U.S. Highlights

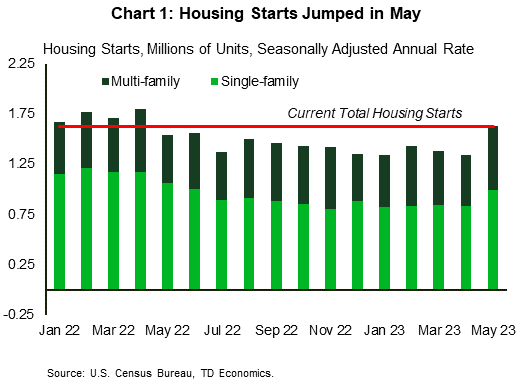

- Housing starts rose 21.7% month-on-month (m/m) in May, hitting its highest level in 13 months as both single-family and multi-family construction picked up.

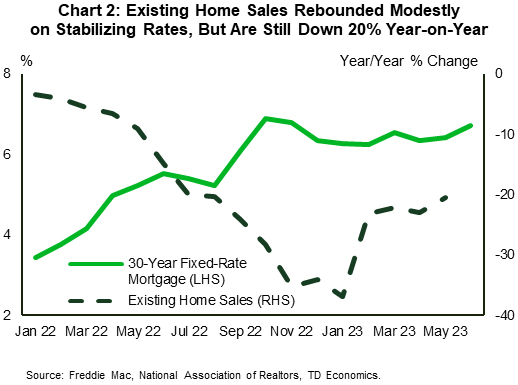

- Existing home sales grew 0.2% m/m in May with elevated mortgage rates and limited supply continuing to act as headwinds.

- FOMC Chair Powell reiterated his expectation that rates would need to rise further this year during his semi-annual Congressional hearing.

Canadian Highlights

- Equity market sentiment soured this week, as more global central banks followed the Bank of Canada in ratcheting up rate hikes. Markets are worried about the coming economic slowdown in the wake of tighter monetary policy.

- April retail sales was the key Canadian data point in a relatively quiet week. Consumers ramped up spending in a wide variety of categories during the month, putting upside risk on Q2 consumer spending.

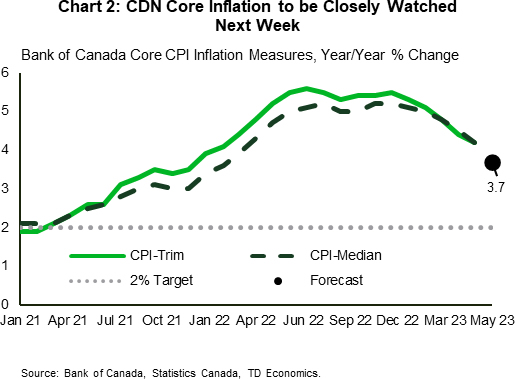

- All eyes will turn to next week’s inflation report for May along with the BoC’s Business Outlook Survey. Both will provide key information for the Bank to weigh ahead of it’s mid-July rate decision.

U.S. – Housing Up, Rates to Follow

The holiday-shortened, first week of summer was relatively quiet on the economic data front. However, we did get to hear from several FOMC members on the heels of last week’s meeting, including Chair Powell who was before Congress this week for the Fed’s semi-annual hearing. We also got a pulse check on housing this week which showed more homes being built and sold. Equity markets drifted lower on the week, as the S&P 500 fell 1.4% and the yield curve inversion steepened as the 10-Year Treasury yield fell by 5 basis-points (bps) to 3.72% as of the time of writing.

The week kicked off on Tuesday with a notable upside surprise in homebuilding activity, as housing starts came in at 1.63 million units (annualized) in May, 231k units higher than expected. Starts rose by 5.5% year-on-year (y/y), marking the first time in 13 months that starts were higher than their year-ago level (Chart 1). Most of the surprise can be attributed to an atypically large jump in single-family starts, while multi-family starts continued to fluctuate near elevated levels. With the prospect of higher for longer rates likely keeping existing home inventory relatively low for the foreseeable future, near-term tailwinds have formed behind residential construction.

