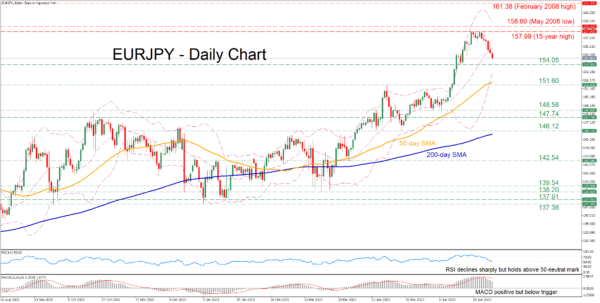

EURJPY has been in a strong uptrend since the beginning of the year, posting a fresh 15-year high of 157.99 in late June. However, this rally appears to be fizzling out, with the pair experiencing a downside correction in the short term.

The momentum indicators currently suggest that bearish forces are strengthening but have not taken control yet. Specifically, the RSI retreated massively but still holds above its 50-neutral mark, while the MACD declined below its red signal line in the positive territory.

Should the pullback extend further, the pair could initially face the recent support of 154.05. If that barricade fails, the spotlight could turn to the May resistance of 151.60, which might serve as support in the future. Failing to halt there, the price could descend towards the June low of 148.58.

Alternatively, if the price reverses back higher, the recent 15-year peak of 157.99 could prove to be the first barrier for buyers to conquer. Slicing through that wall, the pair may advance towards fresh multi-year highs, where the May 2008 low of 158.60 could curb any upside attempts. Even higher, the bulls might attack the February 2008 peak of 161.38.

In brief, it seems that EURJPY’s rally has faltered after reaching extremely overbought conditions and the price is experiencing a strong pullback. Nevertheless, a break below the 50-day simple moving average (SMA) is needed to increase bears’ hopes for a sustained downtrend.