Summary

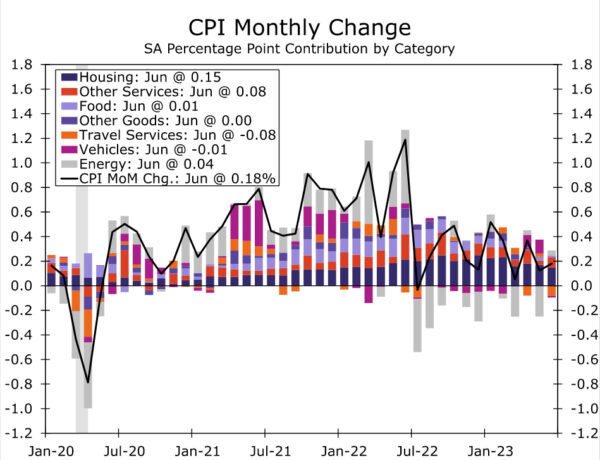

Today’s report on the Consumer Price Index for June brought good news. Headline consumer price inflation increased 0.2% over the month and 3.0% over the past year. For the latter, this was the lowest reading since March 2021. Excluding food and energy prices, the core CPI increased 0.2% (rounded up from 0.16%) over the month, the smallest monthly increase in core inflation since February 2021. A big decline in prices for travel services such as airfares and lodging-away-from-home contributed to the deceleration in core prices, as did the ongoing slowdown in primary shelter inflation. Used vehicle prices declined 0.5%, new vehicle prices rounded flat, and goods prices excluding vehicles fell 0.1%.

In the near term, we expect the more moderate pace of price growth signaled by the June CPI to continue. While the sharp drop in travel prices will be hard to repeat, the decline in vehicle prices has more room to run, and the ongoing disinflation in primary shelter should continue into the second half of this year. More broadly, the expanding supply side of the economy and slowing demand growth are helping to slow inflation from the blistering rates seen in 2021 and 2022. That said, core CPI inflation is still up 4.8% over the past year and 4.1% annualized over the past three months. The FOMC will need to see several more inflation prints like today’s before it declares its mission accomplished.

We expect core inflation in the second half of the year to run about 3% on an annualized basis. This expected improvement relative to the 4.6% pace of core inflation in the first half of this year will likely be enough to where the FOMC believes it can sit and wait for the effects of prior tightening to work through the economy after one additional 25 bps hike at its next meeting on July 26. However, with the underlying trend in inflation likely to be stuck closer to 3% than 2%, rate cuts remain a long way off, in our view.

CPI Inflation Drops to Lowest Reading since March 2021

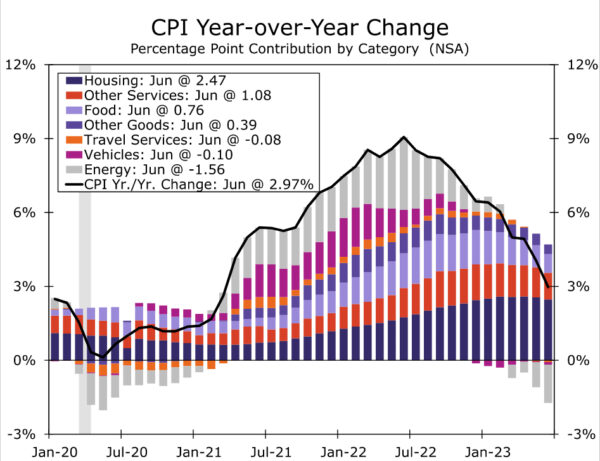

The Consumer Price Index (CPI) rose 0.2% in June, a tenth slower than the consensus expectation among forecasters. Consumer price inflation over the past year fell to 3.0%, the lowest reading since March 2021 and well below the peak of 9.1% in June 2022. Some of the inflation slowdown over the past year has been driven by base effects, particularly for energy prices. One year ago, prices for oil and natural gas were much higher due in large part to a surge in prices that followed Russia’s invasion of Ukraine. But even setting this aside, there are clear signs that inflation continues to slow steadily.

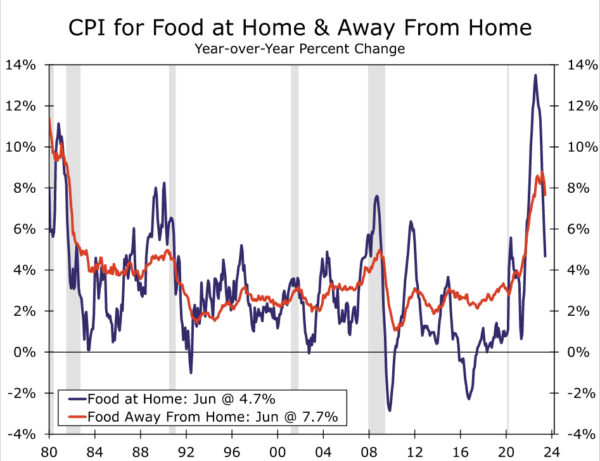

Compared to one month ago, energy prices increased 0.6%, led by gasoline (+1.0%) and electricity (+0.9%). Prices for natural gas utilities continued to come back down to Earth, falling 1.7% in June and 19% over the past year. Food prices increased a modest 0.1% in June compared to May. Grocery store inflation, which rose more sharply last year compared to prices for food consumed away from home, has also dropped off more quickly on the way down. Food at home prices are up “only” 4.7% over the past year. While still high, this is the slowest pace of food inflation in nearly two years.

