Dollar’s selloff gained momentum in today’s Asian trading session, breaking through near-term support levels against Euro and Sterling. The market remains skeptical about the possibility of Fed implementing two or more rate hikes this year. With US CPI release scheduled for tomorrow, traders appear to be positioning themselves for potential downside surprises. Meanwhile, major US stock indexes closed slightly higher overnight, and benchmark 10-year yield slipped below 4% mark during Asian session.

At present, Japanese Yen is holding its position as the strongest currency of the week, as it continues to reverse its downtrend from earlier this year. Swiss Franc stands as the second strongest, followed by Euro, and then Sterling. The relative positions of these European majors could change based on the movements of their crosses, which are currently trading within established ranges. Commodity currencies are distinctly trailing in the race against the greenback.

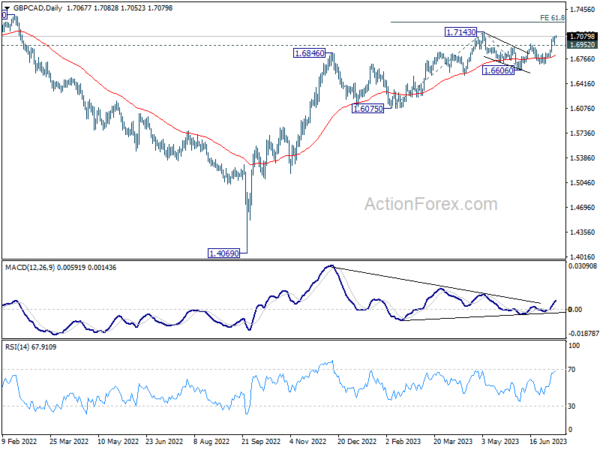

In the context of significant economic events, GBP/CAD deserves attention. Today’s spotlight is on UK employment data, while tomorrow brings UK GDP report and BoC rate decision. Technically speaking, as long as 1.6952 support level holds, rebound from 1.6606 is expected to extend past 1.7143 high. If this happens, it would signify resumption of the overall uptrend from 1.4069 (2022 low), targeting 61.8% projection of 1.6075 to 1.7143 from 1.6606 at 1.7266 in the near term. Nevertheless, break of 1.6952 could extend the corrective pattern from 1.7143 with another falling leg before uptrend resumes.

In Asia, at the time of writing, Nikkei is up 0.04%. Hong Kong HSI is up 1.53%. China Shanghai SSE is up 0.48%. Singapore Strait Times is up 0.12%. Japan 10-year JGB yield is down -0.0135 at 0.459. Overnight, DOW rose 0.62%. S&P 500 rose 0.24%. NASDAQ rose 0.18%. 10-year yield dropped -0.044 to 4.006.

Fed Bostic advocates patience as restrictiveness is working

Atlanta Fed President Raphael Bostic projected a sense of confidence in the current monetary policies during his speech on Monday, suggesting the potential for patience as restrictive strategy seems to be yielding desired outcomes.

Bostic noted, “I have the view that we can be patient — our policy right now is clearly in the restrictive territory,” adding that the economy’s signs of slowing down indicate that the policy is achieving its intended effect.

The Atlanta Fed President pointed out that underlying data for prices “is actually telling a very positive story.” Bostic believes that momentum is building in the disinflationary trend, stating, “We have got that momentum going. You could see inflation getting back to 2% without having to do more.”

Despite his overall optimistic outlook, Bostic did note that he would be concerned if expectations for consumer-price increases became “unanchored.” This situation would necessitate further action from policymakers. However, he expressed confidence that “inflation is still moving steadily back to target” and that inflation expectations are centered around 2%.

Bostic summed up his stance by stating, “I am comfortable being patient.”

Fed Daly: We need to raise rates to bridle the economy more

San Francisco Fed President Mary Daly acknowledged yesterday that while inflation appears to be slowing, it remains far too elevated. In an interview held at the Brookings Institution in Washington, D.C., Daly indicated the need for further measures to counteract inflationary pressures.

She affirmed, “I think it’s a very reasonable projection to say a couple of more rate hikes will be necessary.”

Daly reflected on the resilience of the U.S. economy, which has shown surprising strength despite ongoing economic challenges. The robust data, according to Daly, signal a clear need for intervention: “We need to raise rates to bridle that economy more.”

“With labor market still strong, inflation high, risks of doing too little are outweighing risks of doing too much,” she added.

Nevertheless, “It’s appropriate to slow the pace of rate hikes.”

Australia’s Westpac consumer sentiment up 2.7% mom, but pessimism still prevails

Westpac-MI Consumer Sentiment Index in Australia witnessed a modest 2.7% mom increase in July, rising to 81.3. However, the index remains entrenched the deeply pessimistic territory, a condition that has prevailed for over a year now.

According to Westpac, the main driving force behind this month’s uplift is easing in monthly inflation, which dipped from 6.8% in April to 5.6% in May.

