AUD/NZD is currently the biggest mover for the week, trading up around 1%. Near term rally from 1.0556 accelerated further after surprised RBA rate hike earlier in the week. At the same time, market participants are also factoring in the possibility of further rate hikes from RBA.

In a recent Reuters poll, a snapshot of economists’ expectations reveals a divide: 16 out of 26 expect RBA to hit the pause button in August, while 10 predict another 25bps hike. Looking beyond, a majority (20 out of 26) anticipate another 25bps increase by the end of September.

There’s a consensus among the major local banks – ANZ, CBA, and NAB – that a pause in July is likely, while Westpac is bracing for another 25bps bump. All four banks foresee a terminal rate of 4.35% by the close of September. However, given the uncertainty that even RBA is grappling with regarding the road ahead, these forecasts are subject to revision ahead of each upcoming meeting.

Contrarily, the question of whether RBNZ rate has already peaked at the current 5.50% is under debate. Views are split on the prospect of a further 25bps hike in August.

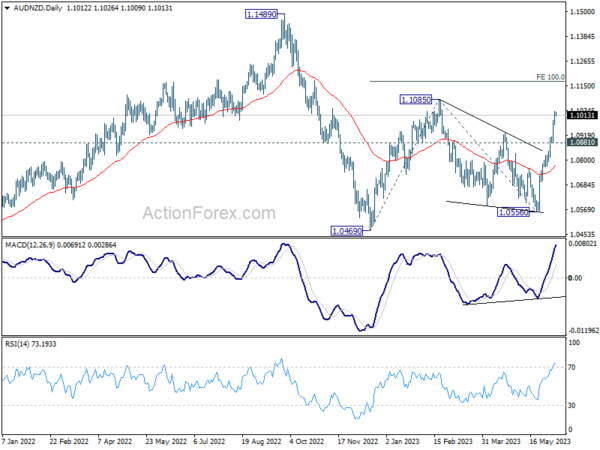

Technically, this week’s rally should confirm that AUD/NZD’s correction from 1.1085 has completed with three waves down to 1.0556. Near term outlook will stay bullish as long as 1.0881 support holds. Next target is 1.1086 resistance. Firm break there will resume whole rise from 1.0469 (2022 low) to 100% projection of 1.0469 to 1.1085 from 1.0556 at 1.1172.

The second half of the year will likely be marked by whether AUD/NZD can hurdle this key 1.1172 projection level. Rejection at this level could frame the rise from 1.0469 as merely a corrective move, and potentially set the stage for a later resumption of overall decline from 2022 high of 1.1489 at a later stage However, a decisive break above 1.1172 could catalyze a more substantial upside move, potentially retesting 1.1489 high.

The outcome will largely hinge on the future steps of RBA and RBNZ post their next move.