GBP/USD breaks resistance

The US dollar sank after slow inflation raised the chance of a pause in interest rate hikes from the Fed. The market mood has stayed positive despite a choppy consolidation under the recent top of 1.2680 over the past month. The pair first hit resistance at 1.2600 and a retracement came to a rest at 1.2490, indicating that buyers are still eager to offer support. Then a decisive bullish breakout would make clearing 1.2680 a formality, extending the pound’s rally towards 1.3000 in the weeks to come. 1.2560 is now a fresh support.

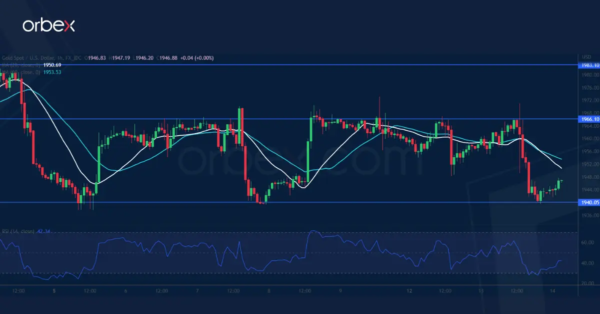

XAU/USD struggles to bounce

Bullion tumbled as risk assets took over with the FOMC expected to keep interest rates unchanged. As the price struggles to secure support in its corrective phase, the triple bottom around 1940 is the recent bulls’ last stronghold and a critical floor to stabilise sentiment. Its breach would trigger a round of liquidation with the psychological level of 1900 as a potential target. 1966 is the first hurdle to lift in case of a bounce and only a close above 1983 which has proved to be a tough level to crack would turn the tide.

US Oil recoups losses

WTI crude bounces thanks to China’s rate cut and a probable hike pause by the Fed. Still, a full retracement of a previous rebound below 67.20 showed a lack of commitment to keep the commodity afloat. As the price inches towards the double bottom of 66.00 on the daily chart, 66.80 saw some bargain hunters. 70.00 is the first level to lift to give the buy side some break, who must clear 73.20 before they could hope for a genuine rebound. Otherwise, the oil price would see the March rally as a mere dead cat bounce.