The Offshore Chinese Yuan (CNH) is witnessing a revival today, as China appears to be intensifying its efforts to curb the currency’s recent slump. Market participants view 7.25 level against Dollar as a significant psychological threshold to uphold.

According to a report by Reuters, there’s evidence that major state-owned Chinese banks are selling dollars in the offshore spot foreign exchange market. This activity suggests that authorities are keen to slow the yuan’s precipitous decline in recent times.

In an additional bid to temper the yuan’s slide, China set its daily reference rate for the managed currency at a stronger-than-anticipated level for a second consecutive day. This move underscores PBoC’s dissatisfaction with the currency’s recent rapid and unilateral depreciation, particularly the swift move from 7.25.

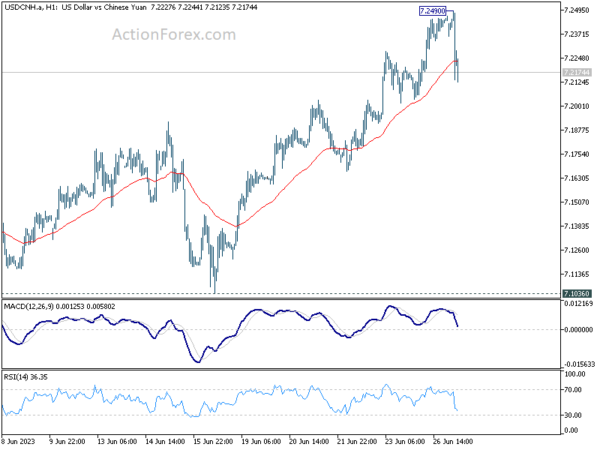

From a pure technical point of view, further rally is still in favor in USD/CNH as long as 7.1036 support holds. But the pair would likely lose upside momentum further as it approaches 161.8% projection of 6.6971 to 6.9963 from 6.8100 at 7.2941. It’s unlikely for USD/CHN to break through 7.3745 high at the first attempt.