cooled faster than the ‘official’ rate which the Fed targets.

But even so, Powell is unlikely to close the door for more hikes next week, as the Fed aims to maintain financial conditions restrictive as long as realized inflation remains elevated. Note that we will not get updated rate projections in this meeting.

We anticipate a muted market reaction as Powell reiterates the FOMC’s data dependent approach, essentially kicking the can down the road. As markets only price in around 8bp for another hike beyond July, the risks could be skewed towards a hawkish reaction. We see 10Y UST yields declining to the 3.50% area by the end of the year, with concurrent steepening of the 2s10s curve, and expect EUR/USD to fall towards 1.06 level in 6M time.