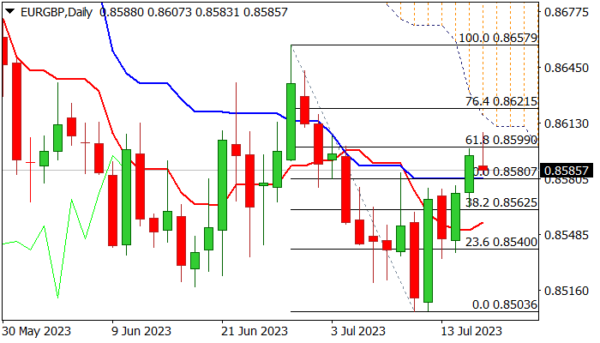

Attempts to extend strong rally of past two days failed at pivotal Fibo barrier at 0.8599 (61.8% of 0.8657/0.8503), as probe above faced strong headwinds from thick falling daily cloud (base of the cloud lays at 0.8610).

Short-lived spike higher is forming a daily candle with long upper shadow, which generates initial signal of possible recovery stall, though needs confirmation in daily close in this shape.

The notion is supported by overbought stochastic and 14-d momentum in negative territory and heading south.

Close below 0.8599 will provide initial negative signal and keep the downside vulnerable, with dip and close below 0.8580 (daily Kijun-sen / broken 50% retracement) to further weaken near-term structure and increase downside risk.

Alternatively, sustained break above 0.8599 pivot to keep bullish bias, but penetration into daily cloud is needed to fully employ bulls for stronger recovery.

Res: 0.8599; 0.8610; 0.8621; 0.8643.

Sup: 0.8580; 0.8562; 0.8540; 0.8518.