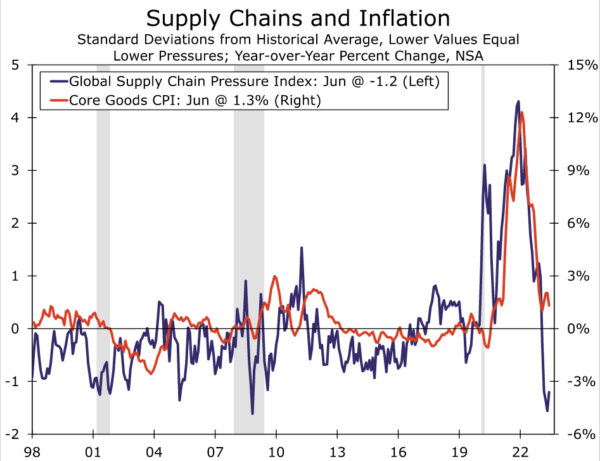

Excluding food and energy, price growth also came in a touch softer than expected. The core CPI rose 0.2% in June, the smallest monthly increase since February 2021. The more benign print was helped along by goods prices resuming their retreat, dropping 0.1%. After back-to-back gains of over 4%, used vehicle prices fell 0.5%, with further declines expected to be on June’s heels as auction prices have tumbled. New vehicle prices edged down ever so slightly (-0.03%), while recreational and household goods also declined in a sign pandemic spending patterns are slowly reverting and supply snarls continue to abate.

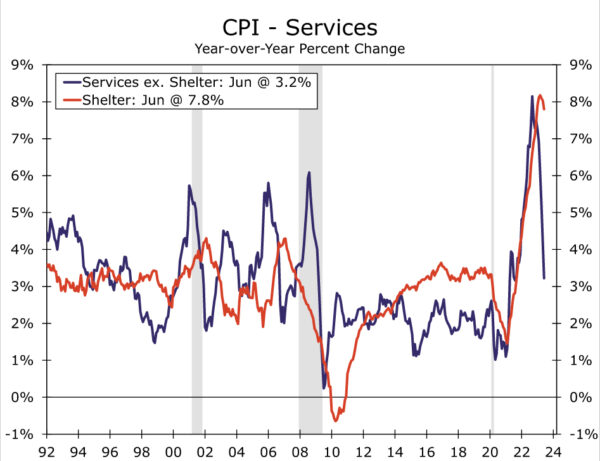

Core services inflation also pointed to activity normalizing after a wild few years. Prices for travel-related services tumbled 3.8% with notable declines in both airfare (-8.1%) and hotel prices (-2.0%). Gains in primary rent and owners’ equivalent rent also decelerated amid a cooler housing market this past year. Yet, prices for remaining “other” services, which include medical care, insurance, recreation and personal care among other things, continue to advance at a solid rate, up 0.3% in June and 3.8% annualized over the past three months.

One More Hike in July, Then Done

Today’s softer-than-expected print with signs of pandemic-era distortions fading provides additional evidence that disinflation is occurring in real-time. Looking ahead, we expect the more moderate pace of price growth signaled by the June CPI to continue. The decline in vehicle prices has more room to run, and the ongoing disinflation in primary shelter should continue in the second half of this year. Goods inflation beyond vehicles also has scope to slow, with supply chain pressures unwinding and the cost of input goods down over the past year. More generally, the increasing financial squeeze on consumers as pandemic savings run dry and borrowing costs rise is making consumers more discerning and less willing price-takers when compared to the past two years.

However, a timely and sustained return to the FOMC’s 2% inflation target remains far from assured. Wages may no longer be accelerating, but the tight jobs market is keeping labor costs growing in excess of the range that is consistent with 2% inflation over time. Prices for food and energy commodities have been largely stable since the start of the year, and the deflationary impulse from these categories should fade in the months ahead. While headline inflation has tumbled from its 42-year high a year ago, we expect the next leg of disinflation to be slower going. Even within the core CPI where the disinflation forces in housing and vehicles will be more pronounced, we expect core inflation in the second half of the year to run a bit north of 3% on an annualized basis. The improvement relative to the 4.6% pace of core inflation in the first half of this year will likely be enough to where the FOMC believes it can sit and wait for the effects of prior tightening to work through the economy after one additional 25 bps hike at its next meeting on July 26. However, with the underlying trend in inflation likely to be stuck closer to 3% than 2%, rate cuts remain a long way off in our view.