On the demand side of the housing equation, we saw existing home sales rise by 0.2% month-on-month (m/m) in May. All of that growth was found in the condo/co-op segment which grew by 4.7% m/m, while single-family sales declined by 0.3% m/m. While existing home sales have rebounded modestly in recent months, they are still down 20% y/y (Chart 2). Stabilizing mortgage rates have helped sales to experience a moderate near-term rebound, but with the Fed eyeing further rate hikes a sustainable rebound is unlikely to materialize this year.

Last week’s FOMC meeting brought a long-awaited pause to one of the most aggressive rounds of monetary policy tightening in decades, but it also came with the caveat that the FOMC expects an additional 50bps of rate hikes will be necessary this year. At his Congressional hearing this week, Chair Powell reiterated his comments from last week that inflation remained too high and that the Fed had more work to do. Other Fed speakers this week diverged, with Bostic seeing current rates as sufficiently restrictive, Goolsbee emphasizing a wait-and-see approach, and Bowman echoing Powell that more work needs to be done.

Across the pond, the Bank of England surprised markets with a 50bps hike on Thursday after core inflation accelerated in recent months. In the U.S., core PCE inflation – the Fed’s preferred inflation measure – has not accelerated, but roughly flatlined since the start of the year. This is why the Fed has favored 25bps hikes as it fine-tunes its approach to the terminal rate, but it is also why last week’s pause was conditional on further policy tightening. Next week we will receive an update on core PCE, and although it is unlikely to shift market expectations for a 25bps hike in July, it will help shape expectations for the rest of the FOMC meetings this year.

Canada – Consumer Updraft Supports Hawkish BoC

Sentiment on equity markets soured this week as more global central banks raised rates to cool inflation that remains overheated across much of the world. In Canada, April retail sales data was the headliner in a relatively quiet week for data. The report underscored the solid momentum on the consumer front. Despite high inflation, increased borrowing costs and uncertainty about recession, consumer spending has held up relatively well this spring.

April retail sales rose an impressive 1.1% month/month, coming in above Statistics Canada’s advance estimate. Inflation was part of the story, but sales in real terms were still up a healthy 0.3% m/m, albeit coming after a couple of months of declines. Sales were up broadly across categories as well: general merchandise (+3.3% m/m), clothing and accessories (+3.1% m/m), food and beverages (+1.5% m/m), health and personal care retailers (+1.0% m/m), sporting goods, hobby items, musical instruments, and books stores (+1.0% m/m) and building material and garden equipment and supplies dealers (+0.7% m/m). Notable exceptions included furnishings, and electronics and appliances.

Consumer momentum looks to have carried through to May. Statistics Canada’s advance estimate for May retail sales points to a solid 0.5% m/m follow through. However, with April’s advance estimate falling well short of the actual data, this must be taken with several grains of salt. The firm retail data puts upside risk to our recent quarterly forecast for consumer spending, which is now tracking closer to a 1% annualized gain for Q2, versus our initial expectation for a relatively flat quarter following a healthy Q1.

This data vindicates the Bank of Canada’s decision to raise the policy rate in early June. Strength in consumer spending had been a key factor in the Bank’s decision to step off the sidelines and raise rates a quarter point. The BoC released its summary of deliberations leading up to its June 7th rate hike this week, and there was little new. The summary expanded on the factors outlined in the Bank’s statement. Attention turns now to what the Bank is likely to do at its July 12th decision.

Next week’s inflation data for May will be key. The BoC’s preferred core inflation metrics – CPI trim and CPI median – had not eased as much as the Bank had hoped in recent months, another key factor in their rate hike. We expect the measures to decelerate to an average 3.7% year/year in May (Chart 2). If inflation cools far more than we expect, our confidence that the BoC is likely to hike again will be reduced.

However, the Bank will be assessing the totality of the data and may not be dissuaded from taking their policy rate higher with one soft inflation report, particularly given ongoing strength in housing, which has knock on effects for spending. Another key indicator is their quarterly Business Outlook Survey, due out next Friday. Last quarter’s survey suggested businesses expected inflation pressures to ease, which hasn’t panned out quite as the Bank would have liked. Nevertheless, business sentiment will be another piece of the data puzzle in their decision.