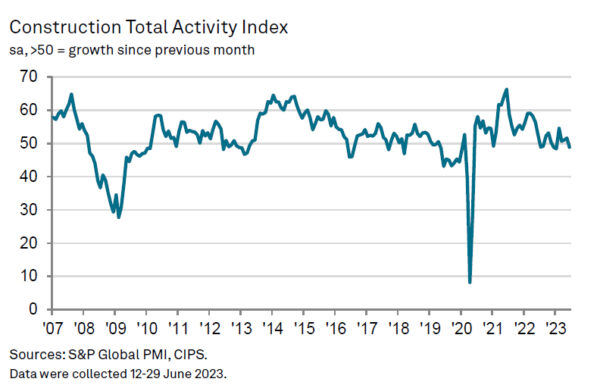

UK’s construction sector faced a downturn in June as PMI fell from 51.6 in May to 48.9, falling short of 50.9 expectation. This marks the first contraction in construction activity in five months, driven primarily by the fastest decline in residential work witnessed in over three years.

Tim Moore, Economics Director at S&P Global Market Intelligence, explained the contraction, stating, “Weaker housing market conditions in the wake of higher borrowing costs acted as a major constraint on UK construction output in June.” According to him, the steep downturn in residential work since May 2020—excluding the slump during lockdown—has been the most rapid in over 14 years.

On a positive note, input prices decreased for the first time since January 2010, a potential silver lining for the construction sector. Additionally, supplier performance improved at its fastest pace in 14 years, signalling some resilience despite the prevailing industry headwinds. However, recent contraction raises concerns about the health of construction sector amidst rising borrowing costs and a cooling housing market.