The latest round of Canadian economic data is in—and it’s unlikely to deter the Bank of Canada from hiking rates again next week. Nothing in the data on employment, inflation, GDP or the second quarter release of the Bank of Canada’s own Business Outlook Survey (BOS) showed sufficient evidence of slowing consumer demand to convince the Bank of Canada another hike isn’t needed. Headline inflation dropped lower in May and could hit the top end of the BoC’s 1% to 3% inflation target range in June on lower energy prices. But the BoC’s preferred CPI trim and median inflation measures (designed to measure underlying broader inflation pressures) were still growing at an elevated 3.5% to 4% on an annualized 3-month average basis. And growth in the so-called ‘supercore’ (services ex-shelter) has been running stronger at 4.7%. GDP growth slowed in April but the preliminary estimate for May was substantially stronger. The Q2 BOS pointed to a still slowing growth backdrop and further easing in the intensity of labour shortages. But the commentary attached by the BoC flagged still higher-than-normal expectations for wage and price increases among Canadian businesses.

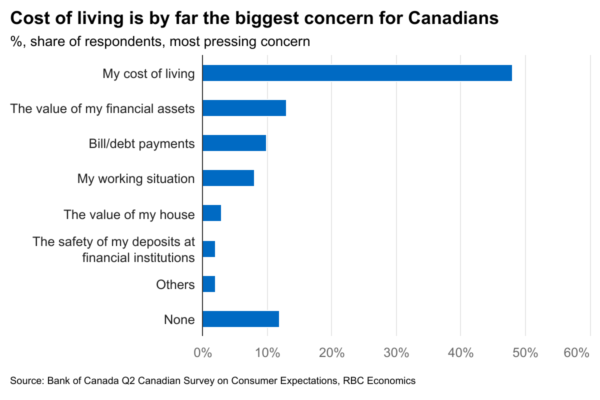

The path for the overnight rate–beyond the expected 25 basis point increase in July—remains very uncertain. We expect next week’s increase to be the last of this cycle. But the BoC has maintained its “proactive” approach when it comes to battling sticky inflation. And it wouldn’t hesitate to hike rates again in September if the economy doesn’t show more signs of cooling off. Still, aggressive rate hikes over the last year are continuing to pass through to household debt payments. Given that, the question that remains is when, not if, economic activity will slow. Consumer insolvencies rose sharply in May, getting closer to pre-pandemic levels. The rate of unemployment remains very low but increased in May and June. And easing labour demand–job openings fell to the lowest level in two years in April—continue to flag more weakness under the surface. It is still our view that further deterioration in economic activity is in the pipeline, as households are increasingly challenged by rising costs of living. That should be enough to keep the Bank of Canada on the sidelines for the remainder of this year.

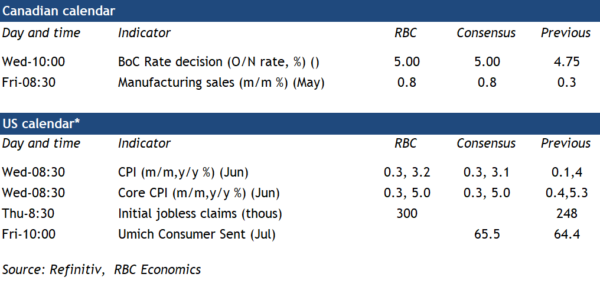

Week ahead data watch

Statistics Canada’s advance estimate indicates manufacturing sales ticked up 0.8% in May, despite a sharp pullback in petroleum prices. The volume of manufacturing sales (excluding price impacts) likely rose more significantly, with increases in both the motor vehicle sector and machinery sales.

U.S. headline inflation in June likely slowed to 3.2% on a year-over-year basis, with widespread moderation among food, energy, and other components. Core inflation (ex-food and energy) is expected to decelerate too as some of the key drivers of recent monthly readings, including rents and used cars, start to turn around following easing in market-posted rent indices and declines in the Manheim used car index.