RBA decision to pause in July, however, failed to instill confidence. In fact, the sentiment was considerably more buoyant before the decision, with an index reading of 88, marking an 11.2% rise from June. Post-RBA responses, on the other hand, presented a combined index reading of 77.9, a dip of -11.6% from the pre-RBA sample and a -1.6% fall from June’s reading.

Westpac’s key message is clear: “Sentiment is probably not going to stage a sustained lift from current deeply pessimistic levels until inflation is much lower and interest rates are firmly on hold.”

Looking ahead to the RBA’s next meeting on August 1, Westpac expects that if annual underlying inflation prints around 6.1% for the June quarter, and if the unemployment rate continues to hold well below full employment, the case for higher rates will be clear.

As such, Westpac anticipates that RBA Board will raise cash rate by 0.25% at both August and September Board meetings, followed by a prolonged pause. The first rate cut in the subsequent easing cycle is expected next May.

Looking ahead

UK employment, and Germany ZEW economic sentiment are the main features in European session. Germany will also publish CPI final while Italy will release industrial production. Later in the day, US will release NFIB small business index.

USD/JPY Daily Outlook

Daily Pivots: (S1) 140.74; (P) 141.87; (R1) 142.47; More…

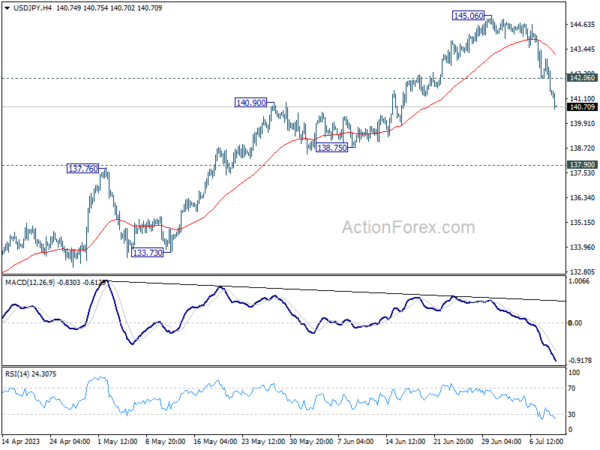

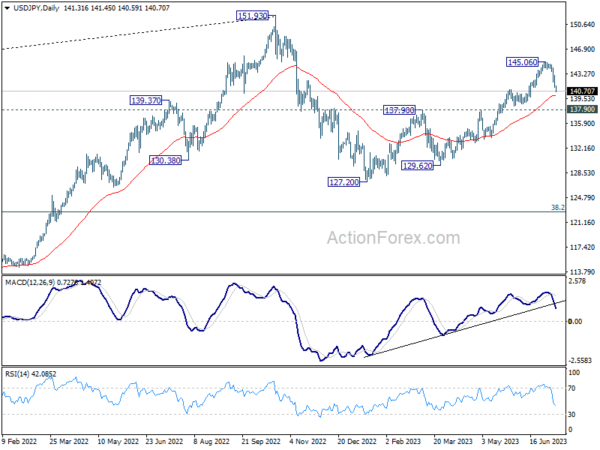

USD/JPY’s fall from 145.06 continues today and and breaches 140.90 resistance turned support. There is no clear sign of bottoming yet, and intraday bias stays on the downside for 137.90 next. On the upside, above 142.06 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another fall.

In the bigger picture, current downside acceleration, as seen in daily MACD, argues that fall from 145.06 is already the third leg of the corrective pattern from 151.93 (2022 high). Sustained break of 137.90 resistance turned support should confirm this case and target 127.20 (2023 low) and below. For now, this will remain the favored case as long as 145.06 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Jun | 4.20% | 3.70% | ||

| 23:50 | JPY | Money Supply M2+CD Y/Y Jun | 2.60% | 2.70% | 2.70% | |

| 00:30 | AUD | Westpac Consumer Confidence Jul | 2.70% | 0.20% | ||

| 01:30 | AUD | NAB Business Conditions Jun | 9 | 8 | ||

| 01:30 | AUD | NAB Business Confidence Jun | 0 | -4 | ||

| 06:00 | GBP | Claimant Count Change Jun | -13.6K | |||

| 06:00 | GBP | ILO Unemployment Rate (3M) May | 3.80% | 3.80% | ||

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y May | 6.80% | 6.50% | ||

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y May | 7.20% | |||

| 06:00 | EUR | Germany CPI M/M Jun F | 0.30% | 0.30% | ||

| 06:00 | EUR | Germany CPI Y/Y Jun F | 6.40% | 6.40% | ||

| 08:00 | EUR | Italy Industrial Output M/M May | 0.90% | -1.90% | ||

| 09:00 | EUR | Germany ZEW Economic Sentiment Jul | -9.5 | -8.5 | ||

| 09:00 | EUR | Germany ZEW Current Situation Jul | -60 | -56.5 | ||

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Jul | -10.2 | -10 | ||

| 10:00 | USD | NFIB Business Optimism Index Jun | 89.9 | 89.4 |