The dollar index is on track for the third consecutive week in red and for the biggest weekly loss since the second week of November.

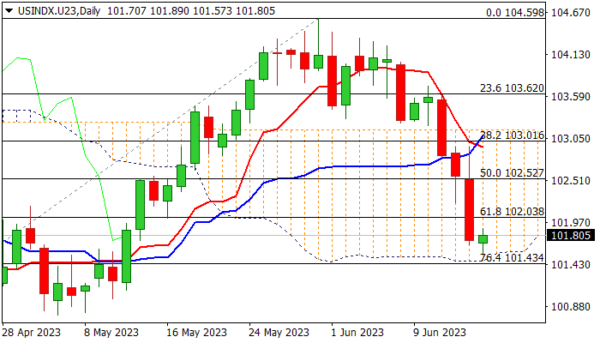

Sharp bearish acceleration in past three days (down 1.75%) hit five-week low (101.57) where bears faced strong headwinds from daily Ichimoku cloud base and nearby Fibo support at 101.43 (76.4% of 100.45/104.59 rally).

Bears are likely to take a breather here as traders look to collect some profits from the latest fall, as well as at the end of the week, with oversold daily studies contributing to potential scenario.

Larger picture remains bearish, suggesting limited correction before bears regain full control for final push towards key short-term support at 100.45 (2023 low posted on Apr 14) and psychological 100 level.

Thursday’s close below Fibo support at 102.03 (61.8%) generated fresh bearish signal, which will be boosted on weekly close below this level.

Extended corrective upticks should not exceed 102.83 (100DMA) to keep bears in play.

Res: 102.03; 102.32; 102.83; 103.08.

Sup: 101.57; 100.99; 100.72; 100.45.