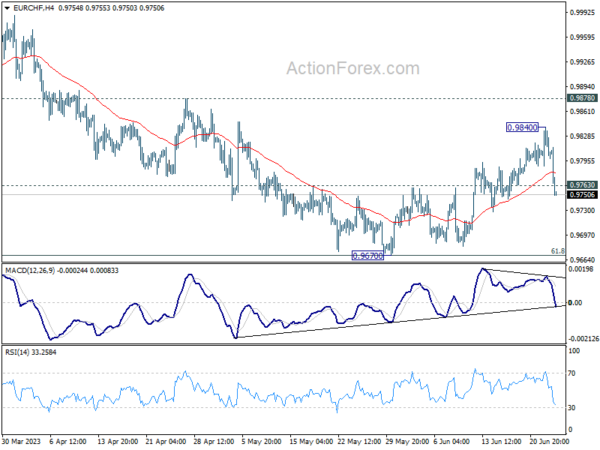

Daily Pivots: (S1) 0.9783; (P) 0.9812; (R1) 0.9834; More…

EUR/CHF’s break of 0.9763 minor support argues that recovery from 0.9670 has completed as a correction to 0.9840 Intraday bias is back on the downside for retesting 0.9670 low. Sustained break there will resume the whole fall from 1.0095. Nevertheless, break of 0.9840 will resume the rebound to 0.9878 resistance.

In the bigger picture, prior rejection by 38.2% retracement of 1.1149 to 0.9407 at 1.0072 suggests that medium term outlook is staying bearish. The pair is also capped below 55 W EMA (now at 0.9924). Down trend from 1.2004 (2018 high) is not complete yet and is in favor to resume through 0.9407 at a later stage. However, decisive break of 1.0095 resistance will raise the chance of bullish trend reversal. Rise from 0.9407 should then target 1.0505 cluster resistance (2020 low at 1.0505, 61.8% retracement of 1.1149 to 0.9407 at 1.1484).