Yen and Dollar are gaining momentum in today’s trading as market sentiment appears to have soured in Asia. The development could be interpreted more as a response to escalating US-China tensions rather than hawkish tone of FOMC minutes released overnight. After all, the minutes just reinforced expectations of further monetary tightening, despite a pause in June. Meanwhile, major US indexes closed only slightly lower, even as treasury yields saw a notable surge.

Australian Dollar is emerging as the day’s worst performer so far, trailed by Euro and Canadian Dollar. On the flip side, Swiss Franc is strengthening on risk aversion, while Sterling displays mixed performance, buoyed by buying against Euro. Market participants are keenly awaiting tomorrow’s US non-farm payroll report, the key event for the week. However, today’s ADP employment and ISM services data may trigger some traders to make early moves.

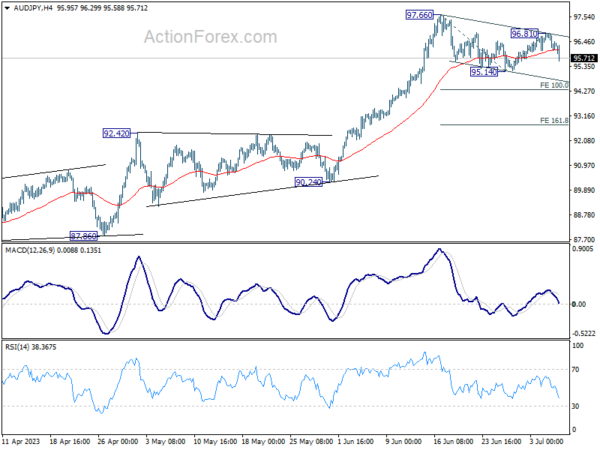

Technically, AUD/JPY’s decline today argues that correction from 97.66 might be ready to resume through 95.14 support. For now, strong support is likely at around 100% projection of 97.66 to 95.14 from 96.81 at 94.29 to complete the correction. But strong break there and downside acceleration below the projection level would raise the chance of larger bearish reversal.

In Asia, at the time of writing, Nikkei is down -1.70%. Hong Kong HSI is down -3.08%. China Shanghai SSE is down -0.53%. Singapore Strait Times is down -0.79%. Japan 10-year JGB yield is up 0.0072 at 0.394. Overnight, DOW dropped -0.38%. S&P 500 dropped -0.20%. NASDAQ dropped -0.18%. 10-year yield rose 0.087 to 3.945.

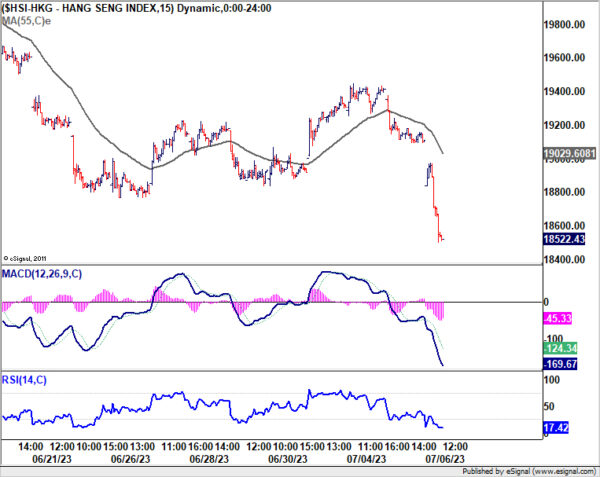

HK HSI dives as Yellen visit China amid rising US-China tensions

Hong Kong HSI is taking a hit today as it gapped down at open and further sell-offs materialized during the initial part of Asian trading session. This market movement mirrors intensifying investor concerns as US Treasury Secretary Janet Yellen starts a four-day visit to China. While the intention behind Yellen’s visit is to de-escalate potential conflicts between these two economic behemoths, atmosphere has notably soured this week.

Earlier in the week, China struck a discordant note by announcing fresh restrictions on export of several critical minerals used in manufacture of semiconductors and solar panels. This move appears to be a tit-for-tat response to the tech export limitations that the US has imposed on China, limiting the sale of advanced computer chips. Further adding to the apprehension, US government is reported to be contemplating additional measures to restrict China’s access to US-based cloud computing services.

On a separate front, China delivered another blow to international diplomatic relations when it abruptly canceled a visit by European Union foreign policy chief Josep Borrell, scheduled for next week, according to an EU spokesperson. The Chinese authorities have not yet disclosed the reasons behind this unexpected cancellation.

From a technical perspective, today’s market turbulence in Hong Kong, marked by a gap down followed by a sharp drop, appears to validate rejection by 55 D EMA (now at 19428.57). Fall from 20155.92 is likely to be another chapter in the overall descent from 22700.85. As decline progresses, a drop below 18044.85 low is expected. However, substantial support is still expected from 61.8% retracement of 14597.31 to 22700.85 at 17692.86, and this could potentially spur a reversal. Let’s see how it goes.

Fed minutes signal disagreement over rate pause

In a display of internal discord, Fed’s June 13-14 meeting minutes indicate that while most officials deemed it “appropriate or acceptable” to maintain rates at 5% to 5.25% target range, a few would have backed a quarter-point increase.

