U.S. Highlights

- The week’s economic data was consistent with an economy that remains resilient, if no longer as robust as it was.

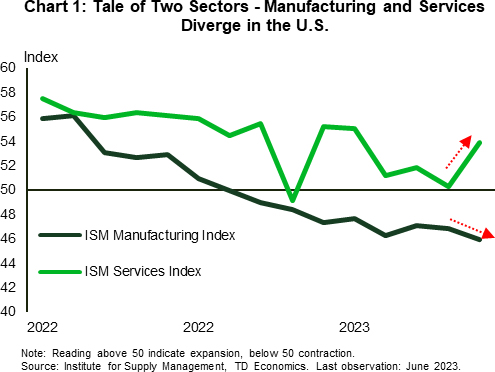

- Performance in the manufacturing and services sectors continued to diverge. The June ISM index showed manufacturing contracted for the eighth consecutive month, while services continued to expand six months in a row.

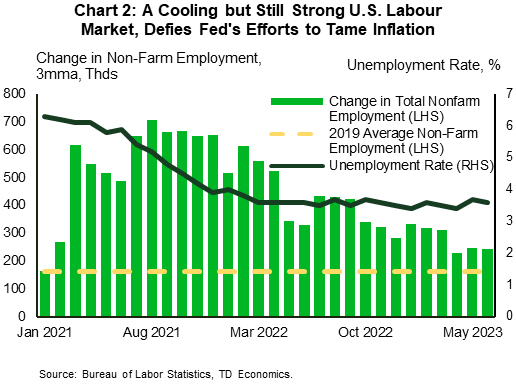

- The overall resilience will likely keep the Fed in hiking mode later this month, as the job market remains tight and wage growth stronger than the Fed would like. The FOMC minutes revealed that a few members favored a hiked at the June meeting, even if they did not formally dissent on the decision.

Canadian Highlights

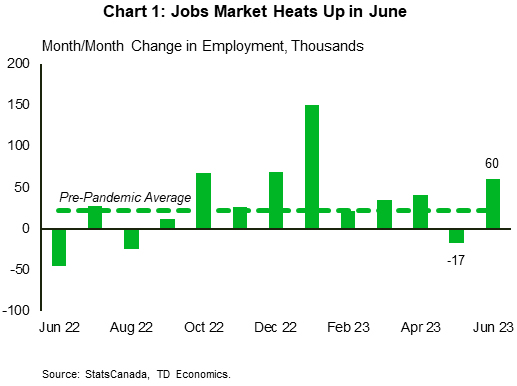

- Canada’s job market sizzled in June, with job gains beating expectations by a factor of three. Odds are the Bank of Canada raises rates a quarter point next week to further slow demand in an overheated economy.

- A more positive development for inflation is that average hourly earnings increased at the slowest pace since May 2022. Wage growth remains a major issue at the port strike in B.C., which could affect the economy through merchandise trade.

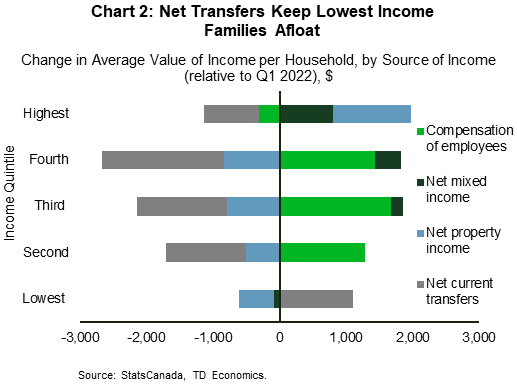

- Statistics Canada’s report on distributions of household economic accounts suggests that the least wealthy are being affected more by the high interest rates and pressures coming from rising prices.

U.S. – Job Market Cooling, But Not Enough

The week that was showcased a U.S. economy that while cooling, is still too resilient to achieve the Fed’s aim. First up, the ISM Manufacturing and Services Indexes showed that the goods sector continued to slow, while the service sector continued to expand, albeit at a modest pace. The manufacturing index declined again in June, falling 0.9 points to a 3-year low of 46.0. This marks its eighth consecutive month in contraction territory and points to deteriorating conditions in the manufacturing sector. The index suggests that demand remains weak in the sector, with new orders still below the 50 mark. Manufacturers have responded by cutting both production and employment (with both sub-indexes coming in below 50). The survey result is consistent with data on consumption expenditure, which showed real spending flat in May and expenditure on goods pulling back by 0.4% on the month.

