Key Highlights

- Gold price is rising above the $1,925 resistance.

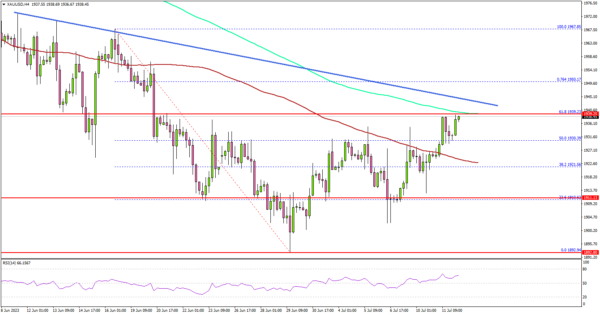

- A major bearish trend line is forming with resistance near $1,942 on the 4-hour chart.

- EUR/USD is aiming for more gains above 1.1010.

- The US Consumer Price Index could decline from 4% to 3.1% in June 2023 (YoY).

Gold Price Technical Analysis

Gold price formed a support base above $1,900 against the US Dollar. The price started a steady increase above the $1,920 and $1,925 resistance levels.

The 4-hour chart of XAU/USD indicates that the price was able to settle above $1,925 and the 100 Simple Moving Average (red, 4 hours). There was a break above the 50% Fib retracement level of the downward move from the $1,967 swing high to the $1,892 low.

However, it is now facing a key barrier at $1,945. There is also a major bearish trend line forming with resistance near $1,942 and the 200 Simple Moving Average (green, 4 hours).

The trend line is also close to the 76.4% Fib retracement level of the downward move from the $1,967 swing high to the $1,892 low. The next major resistance is near the $1,950 level, above which the price could rise toward $1,965.

Any more gains might send the price toward the $1,980 resistance level. Initial support is near the $1,925 level. The next major support is near $1,910.

If the bulls fail to protect the $1,910 support, there is a risk of a major decline. In the stated case, the price could decline toward the $1,890 level.

Looking at EUR/USD, the pair is showing positive signs but it is still struggling to gain bullish momentum above 1.1010.

Economic Releases to Watch Today

- US Consumer Price Index for June 2023 (MoM) – Forecast +0.3%, versus +0.1% previous.

- US Consumer Price Index for June 2023 (YoY) – Forecast +3.1%, versus +4% previous.

- US Consumer Price Index Ex Food & Energy for June 2023 (YoY) – Forecast +5.0%, versus +5.3% previous.

- BoC Interest Rate Decision – Forecast 5.0%, versus 4.75% previous.