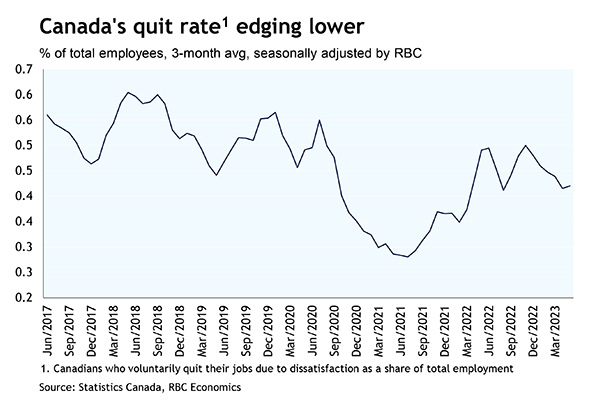

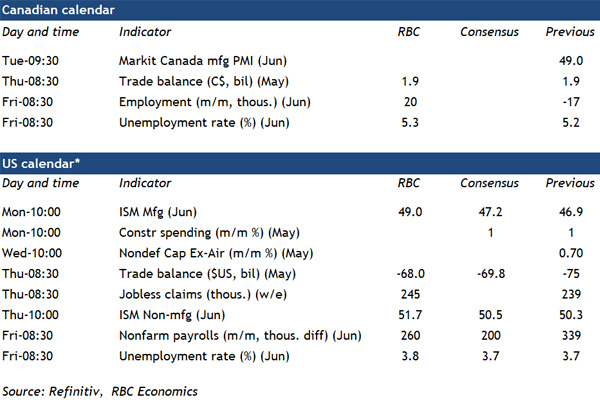

All eyes will be on next week’s labour market data as the Bank of Canada weighs whether raise interest rates again in July. Though Canadian labour markets remain exceptionally tight, job openings have been trending lower, down 21% from peak levels as of April. And May’s unemployment rate inched up—the first increase since August 2022. Meantime, the share of workers quitting their jobs (an indicator of worker confidence in labour markets) has been edging lower. Almost half of businesses are still reporting labour shortages as a key frustration that’s limiting their sales or production—and we still look for a 20,000 increase in employment in June. But with population growth also surging, this won’t be enough to prevent another uptick in the unemployment rate to 5.3%.

The labour report will be the final major economic data release before the BoC meets again on July 12th. And we anticipate an additional 25 basis point hike to emerge from that meeting. Though there are signs that labour markets are softening, the unemployment rate is still historically very low. Inflation has been easing, but slowly, and consumer spending is still running firm. Consumer delinquency rates have been rising and household debt payments will continue to increase due to the lagged impact of earlier interest rate hikes. But economic momentum has likely been too firm for the BoC to change course just yet.

The U.S. Federal Reserve—which will also be eyeing June employment numbers next week—is also likely to hike interest rates by another 25 basis points after taking a pass on an increase in June. The U.S. unemployment rate also edged higher in May. And weaknesses are emerging under the surface in the jobs market. Still, we expect another uptick in the unemployment rate in June but to a 3.8% rate that is still historically very low. With labour markets still too tight, and inflation pressures too firm, the Fed is unlikely to be deterred from at least one more interest rate increase.

- Canadian exports likely ticked down 0.4% in May, mainly driven by a price-related decline in energy exports (oil prices were 10%in May) with offset from higher trade in the auto sector as vehicle production improves. We assume imports also edged higher to leave the trade balance little changed.

- U.S. advance economic indicator reports showed May’s exports of goods fell by $1 billion from the prior month, largely from a drop in food exports. Imports of goods also slowed, by $6.9 billion in May, largest decline saw in the consumer goods sector (-7.3%) with lower oil prices likely also pushing industrial supplies imports lower.

- U.S. jobs report in June likely saw 260K increase in the payroll employment, down from the +339K in May, but still at a high level. We expect the unemployment rate likely edged up to 3.8% (calculated separately from the household survey), from 3.7% in May.