Key Highlights

- EUR/USD corrected gains from the 1.1000 resistance zone.

- It traded below a key bullish trend line with support near 1.0930 on the 4-hour chart.

- GBP/USD also corrected gains from the 1.2840 resistance.

- Bitcoin price saw a strong increase above the $30,000 resistance.

EUR/USD Technical Analysis

The Euro gained pace after it broke the 1.0920 resistance against the US Dollar. EUR/USD even spiked above 1.1000 before the bears appeared.

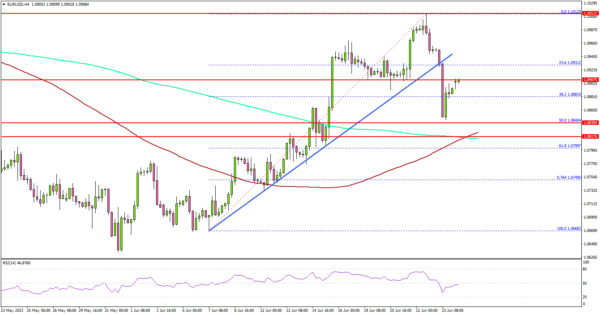

Looking at the 4-hour chart, the pair saw a downside correction from the 1.1010 zone. It traded below a key bullish trend line with support near 1.0930. There was a break below the 38.2% Fib retracement level of the upward move from the 1.0668 swing low to the 1.1012 high.

However, the bulls were active above the 1.0840 level and the 50% Fib retracement level of the upward move from the 1.0668 swing low to the 1.1012 high.

The pair is also above the 100 simple moving average (red, 4 hours) and the 200 simple moving average (green, 4 hours). If there is a fresh increase, the pair might struggle near 1.0930.

The first major resistance is near the 1.0950 zone. If there is a move above the 1.0950 resistance, the pair could rise toward 1.1000. Any more gains might send EUR/USD toward the 1.1050 level.

Immediate support is near the 1.0840 level. The next major support is near the 1.0800 level and the 100 simple moving average (red, 4 hours). If there is a downside break below the 1.0800 support, the pair could decline toward the 1.0750 support. The main support sits at 1.0665.

Looking at GBP/USD, the pair failed to clear the 1.2840 resistance on two occasions and recently saw a downside correction.

Economic Releases

- German IFO Business Climate Index for June 2023 – Forecast 90.7, versus 91.7 previous.

- German IFO Current Assessment Index for June 2023 – Forecast 93.5, versus 94.8 previous.

- German IFO Expectations Index for June 2023 – Forecast 88.0, versus 88.6 previous.