“The participants favoring a 25 basis point increase noted that the labor market remained very tight, momentum in economic activity had been stronger than earlier anticipated, and there were few clear signs that inflation was on a path to return to the Committee’s 2 percent objective over time,” the minutes said.

Yet, many officials expressed concerns about an accelerated tightening pace. “Many also noted that, after rapidly tightening the stance of monetary policy last year, the Committee had slowed the pace of tightening and that a further moderation in the pace of policy firming was appropriate in order to provide additional time to observe the effects of cumulative tightening and assess their implications for policy,” read the minutes.

Overall, these June minutes portray a Federal Reserve grappling with the delicate balancing act of controlling inflation while not excessively tightening monetary policy. The diverging views underscore the precarious position the central bank finds itself in as it navigates the complexities of the evolving economic landscape.

Fed Williams: Data support more rate hikes at some point

New York Fed President John Williams voiced his support for the decision to hold rates steady in June, stating yesterday that it was the right move to allow for further data collection and assessment.

“We can take some time and assess and collect more information and then be able to act, knowing that we also communicated through our projections that we don’t think we’re done, based on what we know,” he said.

However, Williams hinted at further rate hikes while he reaffirmed his commitment to be “data dependent” in his decision-making. But he added that recent data “support the idea the Fed may need to raise rates further at some point.”

Williams’ statements were grounded in ongoing concerns about high core inflation, although he acknowledged the progress made in curtailing inflation so far. He highlighted a slowdown in the inflation of non-housing services prices, a key indicator closely watched by Fed officials. “Even in the category of core services excluding shelter, we’re seeing some slowing of inflation,” he added.

Looking ahead

Germany factory orders, UK construction PMI and Eurozone retail sales will be released in European session. Later in the day, focuses will be on US ADP employment, jobless claims and ISM services. US and Canada will also release trade balance.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 156.63; (P) 157.18; (R1) 157.56; More….

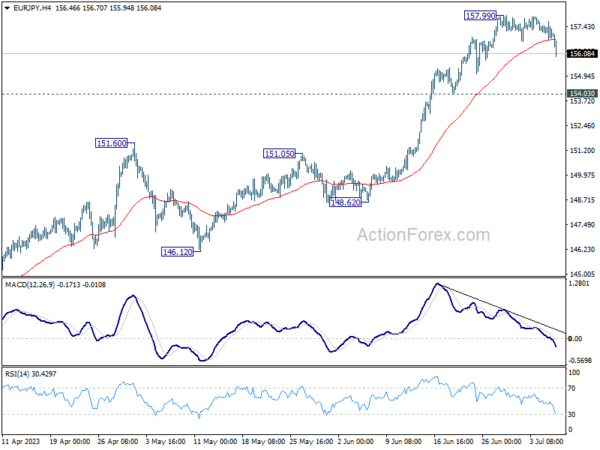

EUR/JPY’s fall from 157.99 is extending lower today and intraday bias is now on the downside with strong break of 55 4H EMA. Deeper correction could be seen to 154.03 support or below. But overall outlook will stay bullish as long as 151.60 resistance turned support holds. Larger rally is still expected to resume through 157.99 after the correction completes.

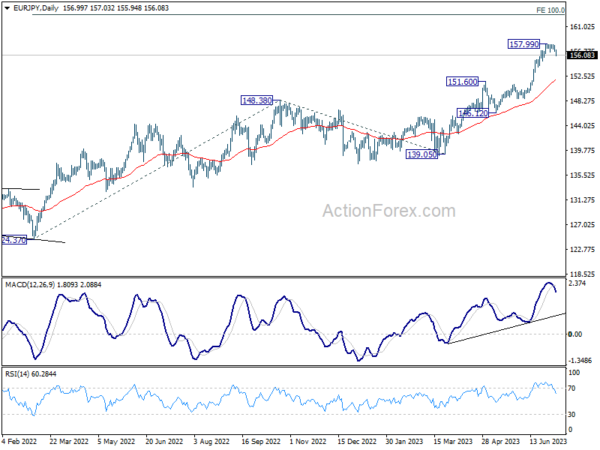

In the bigger picture, rise from 114.42 (2020 low) is in progress. Next target is 100% projection of 124.37 to 148.38 from 138.81 at 162.82. For now, medium term outlook will remain bullish as long as 151.60 resistance turned support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Trade Balance (AUD) May | 11.79B | 10.70B | 11.16B | |

| 06:00 | EUR | Germany Factory Orders M/M May | 1.50% | -0.40% | ||

| 08:30 | GBP | Construction PMI Jun | 50.9 | 51.6 | ||

| 09:00 | EUR | Eurozone Retail Sales M/M May | 0.20% | 0.00% | ||

| 11:30 | USD | Challenger Job Cuts Jun | 286.70% | |||

| 12:15 | USD | ADP Employment Change Jun | 250K | 278K | ||

| 12:30 | USD | Initial Jobless Claims (Jun 30) | 249K | 239K | ||

| 12:30 | USD | Trade Balance (USD) May | -68.2B | -74.6B | ||

| 12:30 | CAD | Trade Balance (CAD) May | 1.5B | 1.9B | ||

| 13:45 | USD | Services PMI Jun F | 54.1 | 54.1 | ||

| 14:00 | USD | ISM Services PMI Jun | 51.3 | 50.3 | ||

| 14:30 | USD | Crude Oil Inventories | -2.0M | -9.6M |