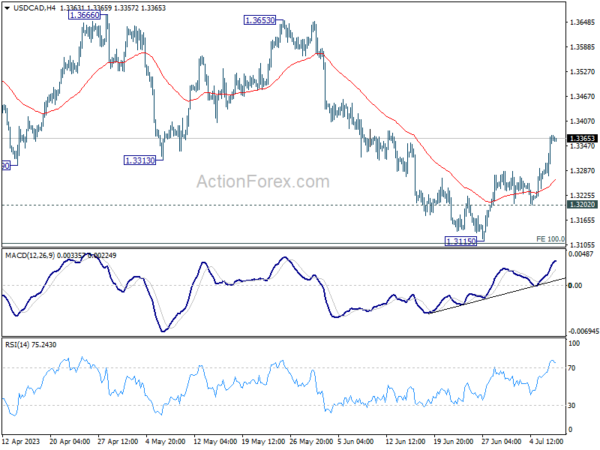

Daily Pivots: (S1) 1.3304; (P) 1.3339; (R1) 1.3402; More….

USD/CAD’s rebound from 1.3115 short term bottom extended higher and it’s now pressing 55 D EMA (now at 1.3369). Intraday bias stays on the upside for the moment. Sustained trading above 55 D EMA will argue that whole corrective pattern from 1.3976 has completed with three waves down to 1.3115. Further rally should then be seen to 1.3653 resistance next. Nevertheless, break of 1.3202 support will bring retest of 1.3115 low instead.

In the bigger picture, price actions from 1.3976 are viewed as a correction to up trend from 1.2005 (2021 low) only. Hence, the up trend is in favor to resume through 1.3976 at a later stage. Nevertheless, another fall below 1.3115 will extending the decline from 1.3976 to 61.8% retracement of 1.2005 to 1.3976 at 1.2758, and raise the chance of bearish trend reversal.