Market picture

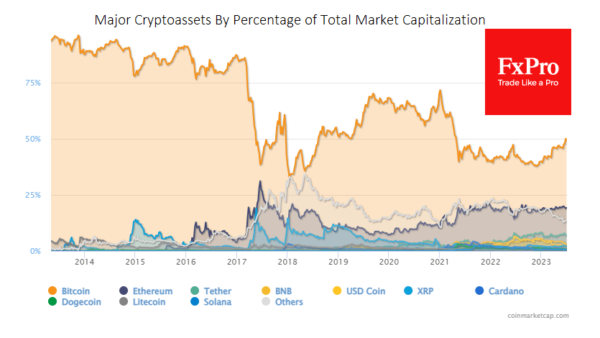

The crypto market cap rose 0.4% over the past 24 hours to $1.21 trillion, peaking at $1.22 trillion, to the highest since April. Bitcoin’s dominance remains nearly 50%, the highest since 2021.

This uptrend was formed late last year and marks a typical market recovery pattern, with the most significant asset in the sector attracting buyer interest first.

It will probably take about a year of bitcoin price recovery before crypto enthusiasts start looking for one with higher potential (risk), pushing altcoins higher and leading to a new wave of capitalisation swell. This means that a real altcoin rally is unlikely before November. In addition, macroeconomic and regulatory conditions should be supportive.

According to CoinShares, investments in cryptocurrencies rose by $125 million last week, the second consecutive week of inflows. Bitcoin investments increased by $123 million and Ethereum by $3 million.

Meanwhile, Bitcoin briefly rebounded above $31.3K on Monday evening, repeating the highs of 23 June, but failed to confirm an upside breakout from the consolidation channel at the start of the European session on Tuesday.

News background

Invesco, VanEck, 21Shares, WisdomTree and Fidelity, sent revised proposals to the SEC to launch a spot bitcoin ETF after previous ones were called “unclear and non-exhaustive” by the Commission. Bloomberg notes the applicants’ increased chances of receiving regulatory approval.

The Bittrex exchange has filed a motion to dismiss the litigation with the SEC. According to the company, the agency has no authority to regulate cryptocurrencies without congressional approval.

Thailand has banned staking and lending in crypto assets in the country. The country’s regulator required exchanges to inform users about the potential risks associated with cryptocurrency trading.

Cryptocurrency ATM operator Bitcoin Depot has announced a listing on Nasdaq. Bitcoin Depot became the first company whose shares were admitted to trading on a major US stock exchange.