While China is having another power battle in the artificial intelligence field against the US, economists are still hoping for the second biggest economy to bolster global growth as recession fears in the rest of the world persist. Monday’s Q2 GDP growth figures could bring some cheer to investors, likely showing the fastest expansion in two years.

Q2 GDP growth expected to pick up pace

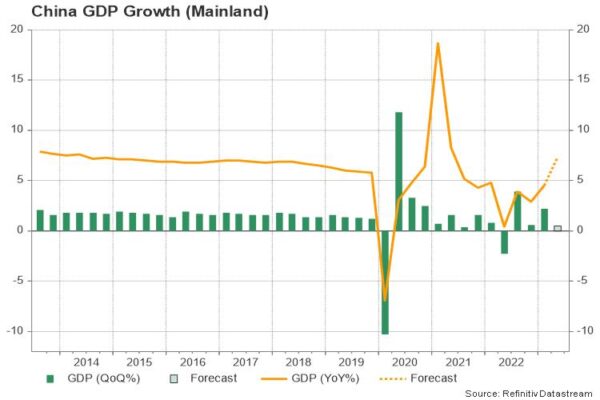

China’s post-lockdown growth was not satisfactory to investors, despite a 4.5% y/y expansion. Traders saw the glass half empty after Chinese officials admitted that “foundation for economic recovery is not solid yet”, while pointing to low base effects for another rosy quarter ahead.

Indeed, given the bleak economic picture in Q2 2022 in the face of pandemic constraints, base effects have probably produced a whopping 7.3% GDP growth in the April-June 2023 period according to forecasts. This is far above the government’s 5.0% expansion target for 2023 and could be good news to investors, who have been long waiting for China’s reopening to bolster global economic activity.

Challenges remain

However, quarter-on-quarter expansion is expected to slow down significantly to 0.5% from 2.2% previously, suggesting that the second quarter did not add much value to the domestic output.

June’s trade report was the latest evidence to cast a shadow on China’s economic strength earlier this week. Exports surprised to the downside, marking their largest decline of 12.4% y/y. Imports stayed negative for the seventh consecutive month, indicating a broken relation with external markets as geopolitical conflicts persist and top trade partners suffer from inflation and recession risks. In detail, Chinese demand for raw materials and semiconductors, which are a key component for the booming AI technology, plummeted in double digits.

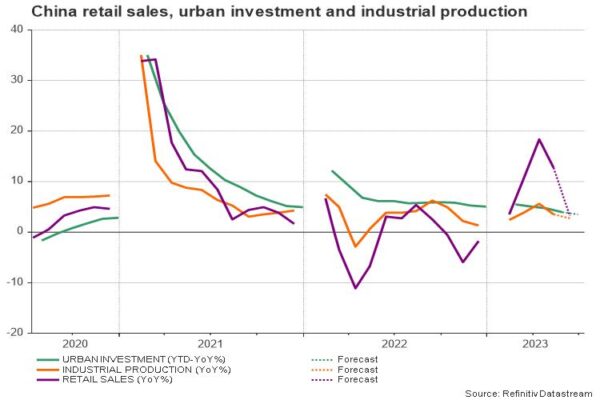

Consumer-driven recovery is not sufficient either, making retail sales data important to watch on Monday too. Estimates point to a sharp pullback from 12.6% y/y to 3.2% y/y, with analysts in JPMorgan, Goldman Sachs and S&P projecting a fading pent-up demand to further weigh on consumption during the upcoming quarters.

Deflation is another reflection of dampened demand. While central banks in developed economies are battling stubbornly high inflation through higher interest rates, China is on the opposite side of the river, with the People’s Bank of China cutting several lending rates in June, albeit marginally, to bolster consumer confidence and therefore boost price pressures. The headline CPI inflation has been falling at a steady pace over the past five months, suggesting that more forceful stimulus measures are needed.

The government has been refraining from providing direct cash to consumers, implementing tax policies and fee cuts instead to support the economy throughout the pandemic. As pledged in January, the ministry of finance will expand its expansionary fiscal policy this year, especially in the property market, where investment is still diminishing. Yet, the government’s bond issuance has been lower than last year expected to bring the total quota to 3.85 trillion yuan compared to 4 trillion yuan in 2022.

Market reaction

Perhaps delayed effects ahead and heightened fiscal debt levels are holding back dynamic support measures for now. Nevertheless, although the months ahead could be challenging given the rising unemployment rate and an uncertain geopolitical environment, potential headlines of new stimulus in China could bode well for risk-sensitive and commodity currencies such as the Aussie given that 32% of Australia’s exports are delivered in China.

Stronger-than-expected GDP data could boost global sentiment and specifically commodity currencies, including the yuan sooner next week, but the reaction could be measured as the second half of 2023 could provide a better picture of China’s economic outlook. In FX markets, AUDUSD could extend its bullish wave towards the 0.6955 resistance area. The 0.7000 psychological mark and the February 14 peak of 0.7028 could next attract attention.

Alternatively, given the optimistic GDP forecasts, a downside surprise cannot be ruled out. A reading below the government’s 5% growth target could weigh significantly on AUDUSD, pressing the pair back to the 0.6800-0.6780 zone, if the broken resistance line gives way at 0.6840. Even lower, the simple moving averages (SMAs) will next attempt to pause the sell-off around 0.6700.