With all the major central bank decisions behind us, the spotlight next week will turn to a new round of inflation releases. The euro has been riding high this month, but whether it still has some miles left in the tank will depend on what the inflation data spells for ECB policy. Meanwhile, the yen has been demolished and since FX intervention seems unlikely, it might take a serious acceleration in Japanese inflation to stop the bleeding.

Can the euro keep going?

It’s been a solid month for the euro, which has capitalized on bets that the European Central Bank will raise interest rates further than previously expected. Despite mounting signs that inflation is cooling off and economic activity is stagnating, the ECB still decided to telegraph its intentions for higher rates.

Ultimately this precommitment might prove to be a mistake since it ties the ECB’s hands, but for now, the rally in European yields has turned the euro into a more attractive investment destination. Another blessing for the euro has been the weakness in the US dollar, and even more so in the Japanese yen lately. After all, FX is a relative game.

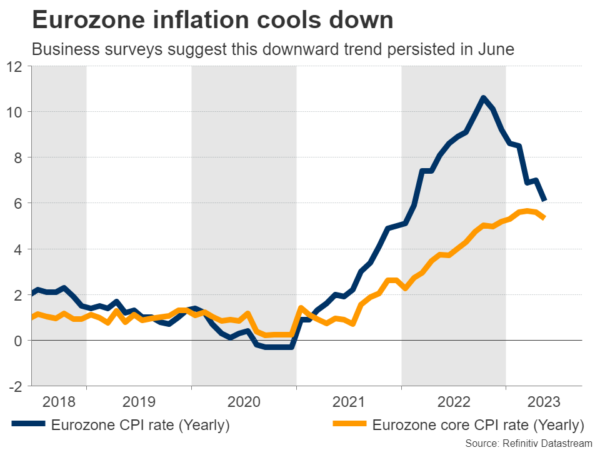

Looking ahead, the question is whether there is still some juice left in the euro’s rally. That might be decided by the inflation report on Friday and what it implies for the ECB’s path. Inflation has been steadily declining this year and the latest business surveys suggest this trend continued in June, with selling prices rising at the slowest pace in over two years.

Markets are already pricing in another two rate increases over the coming months, and admittedly, it will be extremely difficult for the ECB to exceed those expectations amid slowing inflation and with the economy already in a mild technical recession.

Therefore, the euro might not be able to count on any further support from monetary policy. It could still advance if other major currencies keep depreciating, but the rally is unlikely to receive any more ‘fuel’ from the euro side of the equation.

Ahead of the Eurozone-wide flash CPI print on Friday, investors will get a taste of what to expect from the German numbers on Thursday.

Sinking yen turns to inflation data for help

Over in Japan, the yen has been devastated by the Bank of Japan’s refusal to tighten monetary policy. Naturally, the yen’s losses have been heavier against currencies that are backed up by hawkish central banks, hence the parabolic moves in euro/yen and pound/yen.

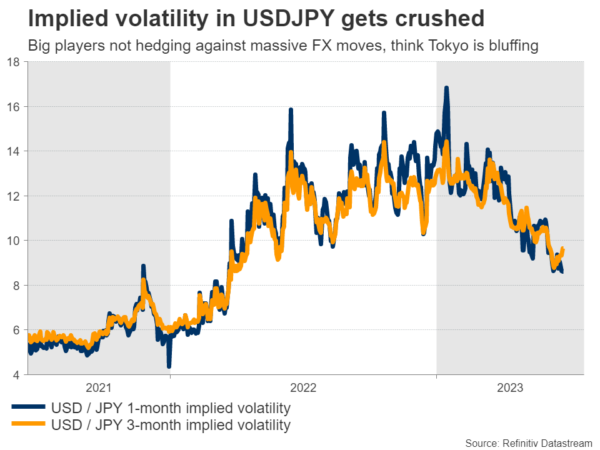

With the currency in freefall, Japanese authorities have stepped up their warnings about FX intervention, but market participants don’t seem to believe them. Implied volatility in dollar/yen has been falling for months now, so bank dealers and investment managers are not panic-hedging against any massive movements in the yen.

Indeed, the intervention rhetoric from Japanese officials has not reached ‘peak levels’ either. So far, the finance minister has refrained from using phrases that would suggest intervention is imminent. Instead, he has been more measured with his comments, which makes the risk of FX intervention appear relatively low for now.

As such, for the yen to stand any chance of a comeback, it would need to rely on speculation that the Bank of Japan might adjust its policy settings next month. This puts extra emphasis on the CPI inflation numbers for Tokyo, which will hit the markets on Friday.

The Tokyo core CPI rate is projected to have risen in June, although just barely. Such an increase probably wouldn’t be enough to get the markets excited about a BoJ policy shift in July, which suggests the yen might continue to suffer for a while longer.

Dollar eyes PCE inflation

In the United States, the show will get started on Tuesday with the release of durable goods orders and new home sales for May, ahead of the core PCE price index on Friday, which will be released alongside personal consumption and income numbers for the same month.

There is a game of chicken being played between Fed officials and market participants in recent weeks, with policymakers telegraphing another two rate increases for this year but investors only pricing in one. As such, the persistence of inflationary pressures will decide who is right, driving the dollar accordingly.

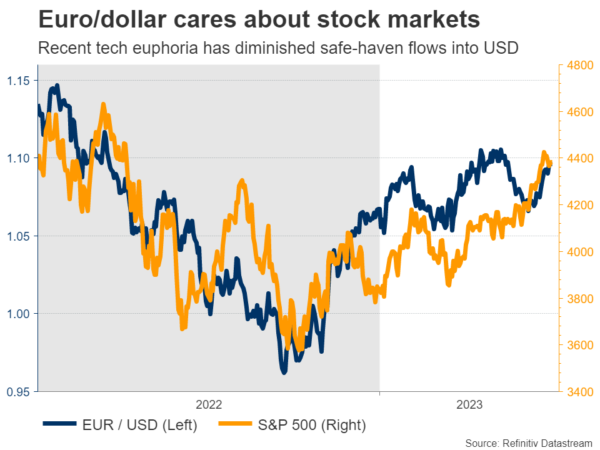

Overall, the greenback has been under some pressure this month, partly because of the market’s skepticism about the Fed’s hawkish signals and partly because of the euphoric tone in stock markets that has diminished safe-haven flows.

Yet, there is some scope for a dollar recovery moving forward, since the US economy seems much more resilient than its competitors and the summer months could be marked by tighter liquidity conditions as the Treasury continues to raise its cash levels.

Finally in neighboring Canada, inflation stats for May are out on Tuesday. The loonie has advanced lately despite the decline in oil prices, mostly on the back of hawkish signals from the Bank of Canada, so the inflation report will be crucial in deciding the longevity of this rally.