The FOMC will announce its interest rate decision on Wednesday at 18:00 GMT, with most market participants anticipating the Committee to hit the brakes on rate increases for the first time since March 2022. Having said that, market expectations could very well change just the day before the decision, when the US CPIs for May are due out, thereby impacting the way the dollar may react to the outcome of the meeting. So, what could officials decide and how may the US dollar perform post this gathering?

Investors convinced the Fed will skip a hike

The last time Fed officials met, they delivered the broadly anticipated 25bps hike, but they removed from the statement the part saying that some additional policy firming may be appropriate and instead turned data dependent. As such, market participants started to raise bets that policymakers could take their hands off the hike button as soon as at the next gathering.

After the meeting though, strong economic data and hawkish remarks by Fed officials have encouraged investors to price in a hike either in June or July, with expectations of massive rate cuts by the end of the year being scaled back.

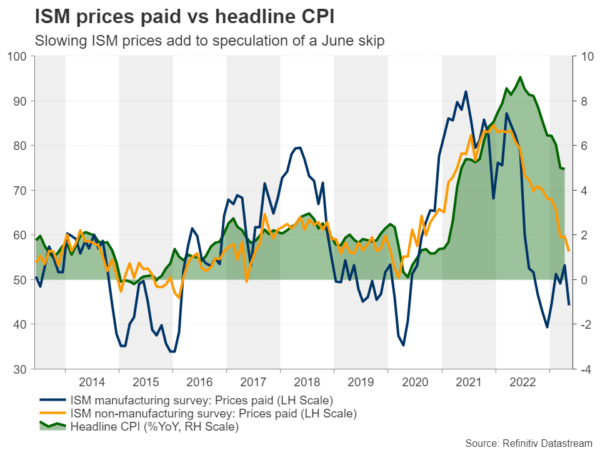

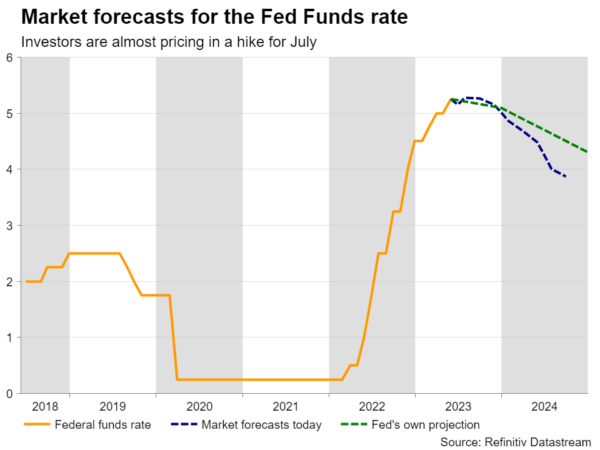

This allowed the dollar to stage a comeback against all its major peers. However, that recovery stalled the last couple of weeks as data pointing to slowing wage growth and subdued prices charged in the manufacturing and service sectors convinced traders that the Fed will skip hiking in June and perhaps do so in July. Specifically, investors are now assigning a 75% probability of no change on Wednesday, while they are penciling in 20bps worth of a hike for July.

As for thereafter, conditional upon a summer hike materializing, market participants foresee nearly two quarter-point cuts by January. Thus, apart from focusing on whether the Committee will press the hike button now, the financial community may also pay attention to the updated macroeconomic projections and especially the new dot plot.

Inflation data to reshape bets just a day before

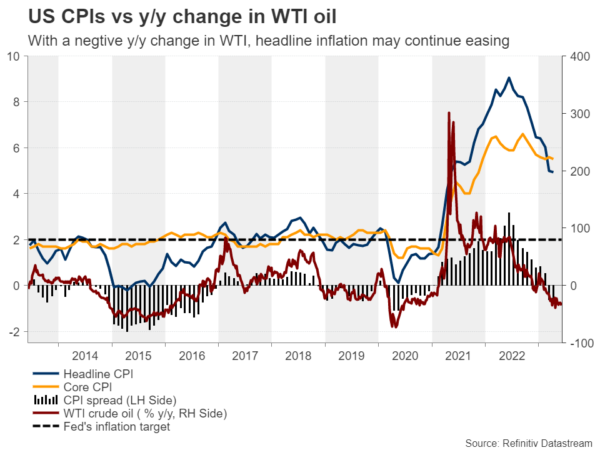

Having said all that though, how the dollar will react to any outcome will depend on the market expectations heading into the meeting, and those expectations could very well be altered the day before the decision, when the US CPIs for May are released. No forecasts are available for the year-on-year rates yet, but with the y/y change in WTI crude oil staying in negative territory, it seems that the limelight is likely to fall on the core rate once again.

A slowdown in underlying price pressures could further diminish the probability of a rate hike on Wednesday and may also lessen the likelihood of that happening in July. The opposite may be true if the core CPI rate accelerates.

Dollar dependent on a combination of outcomes

Therefore, if inflation slows, the Fed will be more tempted to stay sidelined. However, if the updated dot plot shows a higher median rate for this year, the dollar is still likely to rally despite skipping a hike this month, as this will mean a hike in July and no cuts this year. Now, conditional upon inflation accelerating, the only decision that could support the dollar may be a rate increase, as a skip could disappoint those adding to their hike bets just the day before. For the greenback to come under strong selling interest no matter what the results of the inflation report are, the Fed may need to stay sidelined and indicate that no more hikes are needed, which appears to be the least likely scenario at the moment.

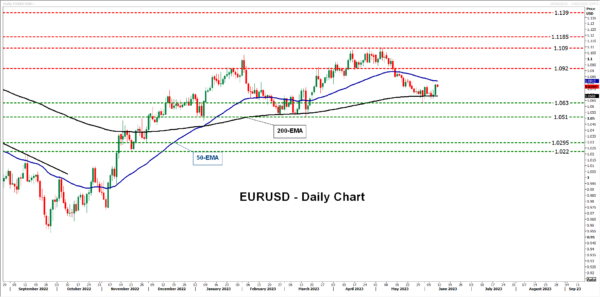

So, with the forthcoming direction of the US dollar dependent on many variables and several combinations of outcomes, the outlook doesn’t seem crystal clear now. The greenback’s comeback has stalled the last couple of weeks, with the currency coming under selling interest on Thursday after initial jobless claims spiked to a 20-month high. This makes the retreat in euro/dollar look like a correction for now.

For a bearish reversal to start being examined, the pair may need to fall below the key zone of 1.0510, which offered strong support between January and March. Something like that could set the stage for declines all the way down to the 1.0295 area, marked by the low of November 30.

On the other hand, a dovish decision could result in advances, but for the picture to be painted with bullish colors, euro/dollar may need to overcome the key resistance zone of 1.1090. If at some point in the not-too-distant future this happens, the bulls may challenge the 1.1185 area, the break of which could carry extensions towards the high of February 21, 2022, at 1.1390.