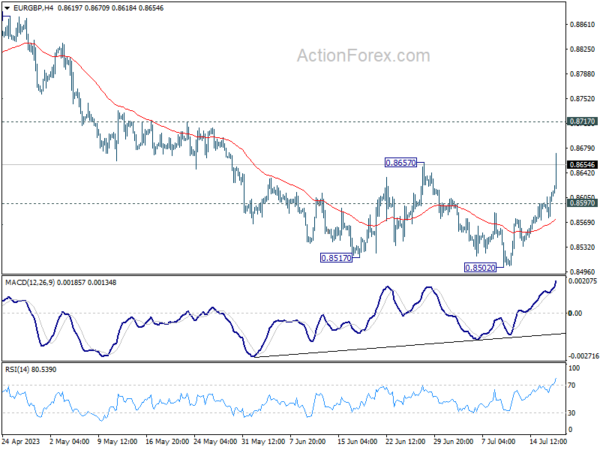

Daily Pivots: (S1) 0.8589; (P) 0.8602; (R1) 0.8627; More…

EUR/GBP’s strong rally and break of 0.8657 resistance confirms short term bottoming at 0.8502, on bullish convergence condition in 4H and D MACD. Current development argues that fall from 0.8977 might have completed its five-wave sequence. Intraday bias is back on the upside for 0.8717 support turned resistance first. Sustained break there will solidify this case and target 0.8977 resistance next. On the downside, though, below 0.8597 will mix up the outlook and turn intraday bias neutral first.

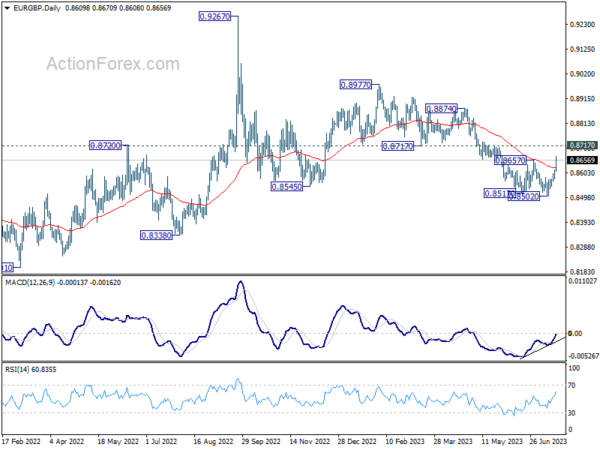

In the bigger picture, the down trend from 0.9267 (2022 high) is seen as part of the long term range pattern from 0.9499 (2020 high). Firm break of 0.8717 support turned resistance will argue that it has completed with three waves down to 0.8502. Further break of 0.8977 will bring retest o f0.9267 high. Nevertheless, break of 0.8502 will resume the decline towards 0.8201 (2022 low).