While a cool down on the goods side will be welcomed by the Fed, the real sticking point is still strong demand on the services side of the economy. The ISM services index remained in expansion territory for the sixth consecutive month in June, highlighting the divergence between the two indexes (Chart 1). While expanding, the services index is still off recent highs, and is consistent with a modest pace of growth in the broader economy. One factor likely to impede growth however is the looming resumption of student loan debt repayments, which combined with a softening labour market and rising interest rates, could reduce consumer spending and growth even further.

Fears about a softening labor market, however, may be more accurately characterized as normalization after the white-hot levels attained during the pandemic. The job opening and labor turnover survey for May showed that over 4 million American workers quit their jobs (250k more than the previous month) and that there were over 9.8 million job openings available. This morning’s jobs data reinforced the picture of a normalizing, but still strong labor market. The report showed firms added 209k jobs, easing from May’s 306k. The unemployment rate also pulled back 0.1 ppts to 3.6% (Chart 2). Taken together, the employment reports are indicative of a relatively resilient labor market despite a more than year-long campaign of rate hikes by the Fed to quell inflation.

In that regard, minutes of the June FOMC meeting revealed that the decision behind the Fed’s first pause may have been unanimous, but some committee members would have supported raising rates. Concerns about the effects of past rate increases though tempered desires for a hike, with the resultant “hawkish pause” in June.

With the services sector and labor market still showing resilience, the Fed is justified in signaling more hikes to come. This will have to be balanced against the hit to consumer spending from the resumption of student loan payments and a possible trade squabble with China over high tech as the two countries impose tit-for-tat measures. The balancing act the Fed is currently undertaking is a delicate one, and they will have to tread cautiously as they walk the tightrope to engineer that elusive soft landing.

Canada – Job Market Sizzles

If you were looking to escape the scorching heat this week, the job market wasn’t the right place. Less than a week before the Bank of Canada’s rate decision on July 12th, the key June jobs report proved to be hotter than expected. The economy added 60k jobs – three times what was expected by the consensus, and more than enough to offset losses reported last month (Chart 1). The S&P TSX moved lower, and the 5-year Government of Canada yield briefly touched 4.0% on a conviction that policy rates are heading higher, and will remain elevated for longer than previously thought.

Meanwhile, the unemployment rate ticked up as more people entered the labour force thanks to a record pace of population growth. The increase in the unemployment rate offers a cautionary note, even as the level of the unemployment rate remains low at 5.4%. With luck, demand for labour will continue to cool in line with a slowdown in broader economic activity, which will help bring wage inflation down.

There was a bit of good news for the Bank of Canada’s inflation battle in the jobs report. Average hourly earnings increased 4.2% over the past year – the slowest year-over-year rate since May 2022. This suggests wage growth is stepping down to trend and gradually getting closer to the pace more consistent with the BoC’s 2% inflation target, but is still higher than the bank would like to see.

Wage growth is a major issue at the negotiating table between the International Longshore and Warehouse Union, representing around 7,400 port workers, and the B.C. Maritime Employers Association during a strike in B.C. that started July 1st. Should the strike continue for another week, the effects on the economy would come through merchandise trade, which in May registered the largest deficit since the fall of 2020. We estimate an impact to July’s GDP would not exceed two tenth of a percentage point and will be offset in August.

A high cost of living and rising debt service cost were also on full display in this week’s Statistics Canada’s report on distributions of household economic accounts in Q1 2023. According to the report, since the start of the Bank of Canada’s hiking cycle last year, lowest income families’ average wages were little changed, self-employment earnings declined, and investment returns failed to dilute the spike in the cost of borrowing. In addition, more of the lowest income households relied on government benefits and paid less taxes – a trend that would become more prevalent as an increasing share of baby boomers retire (Chart 2). In contrast, interest charges for the highest income earners were more than offset by gains in investment earnings, which helped boost overall average disposable income for this segment.

All in all, the report suggests that the least wealthy are being affected more by higher interest rates and inflation. Since fighting the latter is unattainable without keeping a hard line on the former, the Bank of Canada’s task of keeping inflation in check is becoming more complicated by the day. Nevertheless, with the employment market offering little sunshade buffer, the Bank is likely to raise rates next week.