Dollar regains much ground overnight as boosted by revived hopes on tax reform in the US. A critical hurdle was cleared after the Senate approved a budget blueprint for fiscal 2018. That was narrowly passed by 51-49 after marathon debate. Nonetheless, the passing of the blueprint includes instruction that would help Republicans avoid a Democrat filibuster. Senate Majority Leader Mitch McConnell said that "passing this budget is critical to getting tax reform done, so we can strengthen our economy after years of stagnation under the previous administration." Senator Bob Corker, who’s in feud with President Donald Trump, voted the for the budget. Meanwhile, Senator John McCain also voted yes.

Trump concluded Fed chair interviews, leans towards Powell

Separately, it’s reported that Trump has concluded all interviews on the five candidates for next Fed chair. A decision could be announced as soon as next week. The interview with current Fed chair Janet Yellen "went well" according to unnamed source. But it’s also reported that Trump is leaning towards current Fed Governor Jerome Powell for the job. And important factor is that Powell is known to be heavily favored by Treasury secretary Steven Mnuchin. The other three candidates include former Fed Governor Kevin Warsh, Stanford economist John Taylor and National Economic Council Director Gary Cohn. The formal response on the issue from White House spokeswoman Natalie Storm is that "they’re all at the same level of consideration at this time. The president said himself on Tuesday, he likes all of the candidates and has great respect for them all."

Euro resilient despite Catalonia turmoil

Euro is trading as the second strongest one for the week so far, just next to Dollar. The turmoil regarding Catalonia doesn’t have much lasting impact on the common currency so far. Spain has called for a special cabinet meeting on Saturday. It’s believed that officials would trigger the so call Article 155 process to suspend Catalonia autonomy and take away lower powers. At the EU summit, German Chancellor Angela Merkel said they will watch the developments closely. But she leaned towards the Spanish government and said that "we hope that there will be solutions that can be found on the basis of the Spanish constitution." French President Emmanuel Macron also called for "unity".

UK PM May seeks dynamic in Brexit negotiations

UK Prime minister Theresa May also attended the working dinner of EU official sin Brussels. She urged EU leaders to create a "dynamic" in Brexit negotiations" that "enables us to move forward together". And she acknowledged that the process was progressing "step by step" and "from my side there are no indications at all that we won’t succeed." Meanwhile, Merkel said there were "encouraging" signs but progress was "no sufficient" to start trade talks.

On the data front

German PPI rose 0.3% mom, 3.1% in September, above expectation of 0.1% mom, 2.9% yoy. Eurozone current account and UK public sector net borrowing will be featured in European session. But main focus of the day will be Canadian Dollar, including CPI and retail sales. US will release existing home sales.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2458; (P) 1.2476; (R1) 1.2502; More….

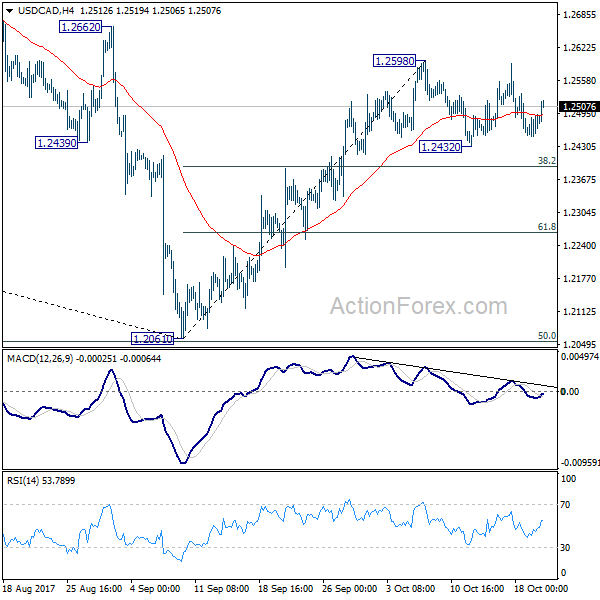

At this point, USD/CAD is staying in consolidation from 1.2598 and intraday bias remains neutral for the moment. In case of deeper fall, downside should be contained by 38.2% retracement of 1.2061 to 1.2598 at 1.2393 to bring rally resumption. On the upside, break of 1.2598 will extend the rebound from 1.2061 to 1.2777 resistance next.

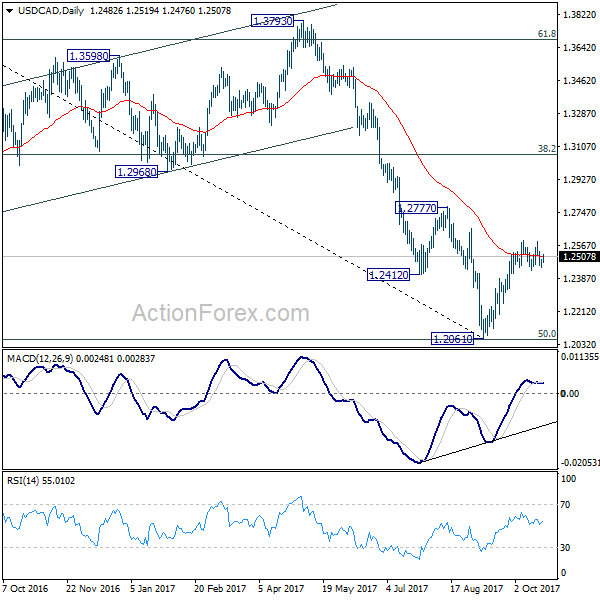

In the bigger picture, USD/CAD should have defended 50% retracement of 0.9406 (2011 low) to 1.4869 (2016 high) at 1.2048. And with 1.2048 intact, we’d favor the case that fall from 1.4689 is a correction. Break of 1.2777 will further affirm this bullish case. That is, larger up trend from 0.9406 is not completed. And in that case, USD/CAD should target 1.3793 resistance next. However, on the other hand, firm break of 1.2048 will indicate that fall from 1.4689 is at least a medium term down trend and should target 61.8% retracement at 1.1424 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 6:00 | EUR | German PPI M/M Sep | 0.30% | 0.10% | 0.20% | |

| 6:00 | EUR | German PPI Y/Y Sep | 3.10% | 2.90% | 2.60% | |

| 8:00 | EUR | Eurozone Current Account (EUR) Aug | 26.2B | 25.1B | ||

| 8:30 | GBP | Public Sector Net Borrowing (GBP) Sep | 5.7B | 5.1B | ||

| 12:30 | CAD | CPI M/M Sep | 0.40% | 0.10% | ||

| 12:30 | CAD | CPI Y/Y Sep | 1.70% | 1.40% | ||

| 12:30 | CAD | CPI Core – Common Y/Y Sep | 1.50% | |||

| 12:30 | CAD | CPI Core – Trim Y/Y Sep | 1.40% | |||

| 12:30 | CAD | CPI Core – Median Y/Y Sep | 1.70% | |||

| 12:30 | CAD | Retail Sales M/M Aug | 0.40% | 0.40% | ||

| 12:30 | CAD | Retail Sales Less Autos M/M Aug | 0.30% | 0.20% | ||

| 14:00 | USD | Existing Home Sales Sep | 5.32M | 5.35M |